Will Bitcoin Really Hit $1 Million by 2030? Kiyosaki’s Bold Claim and What Newcomers Should Know

1. Review of Bitcoin’s History and Current Price

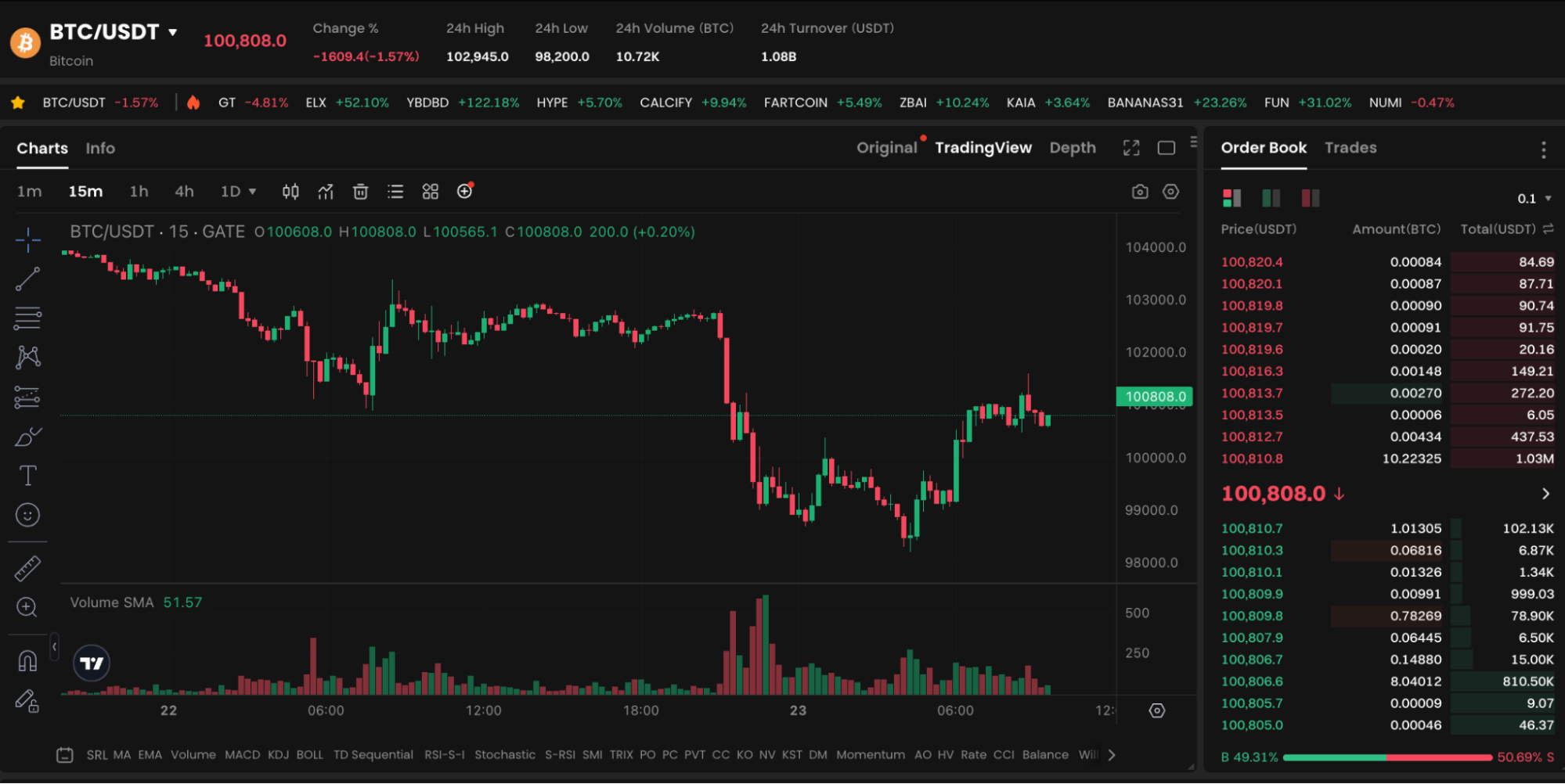

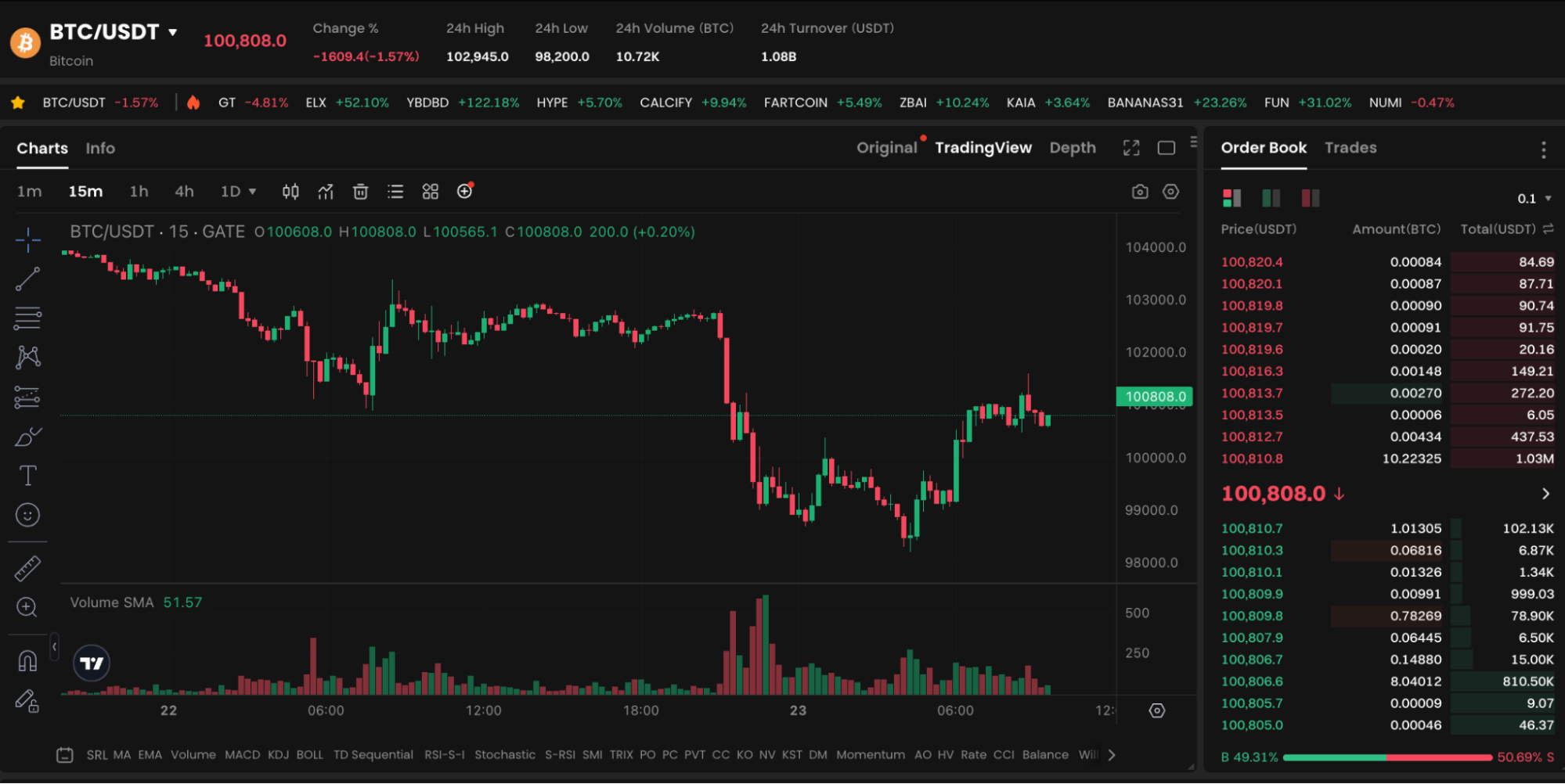

Figure:https://www.gate.com/trade/BTC_USDT

Bitcoin has undergone a transformation from a “hacker toy” to “digital gold” since it was proposed by Satoshi Nakamoto in 2009. From initially being worth less than 1 cent, it first broke through $20,000 in 2017 and soared to a peak of $69,000 in 2021, shocking the world with its dramatic increase.

As of June 23, 2025, the price of Bitcoin is approximately $100,800. Although it briefly dropped below the psychological threshold of $100,000 on the evening of the 22nd, it remains in a fluctuating upward channel overall. Despite the volatility, Bitcoin has been regarded by many institutions as an anti-inflation asset, maintaining its position as the world’s leading cryptocurrency by market capitalization.

2. The Logic Behind Kiyosaki’s Million Dollar Prophecy

In June 2025, Robert Kiyosaki, the author of “Rich Dad Poor Dad,” stated in a public post: “I believe Bitcoin can reach $1,000,000 by 2030.” He sees Bitcoin as a core tool to combat “fake money” (fiat money). He pointed out that governments printing money without limits leads to inflation, while the scarcity and decentralized mechanism of Bitcoin can effectively hedge against this risk.

Kiyosaki stated that he entered the market when Bitcoin was at $6,000, and now he is even more confident about its future upside potential. Although his views are aggressive, there is a certain macroeconomic basis behind them.

3. Four Major Factors Supporting the Long-term Bull Market of Bitcoin

(1) Scarcity and Halving Mechanism: The total supply of Bitcoin is fixed at 21 million coins, with a halving occurring every four years, demonstrating a clear deflationary attribute. In 2024, it just experienced its fourth halving, reducing the daily new coin production from 900 coins to 450 coins. This mechanism forms the supply foundation for long-term price increases.

(2) Institutional and sovereign funds entering the market: Global asset management giants such as BlackRock and Fidelity have significantly increased their holdings in Bitcoin through ETFs and funds. In addition, countries like El Salvador and Argentina have incorporated Bitcoin as legal assets, marking a rise in recognition at the sovereign level.

(3) Global macro uncertainty: Factors such as inflation, geopolitical conflicts, and the decline of dollar hegemony are driving more investors to seek safe-haven assets. Bitcoin, independent of any national monetary system, has become the “safe-haven gold” of the digital age.

(4) The technical ecosystem is continuously improving: Lightning Network, Bitcoin ETF, payment integration, Web3 application development, etc., greatly expanding the practical use cases of Bitcoin, no longer just a “speculative target.”

4. How should newbies participate? Practical advice and risk control reminders

For newbies, although Bitcoin has great potential, it is not without risks. Here are a few suggestions for reference:

(1) Understand volatility risk and prepare for the long term: Bitcoin may rise or fall sharply in the short term. For example, it dropped by 60% within a few months in 2022. Newbies need to have sufficient psychological expectations and should not blindly chase highs and sell lows.

(2) Use a dollar-cost averaging strategy to smooth out costs: It is recommended to invest funds in batches, buying regularly on a monthly or weekly basis, and not to attempt to “buy the dip” or “sell at the peak.” In the long run, this approach can effectively reduce holding costs.

(3) Set up profit-taking and stop-loss mechanisms: establish profit targets and the maximum allowable loss percentage. For example, take some profits when the price rises by 100%, and cut losses if they exceed 20%. Discipline is crucial.

(4) Diversified allocation to avoid single bets: While Bitcoin is powerful, it is also recommended to allocate other assets like Ethereum and stablecoins to form a cryptocurrency asset portfolio, reducing overall volatility.

(5) Pay attention to regulatory and technical risks: Global regulation of cryptocurrencies remains uncertain, which may lead to significant market fluctuations. Additionally, technical issues such as hacker attacks and wallet losses should also be monitored.

Summary

“Will Bitcoin reach one million dollars by 2030?” This question cannot be definitively answered by anyone today. However, from the perspectives of supply mechanisms, institutional holdings, and global economic trends, this goal is not mere fantasy. Robert Kiyosaki’s view may be overly aggressive, but it reflects a high recognition of Bitcoin’s long-term value in the market.

For ordinary investors, it might be wise to consider this million target as a thinking anchor, gradually understanding, entering the market steadily, and allocating reasonably, in order to truly grasp this trend that may change the distribution of future wealth.

Will Bitcoin Really Hit $1 Million by 2030? Kiyosaki’s Bold Claim and What Newcomers Should Know

1. Bitcoin History and Current Price Review

2. The Logic Behind Kiyosaki's Million Dollar Prediction

3. Four major factors support the long-term bull market of Bitcoin

4. How should newbies participate? Practical advice and risk control reminders

Summary

1. Review of Bitcoin’s History and Current Price

Figure:https://www.gate.com/trade/BTC_USDT

Bitcoin has undergone a transformation from a “hacker toy” to “digital gold” since it was proposed by Satoshi Nakamoto in 2009. From initially being worth less than 1 cent, it first broke through $20,000 in 2017 and soared to a peak of $69,000 in 2021, shocking the world with its dramatic increase.

As of June 23, 2025, the price of Bitcoin is approximately $100,800. Although it briefly dropped below the psychological threshold of $100,000 on the evening of the 22nd, it remains in a fluctuating upward channel overall. Despite the volatility, Bitcoin has been regarded by many institutions as an anti-inflation asset, maintaining its position as the world’s leading cryptocurrency by market capitalization.

2. The Logic Behind Kiyosaki’s Million Dollar Prophecy

In June 2025, Robert Kiyosaki, the author of “Rich Dad Poor Dad,” stated in a public post: “I believe Bitcoin can reach $1,000,000 by 2030.” He sees Bitcoin as a core tool to combat “fake money” (fiat money). He pointed out that governments printing money without limits leads to inflation, while the scarcity and decentralized mechanism of Bitcoin can effectively hedge against this risk.

Kiyosaki stated that he entered the market when Bitcoin was at $6,000, and now he is even more confident about its future upside potential. Although his views are aggressive, there is a certain macroeconomic basis behind them.

3. Four Major Factors Supporting the Long-term Bull Market of Bitcoin

(1) Scarcity and Halving Mechanism: The total supply of Bitcoin is fixed at 21 million coins, with a halving occurring every four years, demonstrating a clear deflationary attribute. In 2024, it just experienced its fourth halving, reducing the daily new coin production from 900 coins to 450 coins. This mechanism forms the supply foundation for long-term price increases.

(2) Institutional and sovereign funds entering the market: Global asset management giants such as BlackRock and Fidelity have significantly increased their holdings in Bitcoin through ETFs and funds. In addition, countries like El Salvador and Argentina have incorporated Bitcoin as legal assets, marking a rise in recognition at the sovereign level.

(3) Global macro uncertainty: Factors such as inflation, geopolitical conflicts, and the decline of dollar hegemony are driving more investors to seek safe-haven assets. Bitcoin, independent of any national monetary system, has become the “safe-haven gold” of the digital age.

(4) The technical ecosystem is continuously improving: Lightning Network, Bitcoin ETF, payment integration, Web3 application development, etc., greatly expanding the practical use cases of Bitcoin, no longer just a “speculative target.”

4. How should newbies participate? Practical advice and risk control reminders

For newbies, although Bitcoin has great potential, it is not without risks. Here are a few suggestions for reference:

(1) Understand volatility risk and prepare for the long term: Bitcoin may rise or fall sharply in the short term. For example, it dropped by 60% within a few months in 2022. Newbies need to have sufficient psychological expectations and should not blindly chase highs and sell lows.

(2) Use a dollar-cost averaging strategy to smooth out costs: It is recommended to invest funds in batches, buying regularly on a monthly or weekly basis, and not to attempt to “buy the dip” or “sell at the peak.” In the long run, this approach can effectively reduce holding costs.

(3) Set up profit-taking and stop-loss mechanisms: establish profit targets and the maximum allowable loss percentage. For example, take some profits when the price rises by 100%, and cut losses if they exceed 20%. Discipline is crucial.

(4) Diversified allocation to avoid single bets: While Bitcoin is powerful, it is also recommended to allocate other assets like Ethereum and stablecoins to form a cryptocurrency asset portfolio, reducing overall volatility.

(5) Pay attention to regulatory and technical risks: Global regulation of cryptocurrencies remains uncertain, which may lead to significant market fluctuations. Additionally, technical issues such as hacker attacks and wallet losses should also be monitored.

Summary

“Will Bitcoin reach one million dollars by 2030?” This question cannot be definitively answered by anyone today. However, from the perspectives of supply mechanisms, institutional holdings, and global economic trends, this goal is not mere fantasy. Robert Kiyosaki’s view may be overly aggressive, but it reflects a high recognition of Bitcoin’s long-term value in the market.

For ordinary investors, it might be wise to consider this million target as a thinking anchor, gradually understanding, entering the market steadily, and allocating reasonably, in order to truly grasp this trend that may change the distribution of future wealth.