- Topic

15k Popularity

102k Popularity

128k Popularity

6k Popularity

3k Popularity

- Pin

- 🎉 Hey Gate Square friends! Non-stop perks and endless excitement—our hottest posting reward events are ongoing now! The more you post, the more you win. Don’t miss your exclusive goodies! 🚀

🆘 #Gate 2025 Semi-Year Community Gala# | Square Content Creator TOP 10

Only 1 day left! Your favorite creator is one vote away from TOP 10. Interact on Square to earn Votes—boost them and enter the prize draw. Prizes: iPhone 16 Pro Max, Golden Bull sculpture, Futures Vouchers!

Details 👉 https://www.gate.com/activities/community-vote

1️⃣ #Show My Alpha Points# | Share your Alpha points & gains

Post your - 🚀 ETH jumped to $4,600 this morning, up 8.69% in 24h!

Just shy of the $4,891 ATH—think it breaks through?

📍 Follow Gate_Square, vote and drop your reason.

🎁 4 winners split $100 Futures Voucher! - 📢 Exclusive on Gate Square — #PROVE Creative Contest# is Now Live!

CandyDrop × Succinct (PROVE) — Trade to share 200,000 PROVE 👉 https://www.gate.com/announcements/article/46469

Futures Lucky Draw Challenge: Guaranteed 1 PROVE Airdrop per User 👉 https://www.gate.com/announcements/article/46491

🎁 Endless creativity · Rewards keep coming — Post to share 300 PROVE!

📅 Event PeriodAugust 12, 2025, 04:00 – August 17, 2025, 16:00 UTC

📌 How to Participate

1.Publish original content on Gate Square related to PROVE or the above activities (minimum 100 words; any format: analysis, tutorial, creativ - 💙 Gate Square #Gate Blue Challenge# 💙

Show your limitless creativity with Gate Blue!

📅 Event Period

August 11 – 20, 2025

🎯 How to Participate

1. Post your original creation (image / video / hand-drawn art / digital work, etc.) on Gate Square, incorporating Gate’s brand blue or the Gate logo.

2. Include the hashtag #Gate Blue Challenge# in your post title or content.

3. Add a short blessing or message for Gate in your content (e.g., “Wishing Gate Exchange continued success — may the blue shine forever!”).

4. Submissions must be original and comply with community guidelines. Plagiarism or re - 🎉 The #CandyDrop Futures Challenge# is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

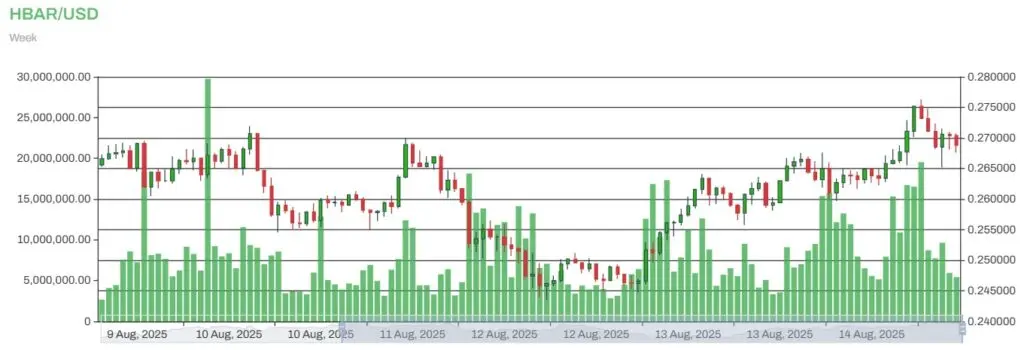

Grayscale Registers For A Hedera ETF, Boosting Investor Sentiment In HBAR

Grayscale recently registered for a Hedera (HBAR) exchange-traded fund (ETF) in the US, boosting bullish sentiment in its related cryptocurrency asset. According to the Division of Corporations website at the Department of State in Delaware, the investment platform submitted its application on Tuesday, August 12.

The event led to a 13% bump in the price of HBAR from Tuesday to the present as its value pivoted between a $0.2435 low on Tuesday and a $0.2759 high today.

ADVERTISEMENT HBAR to USD## Key Features of the Spot Hedera ETF

HBAR to USD## Key Features of the Spot Hedera ETF

Both Hedera and Grayscale have yet to comment officially on the matter. Nonetheless, it could spur heightened investor interest and adoption of HBAR via ETFs.

If approved, the investment instrument would give holders exposure to HBAR without worrying about the complexities of setting up and maintaining a crypto wallet and managing the custody of the token. It would also let investors trade the assets conveniently, like traditional stocks.

Grayscale’s Spot HBAR ETF Filings

Grayscale has notably submitted a 19b-4 for a Hedera ETF on February 24 this year, which the SEC acknowledged. The final deadline for the regulator’s action on the filing is November 11.

ADVERTISEMENTAnalysts like Bloomberg ETF experts James Seyffart and Eric Balchunas are confident about the SEC’s favorable decision on all pending HBAR ETFs, giving the investment products a 90% chance of approval on or before the final deadline this year.

Other Crypto ETF Filings and Products of Grayscale

So far, only Grayscale and Canary Capital have filed for a spot Hedera ETF. Besides HBAR, Grayscale has additionally submitted requests for the approval of spot ETFs based on Litecoin (LTC), Solana (SOL), XRP, Dogecoin (DOGE), Cardano (ADA), Polkadot (DOT), and Avalanche (AVA).

Meanwhile, Grayscale has already launched spot Bitcoin (BTC) and Ethereum (ETH) ETFs last year, with each having two versions to differentiate the converted and spin-off products. The SEC approved its basket ETF in July, but the regulator controversially paused its launch immediately as it supposedly waits to craft a more comprehensive framework for crypto ETFs.

Grayscale’s spot BTC ETFs have displayed -$23.722 billion and $1.689 billion net inflows since launch. On the other hand, its spot ETH ETFs have shown -$4.284 billion and $1.338 billion total net inflows. It should be noted that the figures with negative readings come from the converted investment trusts of the company into ETFs.

ADVERTISEMENT