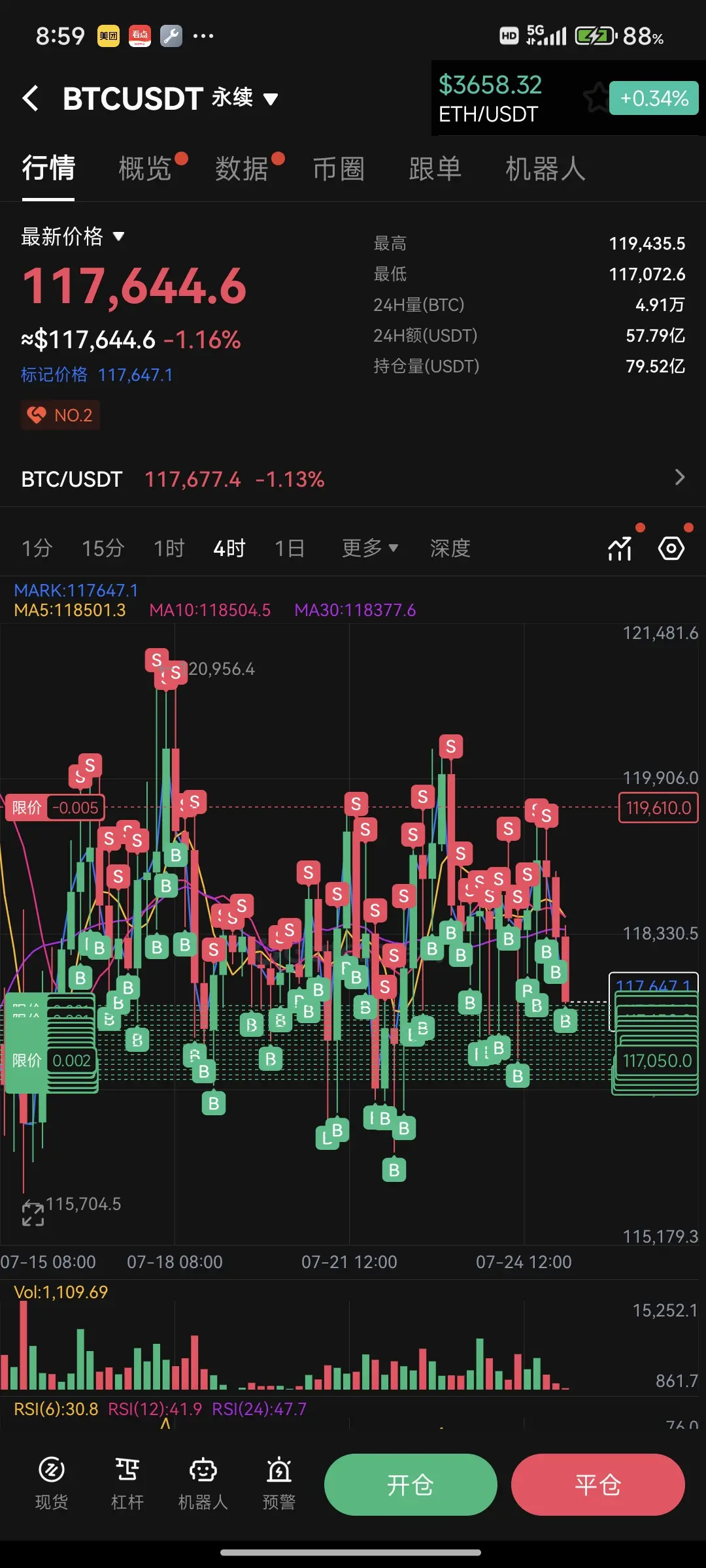

Current price: 117,916.8 USDT (24-hour rise +3.97%), Perptual Futures price 117,898.1 USDT (+3.95%), indicating short-term strength.

- Moving Average System:

MA5 (112,468.4) > MA10 (110,616.1) > MA30 (107,249.0), showing a bullish arrangement, supporting an upward trend.

The price is far above the moving average, be cautious of short-term pullback risks (such as a retreat to MA5 or MA10).

- RSI Indicator:

RSI(6)=86.5 (overbought), RSI(12)=75.8 (approaching overbought), RSI(24)=66.9 (neutral to strong).

- Short-term overheating may face a technical correction, but if it maintains high-level

View Original- Moving Average System:

MA5 (112,468.4) > MA10 (110,616.1) > MA30 (107,249.0), showing a bullish arrangement, supporting an upward trend.

The price is far above the moving average, be cautious of short-term pullback risks (such as a retreat to MA5 or MA10).

- RSI Indicator:

RSI(6)=86.5 (overbought), RSI(12)=75.8 (approaching overbought), RSI(24)=66.9 (neutral to strong).

- Short-term overheating may face a technical correction, but if it maintains high-level

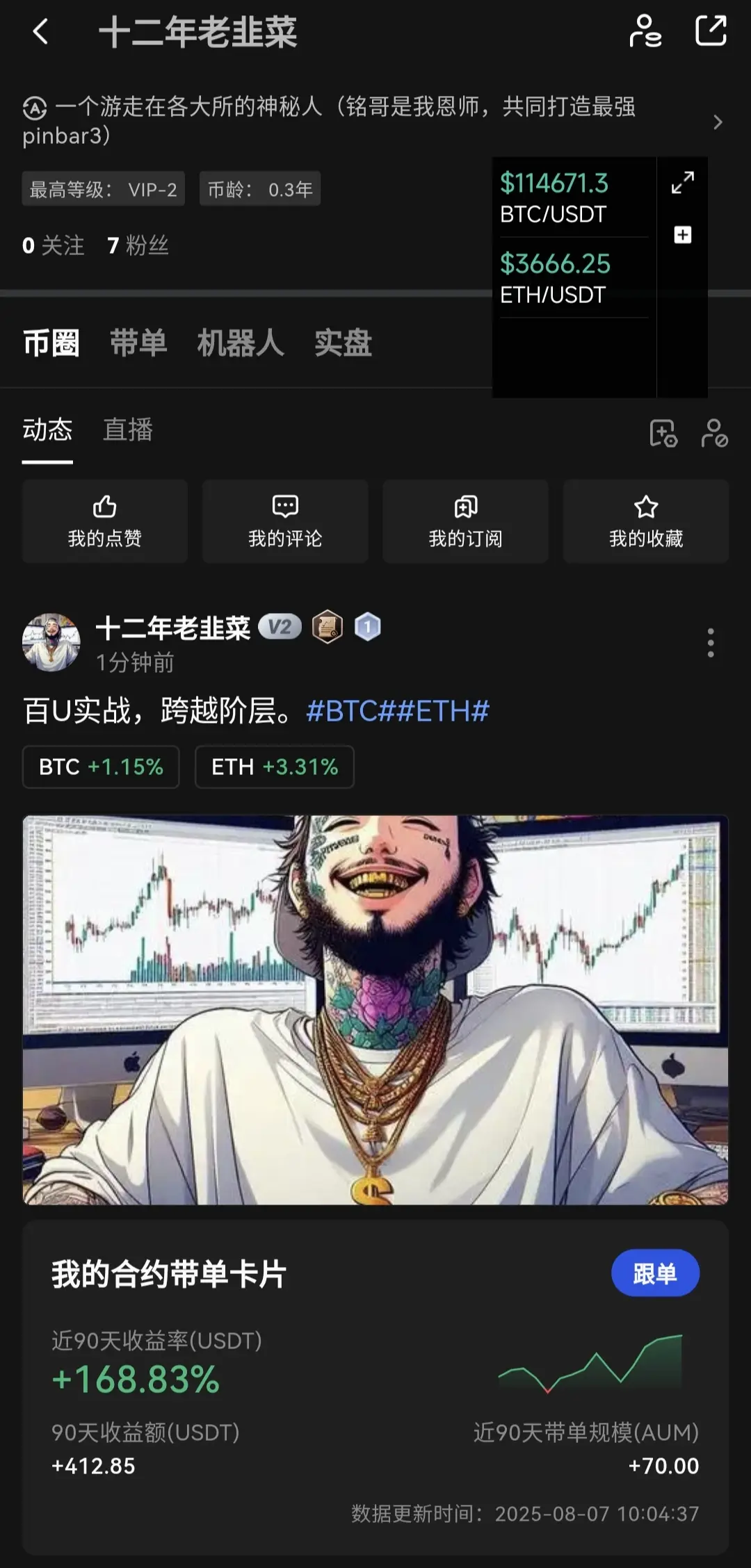

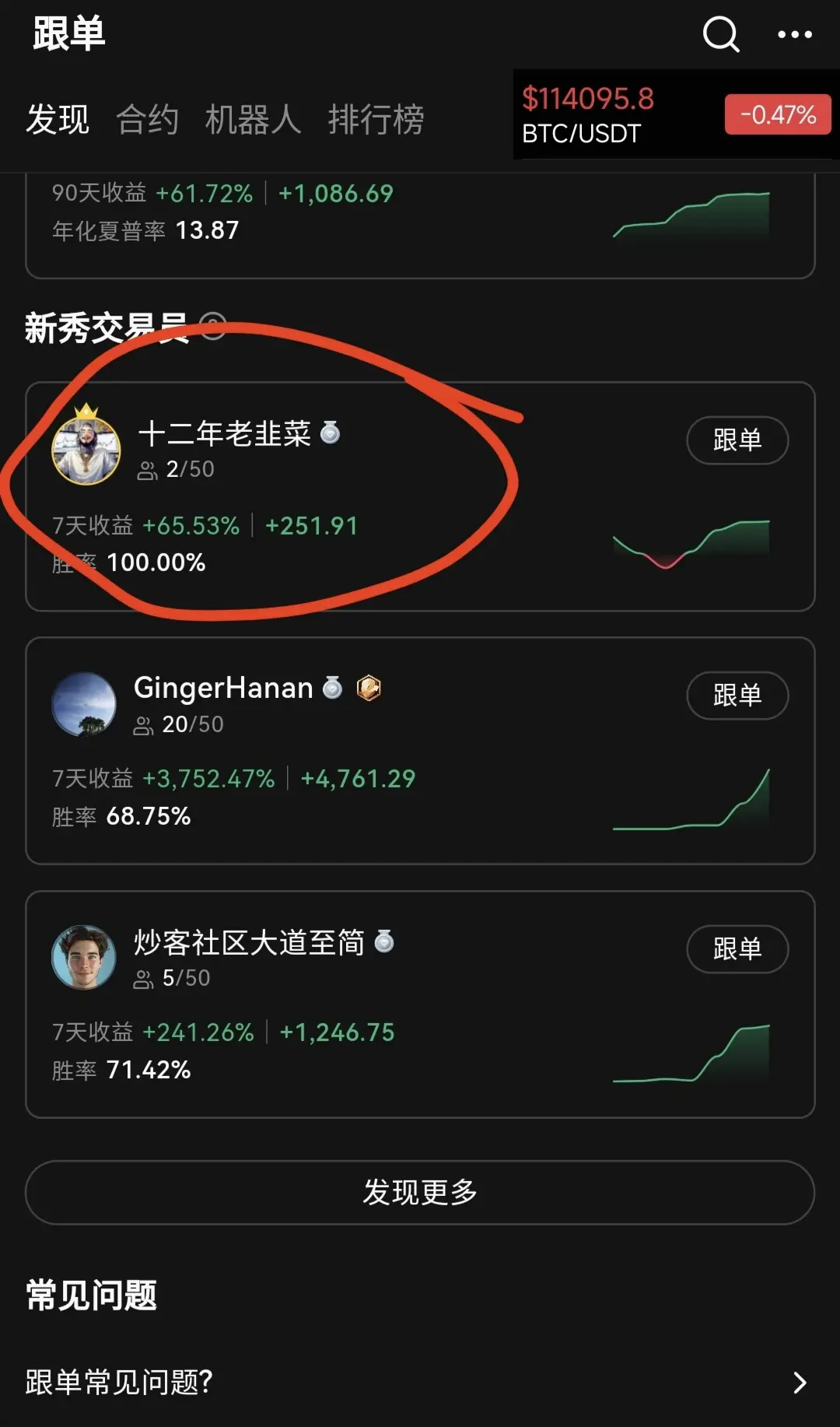

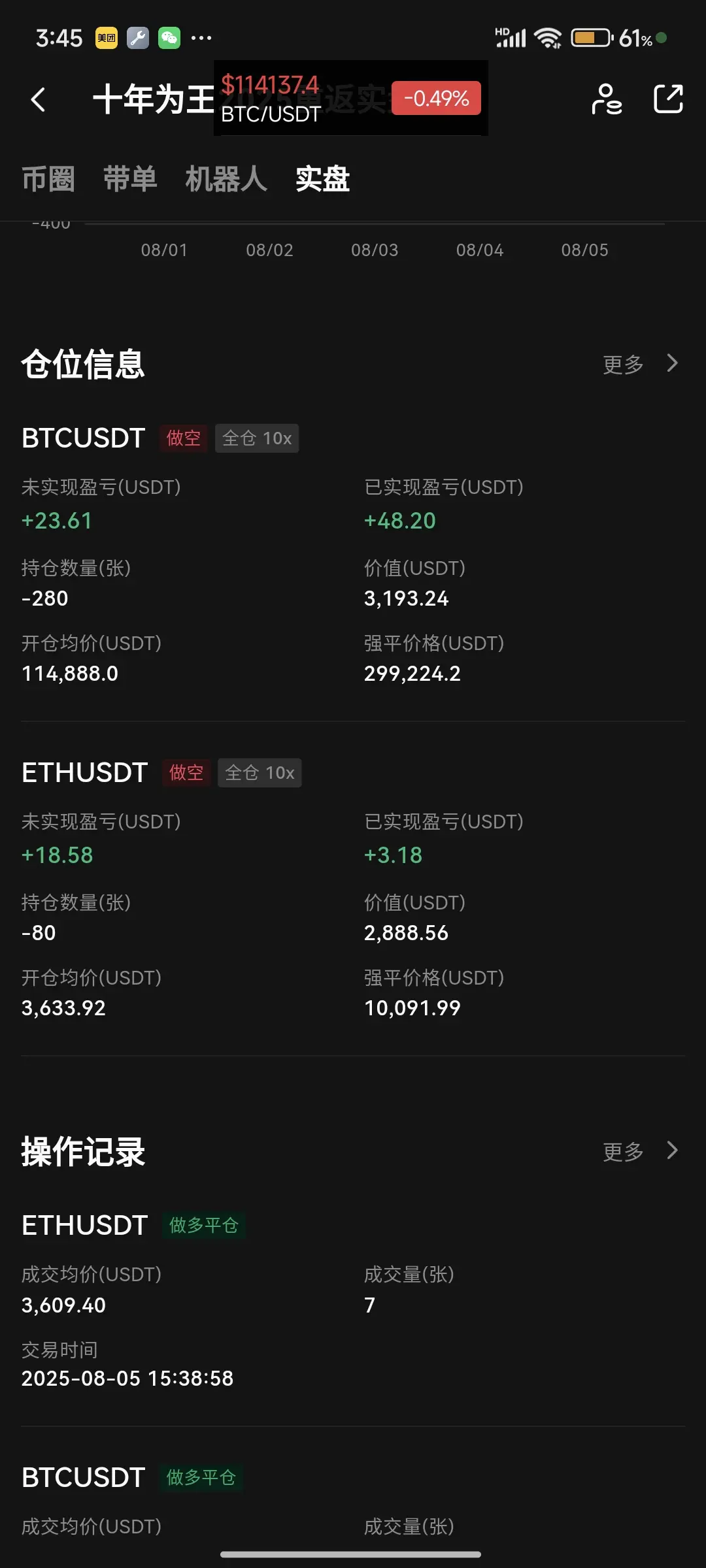

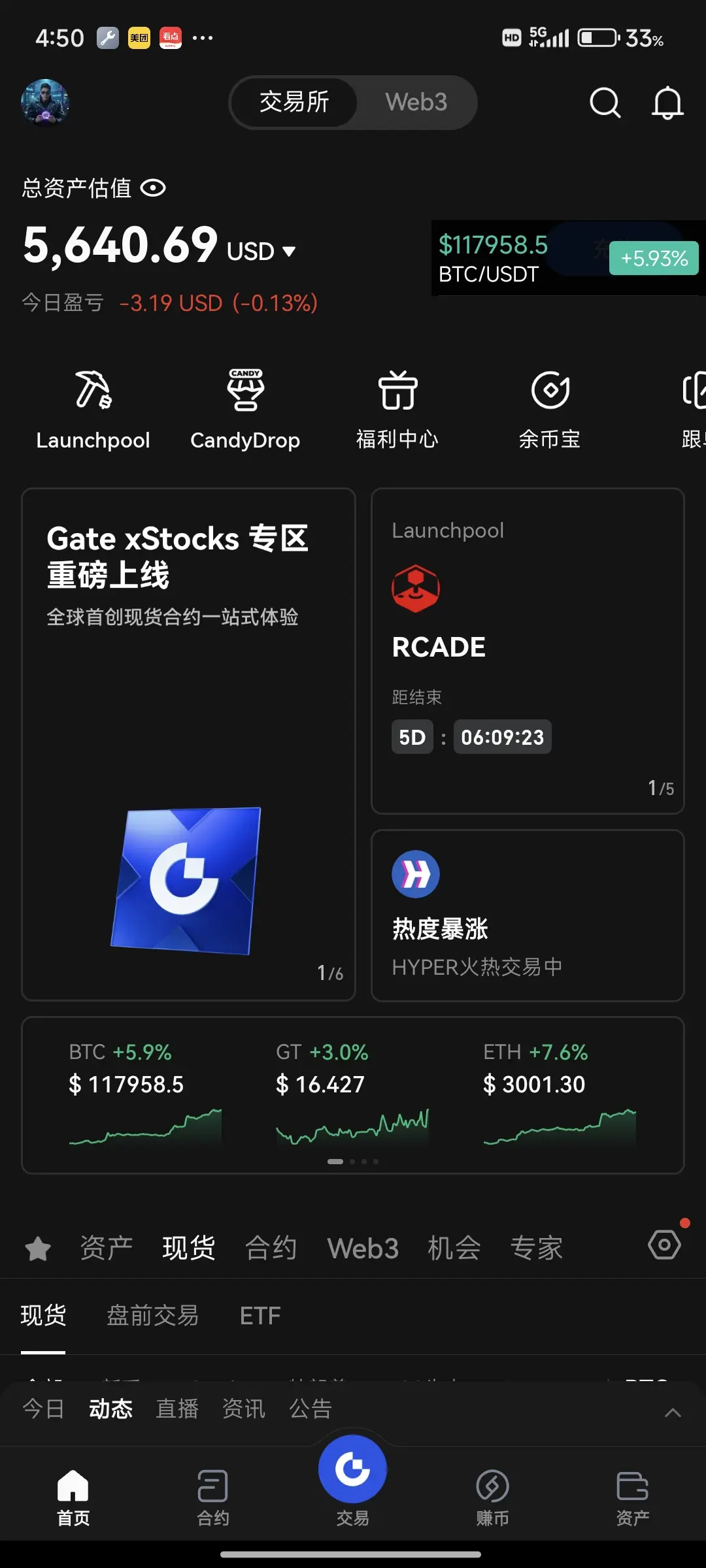

[The user has shared his/her trading data. Go to the App to view more.]