ChenXinyangOnTrends

No content yet

ChenXinyangOnTrends

The market activity during this early morning is particularly significant. BNB's high position has nearly a 30-point range.

BNB-1.49%

- Reward

- like

- Comment

- Share

Have you captured the 200 points of space in this wave of Ether?

View Original

- Reward

- like

- Comment

- Share

This wave of BTC has reached a high level, with a space of 4500 points, the first wave taken at the beginning of the month.

BTC-2.14%

- Reward

- like

- Comment

- Share

From the 4-hour chart of BTC over the past two weeks, the price has been oscillating narrowly around the 118,000 line, with a 24h fluctuation range of 115,000 - 119,000. The EMA moving averages are converging, indicating small short-term fluctuations and relative stability, with a target of 120,000. #BTC#

BTC-2.14%

- Reward

- like

- Comment

- Share

SOL Strategy Analysis

On the technical side, after the 1-hour K-line touched the low of 170, it stabilized and rebounded, breaking through the BBI indicator. The short-term moving averages are turning upwards, with 175 - 178 as key support, and buying support is strong. During the rebound, the volume increased, and there is capital support at the low levels, while the downward momentum is weakening.

Intraday trading strategy: enter between the 175 - 178 range, target 185-190.

On the technical side, after the 1-hour K-line touched the low of 170, it stabilized and rebounded, breaking through the BBI indicator. The short-term moving averages are turning upwards, with 175 - 178 as key support, and buying support is strong. During the rebound, the volume increased, and there is capital support at the low levels, while the downward momentum is weakening.

Intraday trading strategy: enter between the 175 - 178 range, target 185-190.

SOL-4.84%

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

BNB bearish strategy

BNB 1-hour K-line fluctuates. Considering the market environment and technical aspects, there are short-selling opportunities in the 805 - 810 range.

805 - 810 is a resistance zone that has not been broken multiple times in the past. The RSI is overbought, and the momentum of the short-term moving averages is weakening, making it suitable for shorting.

Operation suggestion: 805 - 810 range, target 790, if broken look at 780

BNB 1-hour K-line fluctuates. Considering the market environment and technical aspects, there are short-selling opportunities in the 805 - 810 range.

805 - 810 is a resistance zone that has not been broken multiple times in the past. The RSI is overbought, and the momentum of the short-term moving averages is weakening, making it suitable for shorting.

Operation suggestion: 805 - 810 range, target 790, if broken look at 780

BNB-1.49%

- Reward

- like

- Comment

- Share

7.31 midday ETH bearish strategy

After the Federal Reserve's interest rate cut fell short of expectations, ETH fluctuated between 3670 and 3830 in the past 24 hours. The 1-hour chart shows a rebound encountering resistance, with bulls lacking strength. The 1-hour candlestick rebound faced resistance and failed to effectively break through 3870, with 3880 - 3900 being a short-term strong resistance zone, suggesting a timing strategy for positioning.

Specific operation: 3880 - 3900 range, target interval: 3750 - 3780.

After the Federal Reserve's interest rate cut fell short of expectations, ETH fluctuated between 3670 and 3830 in the past 24 hours. The 1-hour chart shows a rebound encountering resistance, with bulls lacking strength. The 1-hour candlestick rebound faced resistance and failed to effectively break through 3870, with 3880 - 3900 being a short-term strong resistance zone, suggesting a timing strategy for positioning.

Specific operation: 3880 - 3900 range, target interval: 3750 - 3780.

ETH-3.72%

- Reward

- like

- 2

- Share

DreamOfStruggle :

:

🤑View More

7.31 BTC morning thoughts

The 1-hour chart shows a rise and then a fall, with 119000 acting as a short-term rebound resistance zone, and there is a high probability of a retreat upon encountering resistance. If the bulls are weak, the first test will be at the support level of 117500, and if it breaks, then the next target is 116000.

Intraday operation: Short at around 119000, target 117500, if broken look at 116000.

View OriginalThe 1-hour chart shows a rise and then a fall, with 119000 acting as a short-term rebound resistance zone, and there is a high probability of a retreat upon encountering resistance. If the bulls are weak, the first test will be at the support level of 117500, and if it breaks, then the next target is 116000.

Intraday operation: Short at around 119000, target 117500, if broken look at 116000.

- Reward

- like

- Comment

- Share

BTC follows the strategy to sync into longs, 117400, pocketed 1000 points in three hours.

BTC-2.14%

- Reward

- like

- Comment

- Share

ETH Evening Analysis

There is certain moving average support at the 3780 level; moreover, the price rebounded after reaching a short-term low of 3716, indicating the presence of buying pressure below.

From the 1-hour chart, after the price fell from 3941 to 3716, it is in a rebound repair stage, with around 3780 being a reasonable long position during the rebound process. If it breaks upwards, 3850 is a target after breaking a small resistance level during the previous rebound process. If it further breaks above 3850, 3900 is the price area before the previous high correction, which has upward

There is certain moving average support at the 3780 level; moreover, the price rebounded after reaching a short-term low of 3716, indicating the presence of buying pressure below.

From the 1-hour chart, after the price fell from 3941 to 3716, it is in a rebound repair stage, with around 3780 being a reasonable long position during the rebound process. If it breaks upwards, 3850 is a target after breaking a small resistance level during the previous rebound process. If it further breaks above 3850, 3900 is the price area before the previous high correction, which has upward

ETH-3.72%

- Reward

- like

- Comment

- Share

sol idea

From a technical perspective, the current price shows certain support signals around 180.

The price has rebounded from a low of 178, forming signs of short-term oscillation and a bottoming pattern in the 180 range. If it can effectively hold above 180, there is a possibility that the bottom formation will be completed, providing a foundation for a price rally.

From the historical trend, there was a performance that peaked at 195 earlier, indicating that there is room above. Currently, it has retraced to around 180, which is a reasonable correction of the previous rise. Once the bull

From a technical perspective, the current price shows certain support signals around 180.

The price has rebounded from a low of 178, forming signs of short-term oscillation and a bottoming pattern in the 180 range. If it can effectively hold above 180, there is a possibility that the bottom formation will be completed, providing a foundation for a price rally.

From the historical trend, there was a performance that peaked at 195 earlier, indicating that there is room above. Currently, it has retraced to around 180, which is a reasonable correction of the previous rise. Once the bull

SOL-4.84%

- Reward

- like

- Comment

- Share

7.30 BNB idea

After BNB surged to 860 on the 28th, it did not hold steady and began to decline, dropping to 830 that evening.

On the 29th, it started to oscillate around the 830 line for a whole day, and similarly dropped to the 810 line at the same time in the evening.

Today, the situation continues to oscillate around the 810 level as in the past two days. However, this situation will not last; after a short-term decline and oscillation, a rebound will follow, given that it has already broken above 860.

Idea: 790-800 is a key level, target 830, if it breaks up, continue to look at 850, defen

View OriginalAfter BNB surged to 860 on the 28th, it did not hold steady and began to decline, dropping to 830 that evening.

On the 29th, it started to oscillate around the 830 line for a whole day, and similarly dropped to the 810 line at the same time in the evening.

Today, the situation continues to oscillate around the 810 level as in the past two days. However, this situation will not last; after a short-term decline and oscillation, a rebound will follow, given that it has already broken above 860.

Idea: 790-800 is a key level, target 830, if it breaks up, continue to look at 850, defen

- Reward

- like

- Comment

- Share

BTC short-term moving averages EMA7 and EMA25 are flat and turning up, the 15-minute K-line is at the bottom and rebounding, and the downward momentum is weakening.

The K-line closed positively within the range. Monitor the 1/4 hour moving average, and decisively exit if it falls below the stop-loss level or encounters significant negative news; if it rises to 119500, partial take profit can be applied, and the remaining position should adjust the stop-loss to gamble.

Idea: 117500 - 118000 range, target 119500, stop loss at 116500 - 117000 #BTC#

The K-line closed positively within the range. Monitor the 1/4 hour moving average, and decisively exit if it falls below the stop-loss level or encounters significant negative news; if it rises to 119500, partial take profit can be applied, and the remaining position should adjust the stop-loss to gamble.

Idea: 117500 - 118000 range, target 119500, stop loss at 116500 - 117000 #BTC#

BTC-2.14%

- Reward

- like

- Comment

- Share

Evening thoughts on July 29

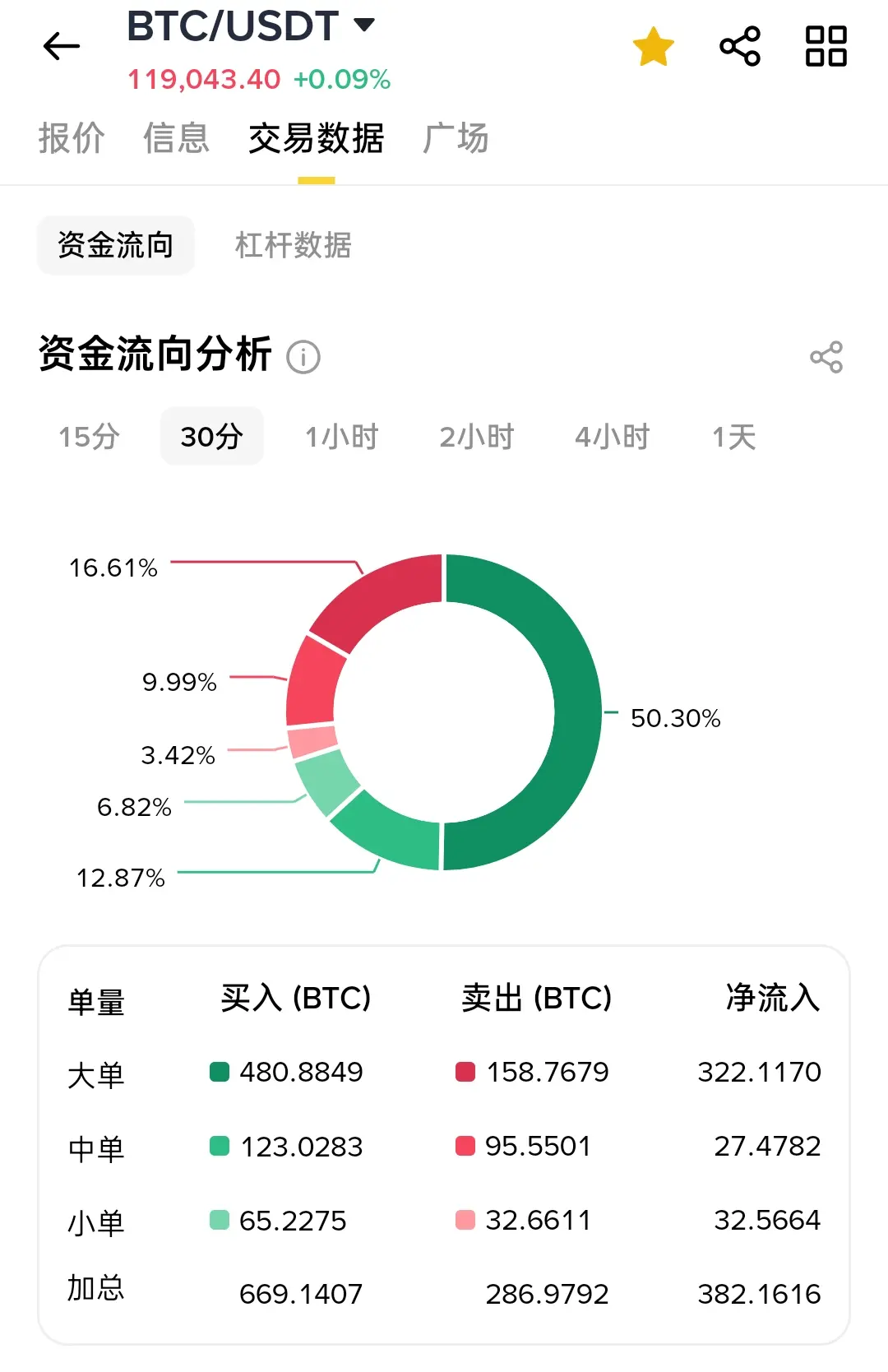

Bitcoin has remained steady above 118,000 for the past couple of days, mostly fluctuating between 118,500 and 119,000. In this situation, there is still capital flowing into the market, with nearly 400 Bitcoins entering within half an hour. This proves that the trend of Bitcoin remains stable and strong.

Idea: You can go short at the range of 118000-118500 for Bitcoin, with a target of 119500-120000, and a stop loss at 117500 #BTC# .

Bitcoin has remained steady above 118,000 for the past couple of days, mostly fluctuating between 118,500 and 119,000. In this situation, there is still capital flowing into the market, with nearly 400 Bitcoins entering within half an hour. This proves that the trend of Bitcoin remains stable and strong.

Idea: You can go short at the range of 118000-118500 for Bitcoin, with a target of 119500-120000, and a stop loss at 117500 #BTC# .

BTC-2.14%

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

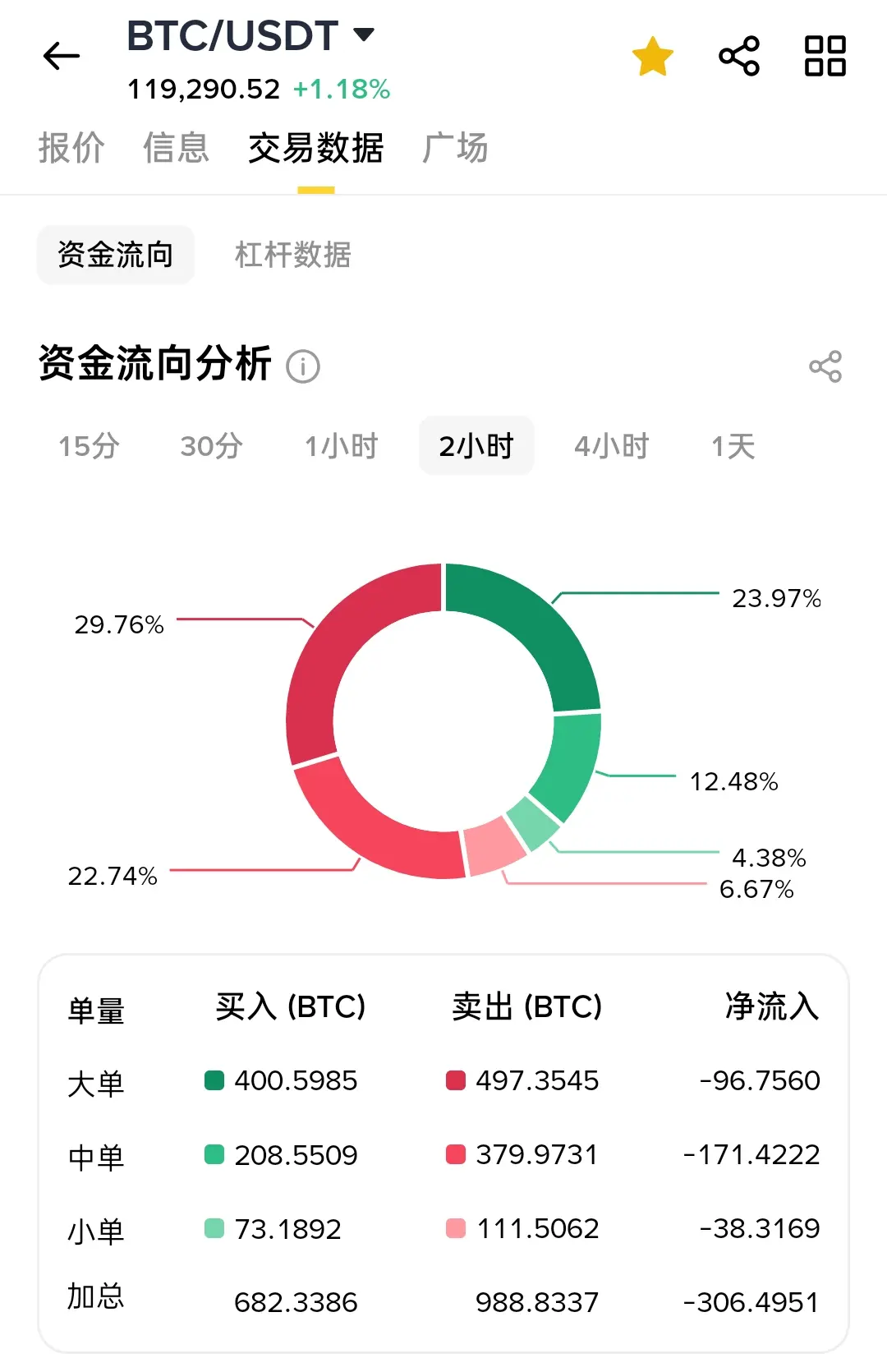

BTC fluctuated upwards over the weekend for two days, almost wiping out the few short positions at low levels, and market panic sentiment has already emerged.

The current strategy leans bearish, it is better to be cautious when chasing longs - the market funds have begun to flow out, and the upward momentum may be hard to sustain.

Consider placing a short position around the current price of approximately 120000, with a short-term target of 118000. If it breaks down, look for 116000, and set the stop loss at 1000 points.

This wave of short positions may go against the current market sentim

The current strategy leans bearish, it is better to be cautious when chasing longs - the market funds have begun to flow out, and the upward momentum may be hard to sustain.

Consider placing a short position around the current price of approximately 120000, with a short-term target of 118000. If it breaks down, look for 116000, and set the stop loss at 1000 points.

This wave of short positions may go against the current market sentim

BTC-2.14%

- Reward

- like

- Comment

- Share