CoincrazeCentral

No content yet

CoincrazeCentral

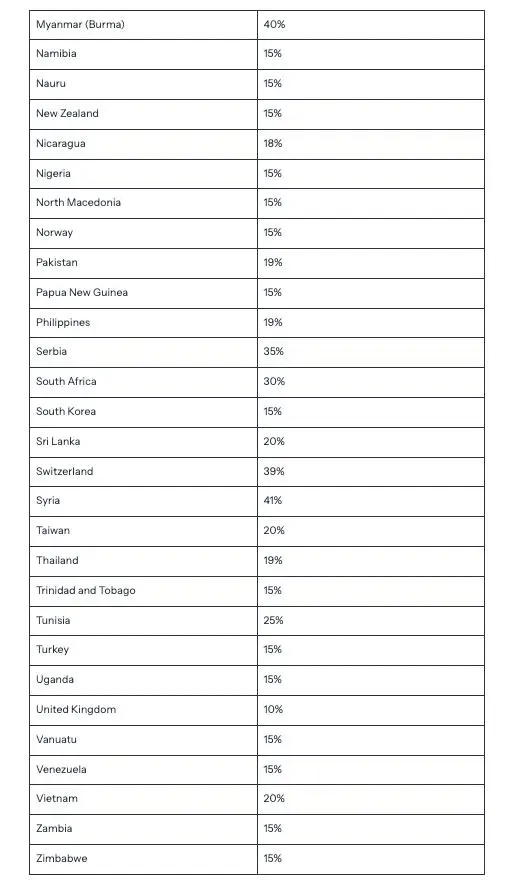

Trump just raised tariffs on Canada to 35%.

More hikes are coming — targeting countries across Asia, Europe, even Latin America.

This isn’t about trade efficiency anymore.

It’s about leverage, retaliation, and showing who controls the terms.

But here’s the thing: global supply chains can reroute.

Capital flows? Much harder.

That’s why open, borderless financial infrastructure — like crypto — matters more than ever.

Because when goods get taxed and payments get gated, programmable money becomes geopolitical neutrality.

#Tariffs # TradePolicy #Crypto # ProgrammableMoney #MacroFinance # Trump #Globa

More hikes are coming — targeting countries across Asia, Europe, even Latin America.

This isn’t about trade efficiency anymore.

It’s about leverage, retaliation, and showing who controls the terms.

But here’s the thing: global supply chains can reroute.

Capital flows? Much harder.

That’s why open, borderless financial infrastructure — like crypto — matters more than ever.

Because when goods get taxed and payments get gated, programmable money becomes geopolitical neutrality.

#Tariffs # TradePolicy #Crypto # ProgrammableMoney #MacroFinance # Trump #Globa

- Reward

- like

- Comment

- Share

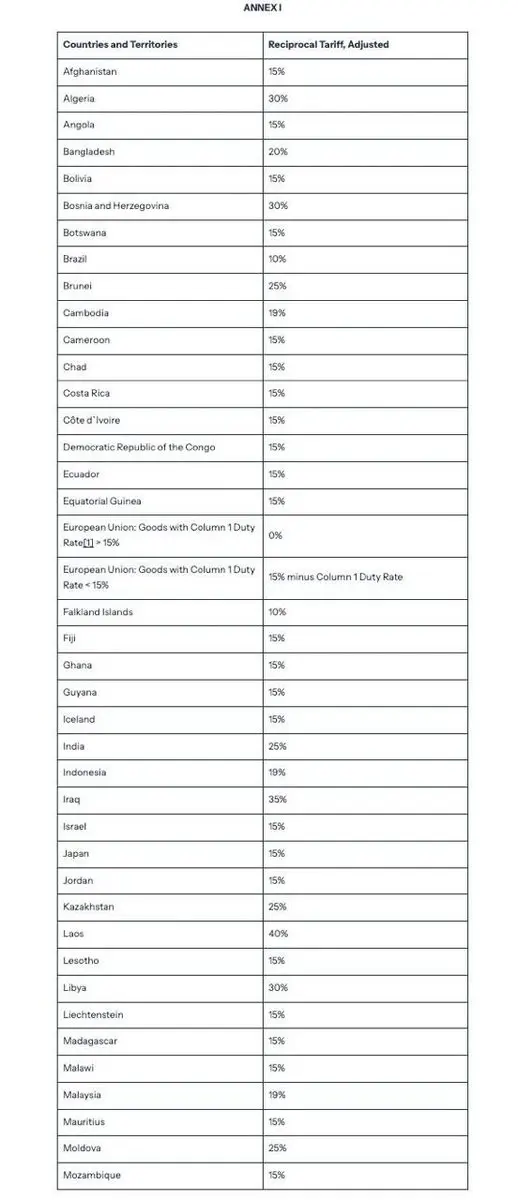

The White House just released the most aggressive crypto-forward roadmap in U.S. history.

It ends regulation-by-enforcement.

Creates safe harbor + sandbox rules.

Puts stablecoins under federal law.

And explicitly bans CBDCs.

Whether you love Trump or not, this is how a government embraces innovation:

• DeFi integrated into TradFi

• Banks greenlit for crypto services

• Clarity for staking, wrapping, self-custody

• No more weaponizing banking access (goodbye Choke Point 2.0)

America’s making a play to lead the Golden Age of Crypto — not just regulate it.

This isn’t just policy. It’s positioning.

It ends regulation-by-enforcement.

Creates safe harbor + sandbox rules.

Puts stablecoins under federal law.

And explicitly bans CBDCs.

Whether you love Trump or not, this is how a government embraces innovation:

• DeFi integrated into TradFi

• Banks greenlit for crypto services

• Clarity for staking, wrapping, self-custody

• No more weaponizing banking access (goodbye Choke Point 2.0)

America’s making a play to lead the Golden Age of Crypto — not just regulate it.

This isn’t just policy. It’s positioning.

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

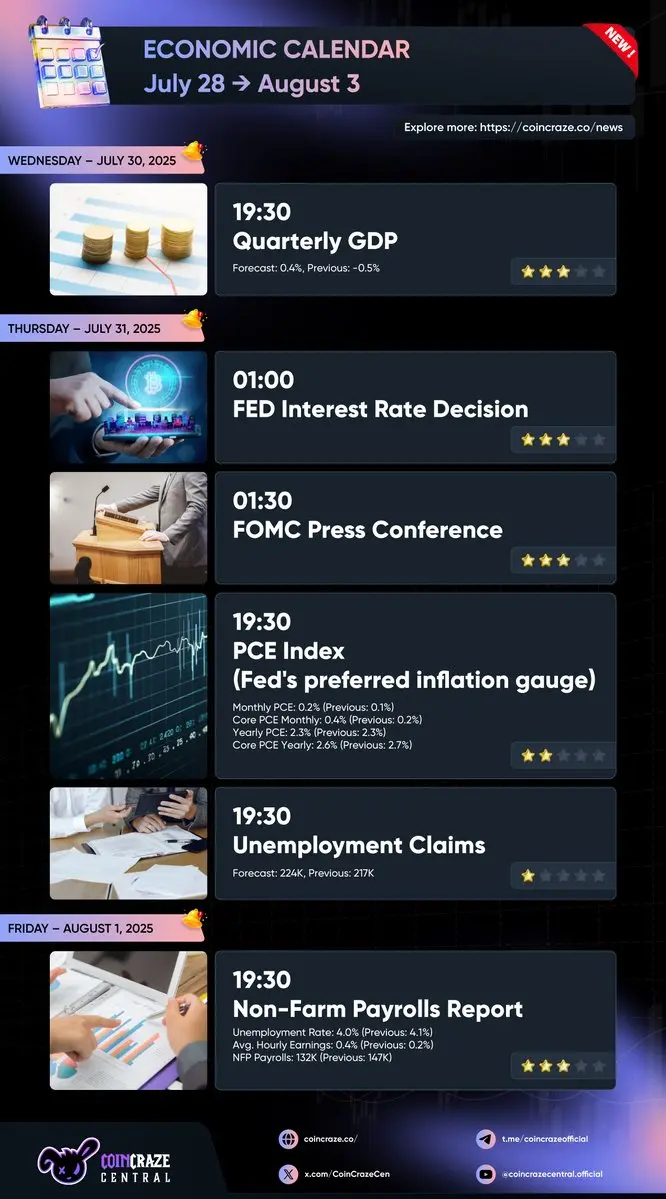

Heads up, everyone! The Fed will announce its interest rate decision at 1 AM (UTC+7) tonight.

According to CME FedWatch, nearly 97% of investors expect rates to stay unchanged, while only 3% anticipate a small hike.

Even BlackRock leans toward no change.

🔥 What’s your prediction? Are you with the majority — or expecting a surprise move?

According to CME FedWatch, nearly 97% of investors expect rates to stay unchanged, while only 3% anticipate a small hike.

Even BlackRock leans toward no change.

🔥 What’s your prediction? Are you with the majority — or expecting a surprise move?

MOVE-5.88%

- Reward

- like

- Comment

- Share

🚨 Something new and exclusive is coming your way

@CoinCrazeCen × @Gate_io this week 🚀

There are exciting signs of a Special Reward Drop

Looks like something big is slowly unfolding...

⏳Stay tuned! @CoinCrazeKR

#Coincraze# #Gate# #CryptoEvent# #Rewarddrop#

@CoinCrazeCen × @Gate_io this week 🚀

There are exciting signs of a Special Reward Drop

Looks like something big is slowly unfolding...

⏳Stay tuned! @CoinCrazeKR

#Coincraze# #Gate# #CryptoEvent# #Rewarddrop#

LOOKS-0.42%

- Reward

- like

- Comment

- Share

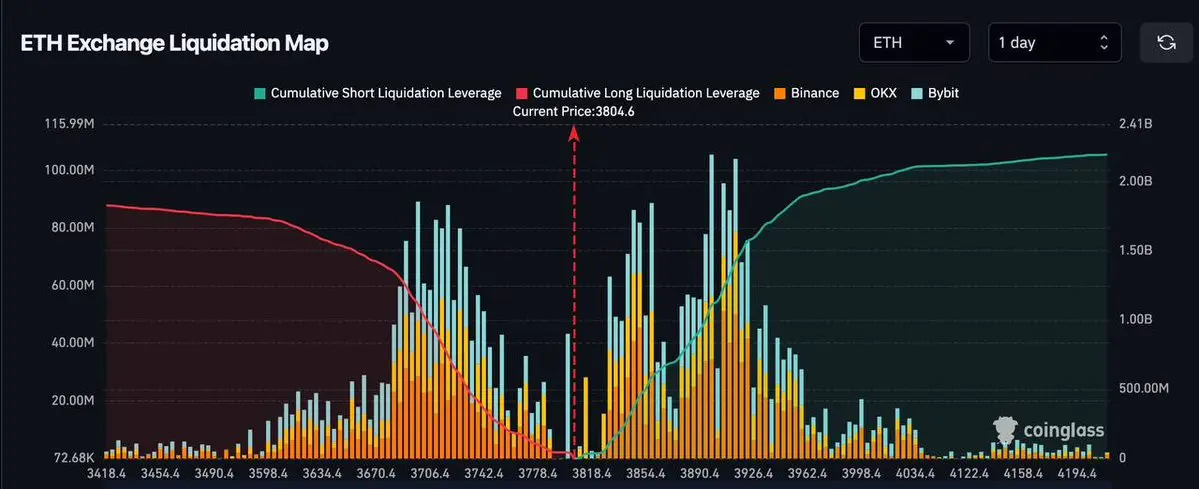

🔥 $2 billion in short positions will be liquidated if $ETH returns to the $4,000

On the flip side, over $1.6 billion in long positions will be wiped out if ETH breaks below $3,630.

ETH is currently at $3,800, exactly $200 away from both liquidation zones.

Which side will get liquidated first?

#coincraze # ccc #btcprice # Newsnight #newscrypto # cryptocurrency #discuss # Coincrazebot #tradingbot

On the flip side, over $1.6 billion in long positions will be wiped out if ETH breaks below $3,630.

ETH is currently at $3,800, exactly $200 away from both liquidation zones.

Which side will get liquidated first?

#coincraze # ccc #btcprice # Newsnight #newscrypto # cryptocurrency #discuss # Coincrazebot #tradingbot

- Reward

- like

- Comment

- Share

The court just upheld Trump’s move to kill the $800 de minimis exemption. No more duty-free Chinese imports to the U.S.

This changes the game for fast fashion, e-comm startups, and any business built on just-in-time global shipping.

It’s not just about Shein and Temu. It’s about the end of cheap, direct-to-door cross-border commerce as we know it.

When compliance gets this expensive, companies (and AI agents) will start choosing open financial infrastructure.

Crypto doesn’t dodge tariffs — but it removes permissioned rails from the equation.

Trade barriers are back. Programmable money just bec

This changes the game for fast fashion, e-comm startups, and any business built on just-in-time global shipping.

It’s not just about Shein and Temu. It’s about the end of cheap, direct-to-door cross-border commerce as we know it.

When compliance gets this expensive, companies (and AI agents) will start choosing open financial infrastructure.

Crypto doesn’t dodge tariffs — but it removes permissioned rails from the equation.

Trade barriers are back. Programmable money just bec

- Reward

- like

- Comment

- Share

🚨 U.S. Treasury just raised its Q3 borrowing estimate to $1.007 trillion — up $453B from April’s forecast.

Why?

Lower starting cash and weaker-than-expected net inflows.

Add another $590B expected in Q4, and we’re looking at $1.6T+ in new debt just in the back half of 2025.

In contrast, Q2 borrowing was just $65B — dramatically undershooting forecasts thanks to tight cash management.

What does this mean?

The U.S. is entering a phase of rapid re-leveraging into year-end.

Higher issuance = upward pressure on yields.

And for crypto markets? Liquidity dynamics will matter more than rate guidance.

Why?

Lower starting cash and weaker-than-expected net inflows.

Add another $590B expected in Q4, and we’re looking at $1.6T+ in new debt just in the back half of 2025.

In contrast, Q2 borrowing was just $65B — dramatically undershooting forecasts thanks to tight cash management.

What does this mean?

The U.S. is entering a phase of rapid re-leveraging into year-end.

Higher issuance = upward pressure on yields.

And for crypto markets? Liquidity dynamics will matter more than rate guidance.

- Reward

- like

- Comment

- Share

JPMorgan is charging fintechs like Plaid for API access.

Why? 1.89B data requests in June — but only 13% came from real users. The rest? Automated pings, background refreshes, API noise.

This isn’t just about fees. It’s a sign:

Legacy banking infrastructure wasn’t built for real-time, permissionless finance. Especially not for AI or automation.

Crypto rails, on the other hand, don’t care if your transaction comes from a user, a bot, or a smart contract.

It’s open, direct, and doesn’t need Plaid in the middle.

If AI is the front end of money, crypto is the only backend that actually fits.

#JPMo

Why? 1.89B data requests in June — but only 13% came from real users. The rest? Automated pings, background refreshes, API noise.

This isn’t just about fees. It’s a sign:

Legacy banking infrastructure wasn’t built for real-time, permissionless finance. Especially not for AI or automation.

Crypto rails, on the other hand, don’t care if your transaction comes from a user, a bot, or a smart contract.

It’s open, direct, and doesn’t need Plaid in the middle.

If AI is the front end of money, crypto is the only backend that actually fits.

#JPMo

- Reward

- like

- Comment

- Share

A federal judge just ruled the Fed doesn’t have to open its FOMC meetings to the public.

No surprise there — but it highlights the deeper issue:

We’re in a world where trillion-dollar decisions are made behind closed doors… and markets are expected to just interpret tone.

In crypto, everything’s on-chain.

In TradFi, everything’s off-record — until it’s not.

If the Fed wants trust, it doesn’t need to livestream meetings.

But it does need to catch up to an era where transparency isn’t a luxury — it’s infrastructure.

#FOMC # Fed #Transparency # CryptoVsTradFi #MonetaryPolicy # Bitcoin #MacroFinance

No surprise there — but it highlights the deeper issue:

We’re in a world where trillion-dollar decisions are made behind closed doors… and markets are expected to just interpret tone.

In crypto, everything’s on-chain.

In TradFi, everything’s off-record — until it’s not.

If the Fed wants trust, it doesn’t need to livestream meetings.

But it does need to catch up to an era where transparency isn’t a luxury — it’s infrastructure.

#FOMC # Fed #Transparency # CryptoVsTradFi #MonetaryPolicy # Bitcoin #MacroFinance

- Reward

- like

- Comment

- Share

🗓 MACRO ECONOMIC CALENDAR

WEEK 01, AUGUST

➡️ This week includes several key announcements that may cause price volatility — be cautious with leverage usage.

🎯 As of now, the probability of a Fed rate cut on July 31 (according to CME) is:

+ No change: 95.7%

+ Cut by 25 basis points: 4.3%

#coincraze # ccc #btcprice # Newsnight #newscrypto # cryptocurrency #discuss # Coincrazebot #tradingbot

WEEK 01, AUGUST

➡️ This week includes several key announcements that may cause price volatility — be cautious with leverage usage.

🎯 As of now, the probability of a Fed rate cut on July 31 (according to CME) is:

+ No change: 95.7%

+ Cut by 25 basis points: 4.3%

#coincraze # ccc #btcprice # Newsnight #newscrypto # cryptocurrency #discuss # Coincrazebot #tradingbot

MAY-3.86%

- Reward

- like

- Comment

- Share

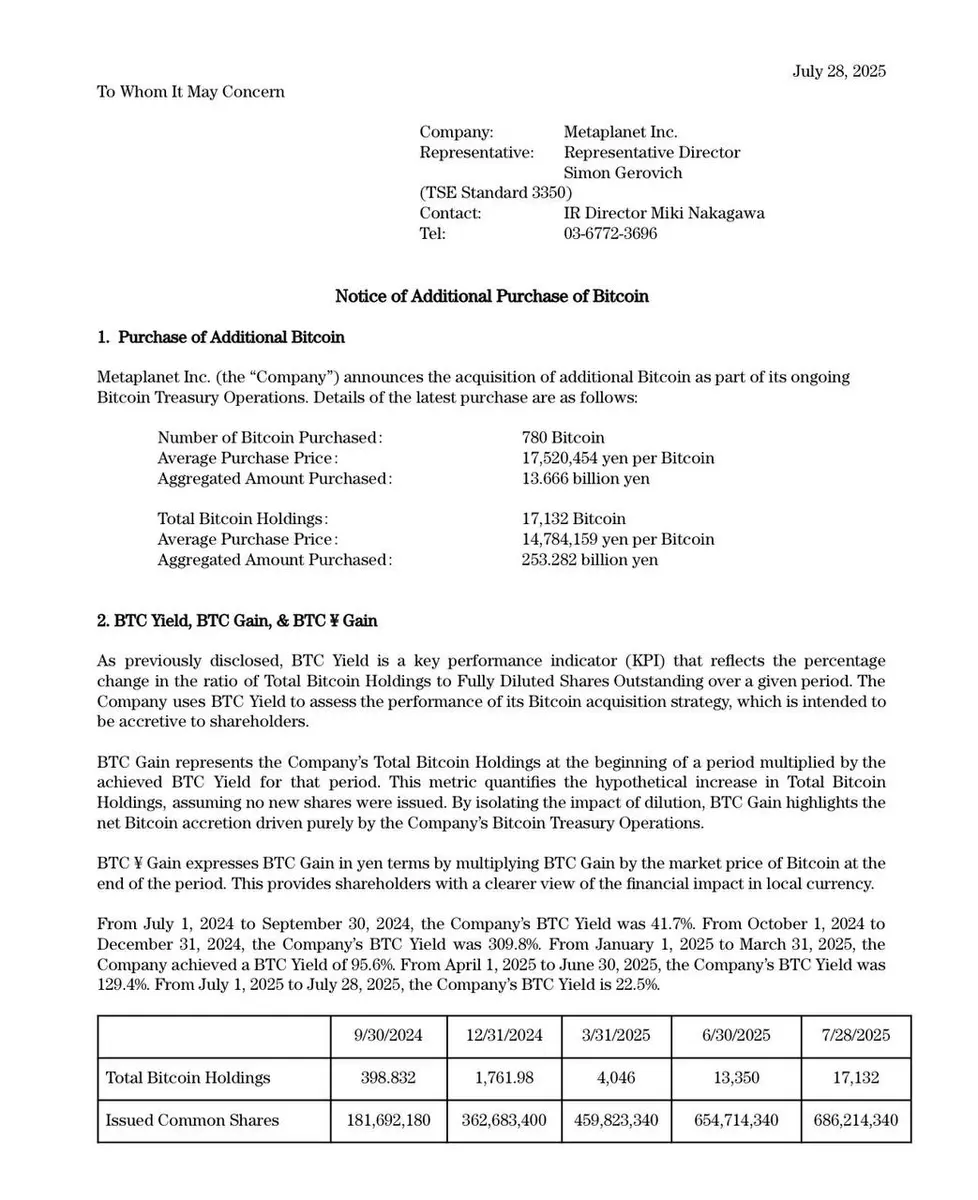

Metaplanet just bought another 780 BTC — now holding over 17,000 Bitcoin.

This isn’t a marketing stunt. It’s Japan’s version of MicroStrategy, but with a capital strategy that’s starting to scale globally.

Their BTC Yield hit 129% last quarter. They're not chasing price — they’re compounding conviction.

At this rate, they’re not just buying Bitcoin.

They’re becoming a Bitcoin-native treasury system.

And that’s a model more public companies may start copying — in Asia and beyond.

#Metaplanet # Bitcoin #BTC # CorporateTreasury #MacroFinance # CryptoStrategy

This isn’t a marketing stunt. It’s Japan’s version of MicroStrategy, but with a capital strategy that’s starting to scale globally.

Their BTC Yield hit 129% last quarter. They're not chasing price — they’re compounding conviction.

At this rate, they’re not just buying Bitcoin.

They’re becoming a Bitcoin-native treasury system.

And that’s a model more public companies may start copying — in Asia and beyond.

#Metaplanet # Bitcoin #BTC # CorporateTreasury #MacroFinance # CryptoStrategy

- Reward

- like

- Comment

- Share

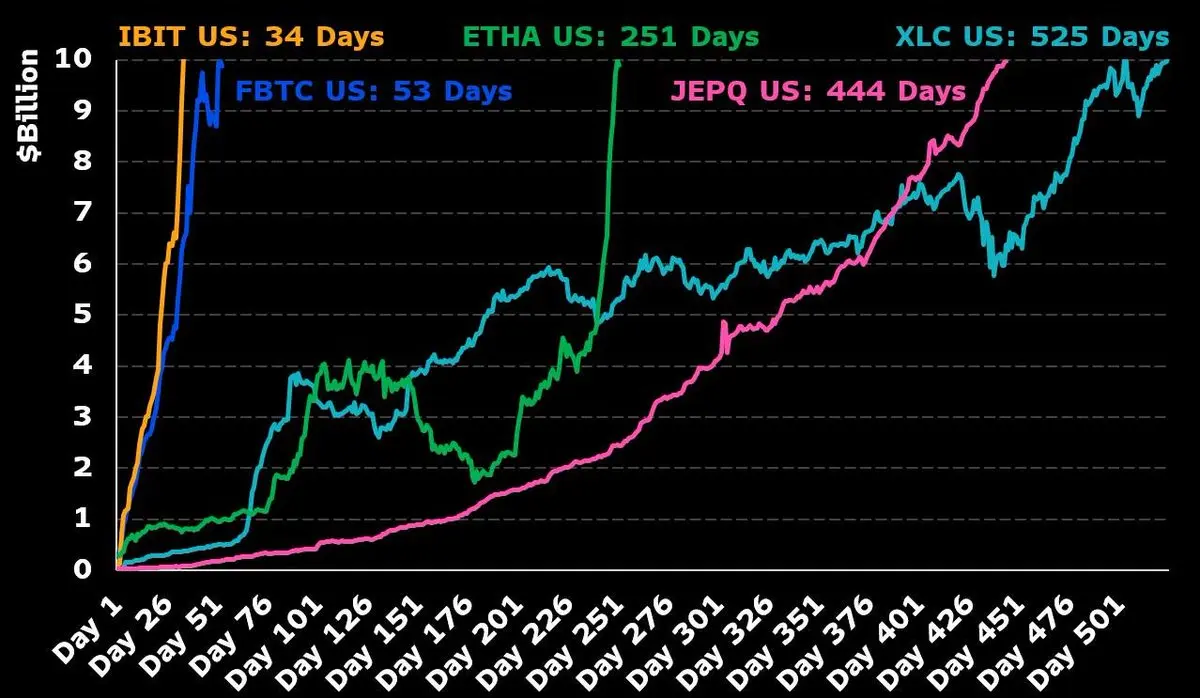

BlackRock’s Ether ETF (ETHA) just hit $10B AUM in under a year.

Third-fastest ETF to ever do it.

And it doubled from $5B → $10B in just 10 days.

That’s not retail FOMO.

That’s institutions quietly allocating into Ethereum — not for the hype, but for the fundamentals.

The narrative is shifting: ETH isn’t just tech

infrastructure anymore.

It’s becoming a macro asset.

#Ethereum # ETHA #BlackRock # CryptoETF #InstitutionalAdoption # DigitalAssets #MacroFinance

Third-fastest ETF to ever do it.

And it doubled from $5B → $10B in just 10 days.

That’s not retail FOMO.

That’s institutions quietly allocating into Ethereum — not for the hype, but for the fundamentals.

The narrative is shifting: ETH isn’t just tech

infrastructure anymore.

It’s becoming a macro asset.

#Ethereum # ETHA #BlackRock # CryptoETF #InstitutionalAdoption # DigitalAssets #MacroFinance

- Reward

- like

- Comment

- Share

Nearly 30,000 BTC disclosed in one week.

62 corporate updates.

New funds. New treasuries. New conviction.

This isn’t just MicroStrategy anymore — it’s becoming a global playbook.

Bitcoin is quietly turning into a default treasury asset for a new class of companies.

Not hype. Not speculation.

Just balance sheet strategy in real time.

The walls between TradFi and digital reserves are getting thinner by the day.

#Bitcoin # BTC #CorporateTreasury # CryptoFinance #InstitutionalAdoption # MacroMoves

62 corporate updates.

New funds. New treasuries. New conviction.

This isn’t just MicroStrategy anymore — it’s becoming a global playbook.

Bitcoin is quietly turning into a default treasury asset for a new class of companies.

Not hype. Not speculation.

Just balance sheet strategy in real time.

The walls between TradFi and digital reserves are getting thinner by the day.

#Bitcoin # BTC #CorporateTreasury # CryptoFinance #InstitutionalAdoption # MacroMoves

- Reward

- like

- Comment

- Share

The U.S.–EU trade deal is done: a 15% tariff on most European goods entering the U.S., agreed just hours before the August 1 deadline. 🇺🇸🇪🇺

In return, the EU will:

• Buy $750 billion in U.S. energy over three years

• Invest $600 billion in the U.S. economy, including military equipment

This isn’t all good news—steel and aluminum tariffs at 50% still stand, and details on other sectors remain uncertain.

The deal averts a headline-grabbing trade war but leaves many questions unanswered.

What strikes me most:

• It’s trade policy used as geopolitical leverage.

• The uncertainty isn’t gone—it’s

In return, the EU will:

• Buy $750 billion in U.S. energy over three years

• Invest $600 billion in the U.S. economy, including military equipment

This isn’t all good news—steel and aluminum tariffs at 50% still stand, and details on other sectors remain uncertain.

The deal averts a headline-grabbing trade war but leaves many questions unanswered.

What strikes me most:

• It’s trade policy used as geopolitical leverage.

• The uncertainty isn’t gone—it’s

- Reward

- like

- Comment

- Share

🔥US and China agree to extend trade tariff suspension for another 90 days

Another reason for the market to fly again tomorrow???

Another reason for the market to fly again tomorrow???

- Reward

- like

- Comment

- Share

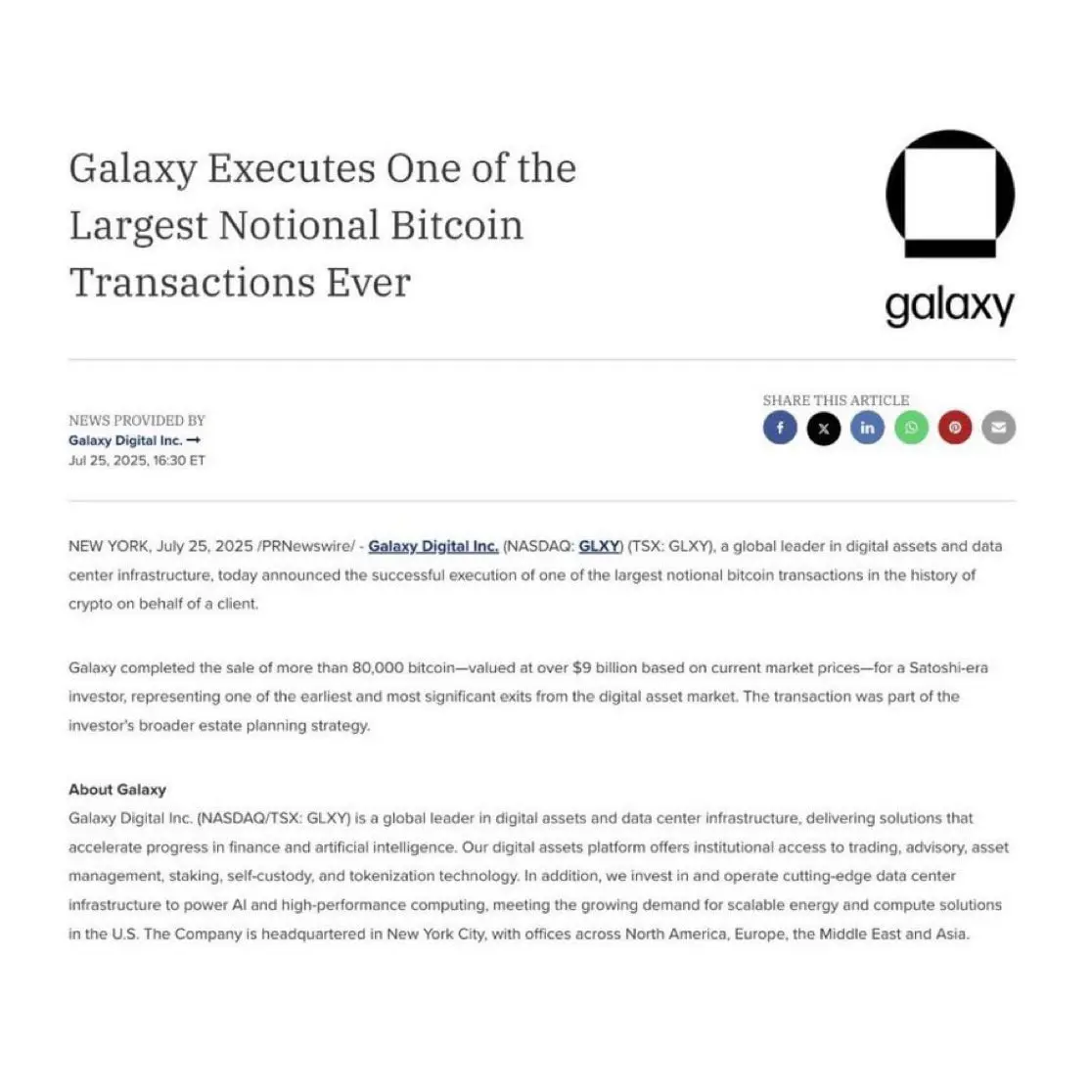

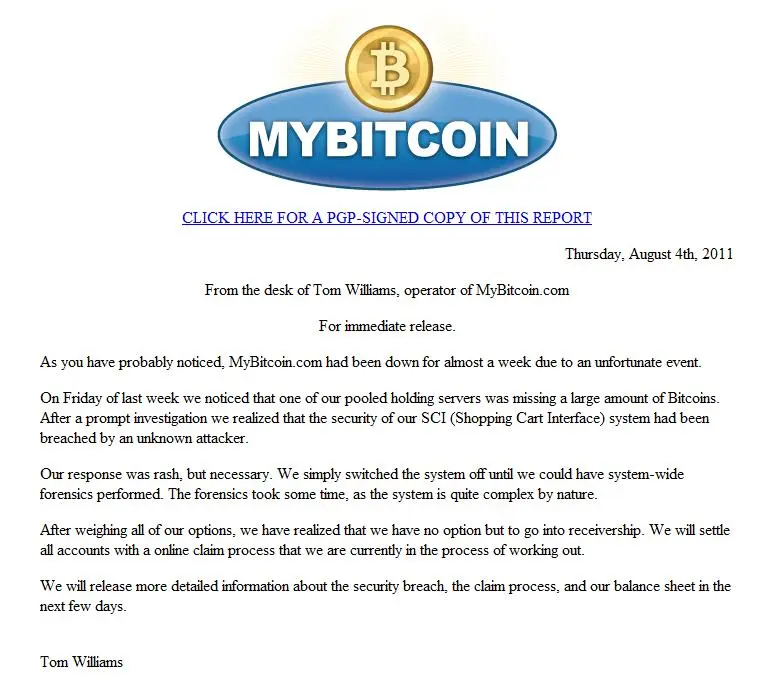

🔥 BTC price almost flat after last night's "billion dollar" profit-taking

Over 80,000 BTC (~9 billion USD) were sold by Galaxy Digital overnight

This $BTC is said to have been "sleeping" for 14 years and is related to a wallet that used to be on the MyBitcoin platform since 2011

#btc # btcprice #coincraze # ccc #chartbtc

Over 80,000 BTC (~9 billion USD) were sold by Galaxy Digital overnight

This $BTC is said to have been "sleeping" for 14 years and is related to a wallet that used to be on the MyBitcoin platform since 2011

#btc # btcprice #coincraze # ccc #chartbtc

- Reward

- like

- Comment

- Share

An 80,000 BTC sell — from a wallet untouched since 2011 — just happened.

That’s over $9.5B in Bitcoin… and the market barely flinched.

This is no longer the same asset class it was a few years ago.

We just absorbed one of the largest sells in crypto history with a 3% dip and a full rebound.

Why? Because this wasn’t panic — it was coordinated, institutional, and liquid.

Bitcoin isn’t fragile anymore. It’s antifragile.

#Bitcoin # GalaxyDigital #WhaleMove # BTC #CryptoMarkets # InstitutionalCrypto #SatoshiEra

That’s over $9.5B in Bitcoin… and the market barely flinched.

This is no longer the same asset class it was a few years ago.

We just absorbed one of the largest sells in crypto history with a 3% dip and a full rebound.

Why? Because this wasn’t panic — it was coordinated, institutional, and liquid.

Bitcoin isn’t fragile anymore. It’s antifragile.

#Bitcoin # GalaxyDigital #WhaleMove # BTC #CryptoMarkets # InstitutionalCrypto #SatoshiEra

- Reward

- like

- Comment

- Share

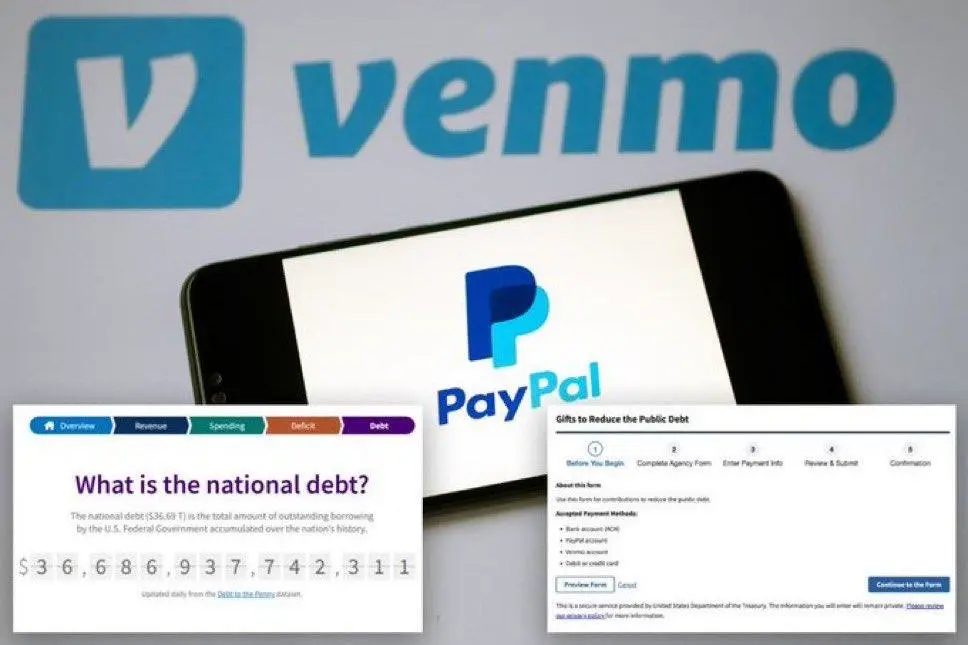

You can now Venmo the U.S. Treasury to help pay down the $36.7 trillion national debt. Yes, really.

It’s symbolic. It’s cute. It’s also irrelevant.

The entire “Gifts to Reduce the Public Debt” program has raised just $67M since 1996 — that’s about 1.5 seconds of interest on current debt.

If this is how we’re addressing fiscal crisis in 2025, it says a lot about the system.

You don’t solve trillion-dollar problems with donations.

You solve them with discipline.

#USDebt # FiscalPolicy #Venmo # Macro #CryptoFinance # DebtCrisis #PolicySignals

It’s symbolic. It’s cute. It’s also irrelevant.

The entire “Gifts to Reduce the Public Debt” program has raised just $67M since 1996 — that’s about 1.5 seconds of interest on current debt.

If this is how we’re addressing fiscal crisis in 2025, it says a lot about the system.

You don’t solve trillion-dollar problems with donations.

You solve them with discipline.

#USDebt # FiscalPolicy #Venmo # Macro #CryptoFinance # DebtCrisis #PolicySignals

- Reward

- like

- Comment

- Share