$COIN

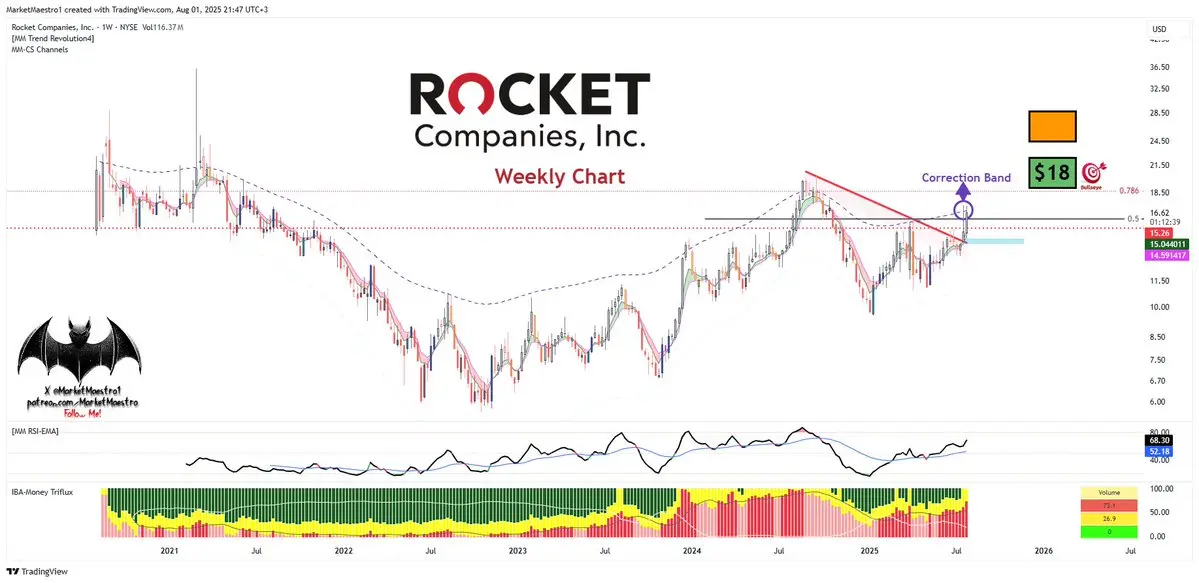

When an instrument collides with the correction band on a monthly basis, it most likely signals an upcoming correction. My friends on Patreon know I’ve been saying for a while that a correction could begin

When an instrument collides with the correction band on a monthly basis, it most likely signals an upcoming correction. My friends on Patreon know I’ve been saying for a while that a correction could begin

BAND-3.28%