SatoshiFollower

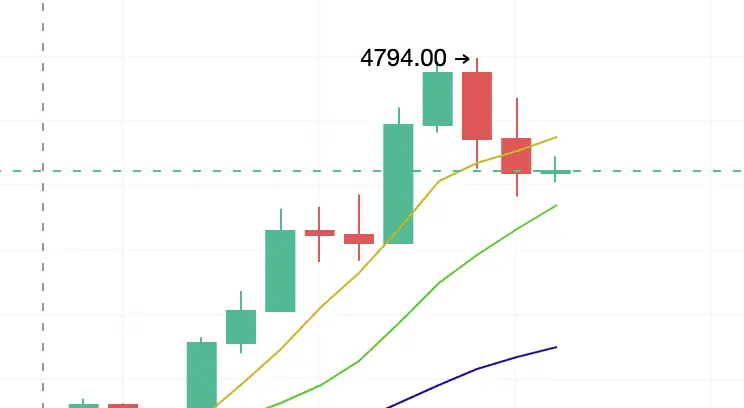

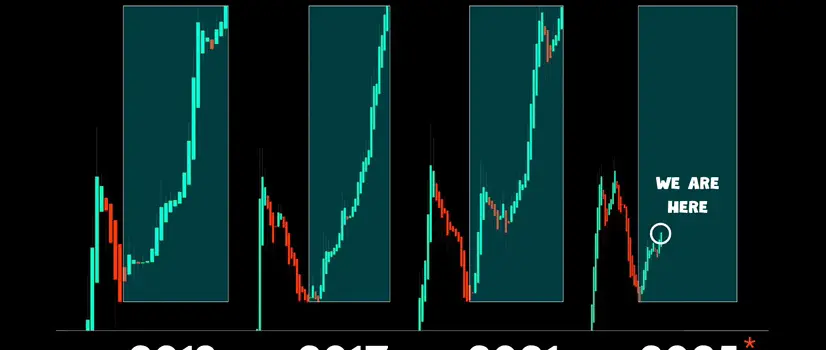

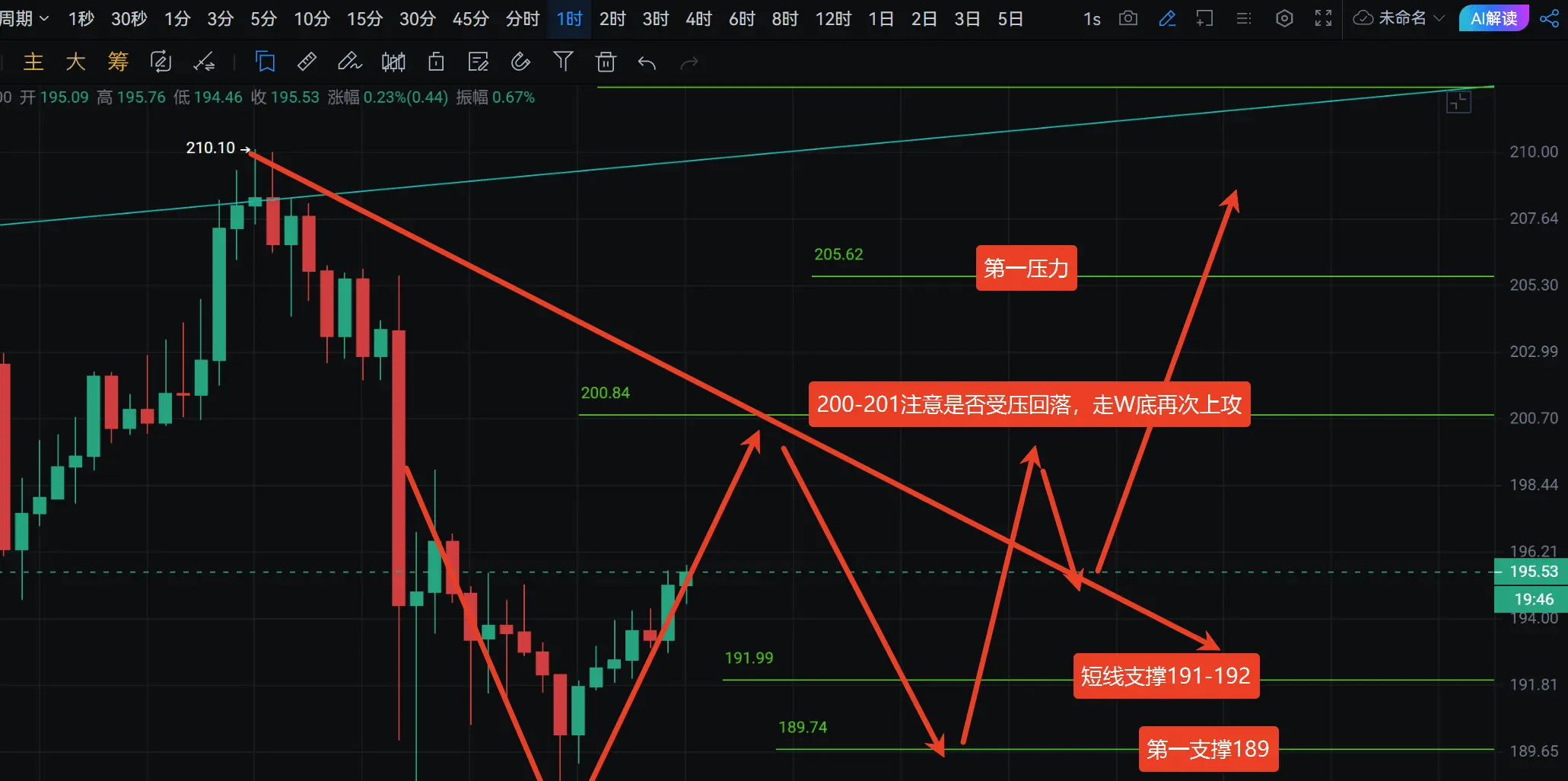

Recently, the Ethereum (ETH) market has experienced significant volatility. Last week, ETH briefly approached its historical high of $4,878, before retreating to around $4,448. This price fluctuation has triggered varying reactions among market participants, showing a clear trend of divergence.

Data shows that Bitcoin and Ether have both retreated after reaching their peaks. Bitcoin has dropped approximately 5% from its new high of over $124,400, falling to the $117,000 range. This caused the entire cryptocurrency market to experience a cumulative decline on Saturday morning, with the total ma

View OriginalData shows that Bitcoin and Ether have both retreated after reaching their peaks. Bitcoin has dropped approximately 5% from its new high of over $124,400, falling to the $117,000 range. This caused the entire cryptocurrency market to experience a cumulative decline on Saturday morning, with the total ma