Gate Research: Stablecoins Enter the Regulatory Era, Ushering in a New Generation of Monetary Sovereignty Contest

Abstract

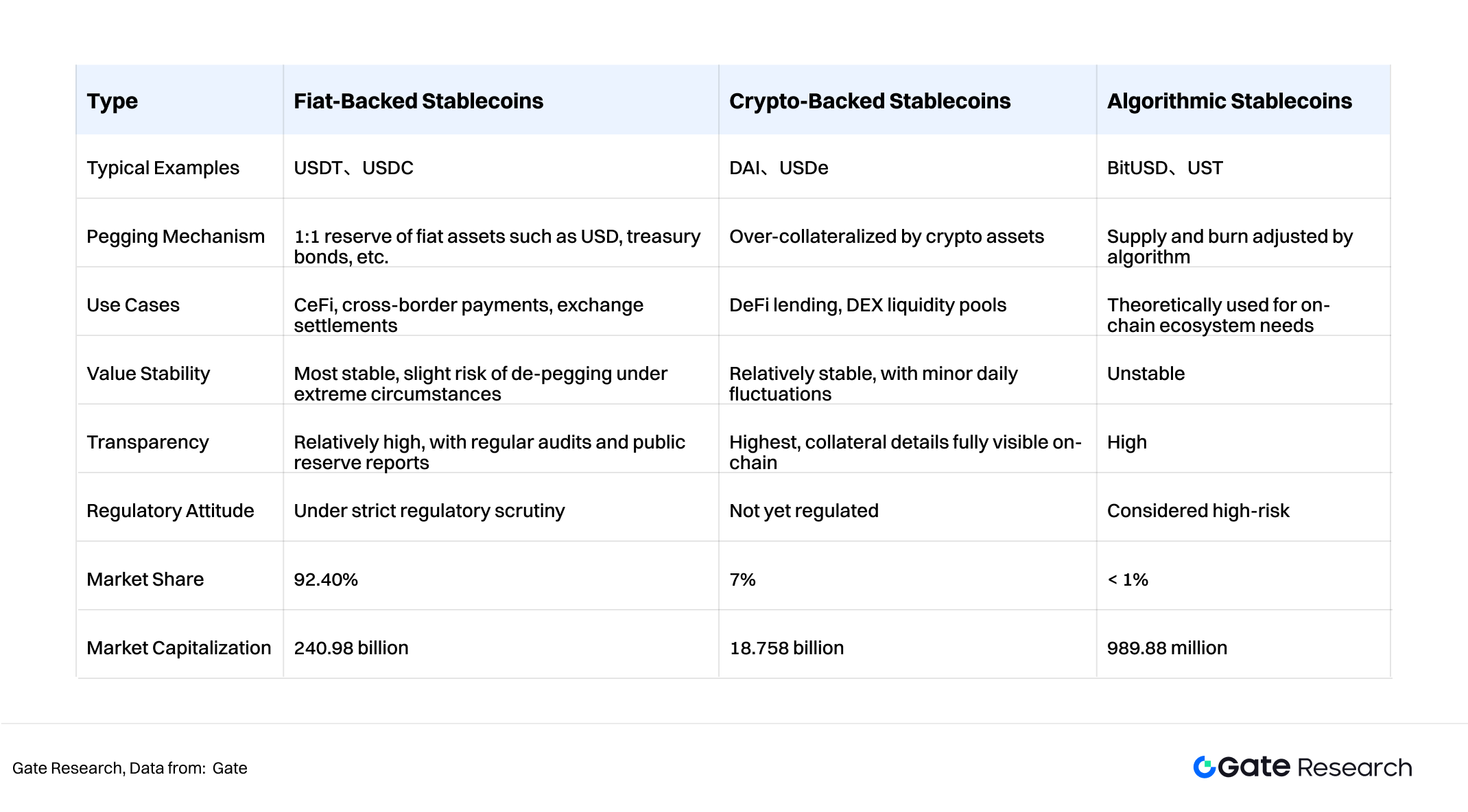

- Stablecoins are categorized into three types based on their price-pegging mechanisms: fiat-collateralized stablecoins, cryptocurrency-collateralized stablecoins, and algorithmic stablecoins.

- Currently, the global market capitalization of stablecoins has reached $260.728 billion, accounting for approximately 1% of the nominal GDP of the United States in 2024. The number of stablecoin holders has surpassed 170 million, which is about 2% of the global population, and they are widely distributed across more than 80 countries and regions.

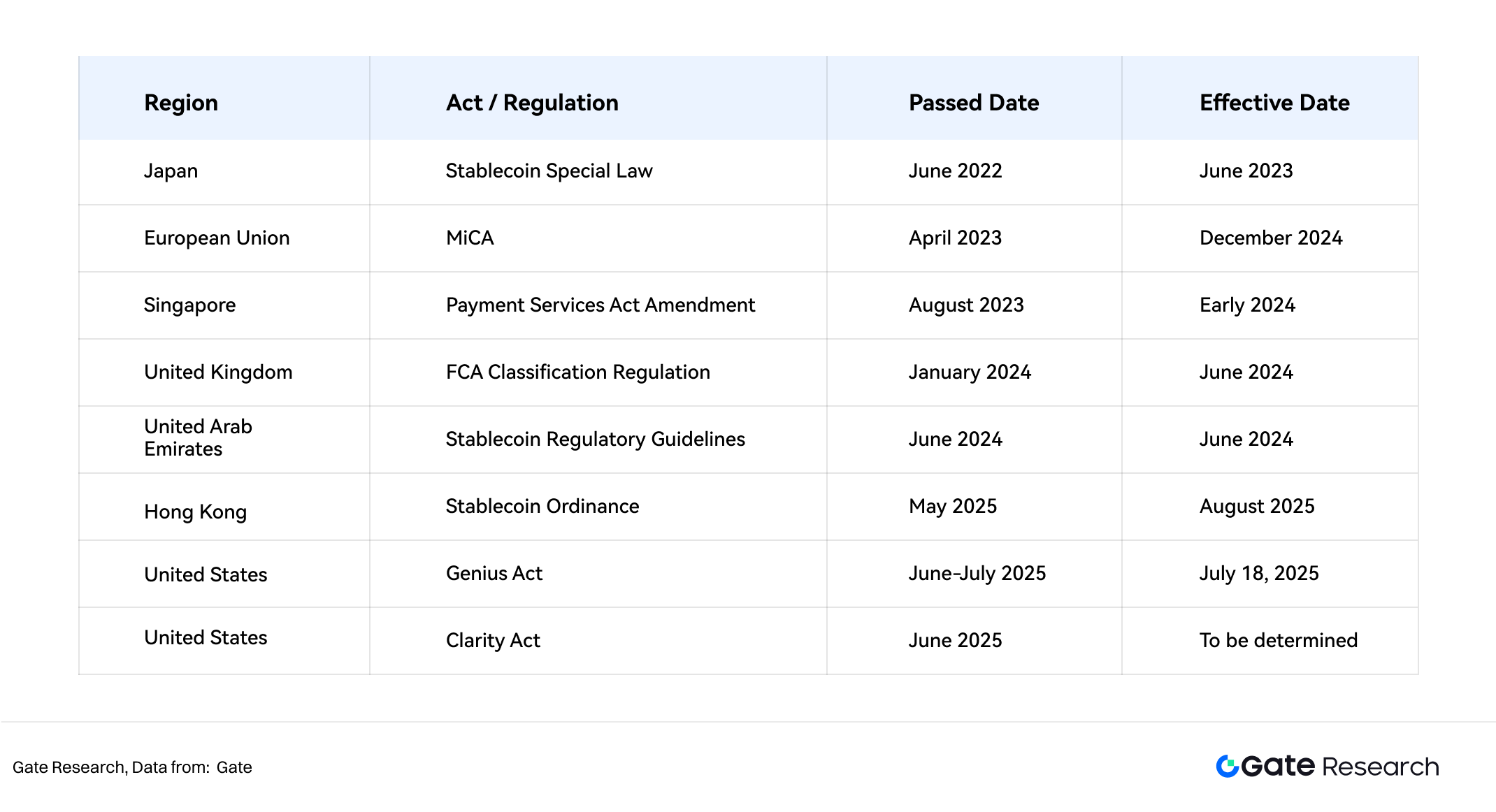

- Governments around the world are increasingly focusing on the regulation of stablecoins. The core legislative motivations include financial stability, monetary sovereignty, and cross-border capital regulation. Economic entities such as the United States and Hong Kong have introduced systematic regulatory frameworks, marking the entry of stablecoins into a new era of strict regulation. The international financial order and the structure of monetary power are being reshaped.

- The rise of stablecoin is underpinned by a covert struggle for monetary sovereignty and financial hegemony. As a strategic resource at the intersection of financial sovereignty, financial infrastructure, and capital market pricing power, stablecoins have become the focal point of financial governance.

- While stablecoin improve financial efficiency, they still face challenges such as risks from the pegging mechanisms, decentralization conflicts, and cross-border regulatory coordination.

Introduction

On July 18, 2025, the U.S. House of Representatives passed the GENIUS Act with 308 votes in favor and 122 votes against. The CLARITY Act, which regulates the structure of the crypto market, has been submitted to the Senate, while another bill opposing Central Bank Digital Currencies (CBDCs) passed the House vote.

Beyond the United States, countries around the world are rolling out stablecoin policies: Hong Kong will implement the Stablecoin Regulation on August 1, Russia’s central bank is offering crypto custodial services, and Thailand has introduced a crypto sandbox. These developments mark the beginning of stablecoins entering the era of regulation, and the geopolitical struggle over stablecoins has officially commenced.

Given that stablecoin legislation has become a focal point in financial governance, this report aims to analyze the motivations behind various governments’ stablecoin regulatory initiatives, compare the similarities and differences among relevant laws, and examine the impact of stablecoin compliance on the existing financial order. It seeks to provide valuable insights for industry builders and investors to inform their decision-making. The report recommends that practitioners focus primarily on fiat-collateralized stablecoins, avoid the compliance risks associated with algorithmic stablecoins, and, whenever possible, choose stablecoins recognized by local regulators.

1.1 Definition and Classification of Stablecoins

Traditional cryptocurrencies, primarily Bitcoin (BTC), suffer from high price volatility, which hinders the promotion and adoption of cryptocurrencies. Stablecoins were introduced in 2014 as a solution to this issue. A stablecoin is a type of cryptocurrency designed to maintain price stability.

Stablecoins typically achieve value pegging through mechanisms linked to fiat currencies, commodities, other cryptocurrencies, or by utilizing algorithmic stabilization mechanisms. They are widely used in the financial sector as core mediums for digital asset trading, DeFi applications, and cross-border payments.

Based on how they maintain their value, stablecoins can be divided into three types:

- Fiat-Collateralized Stablecoins

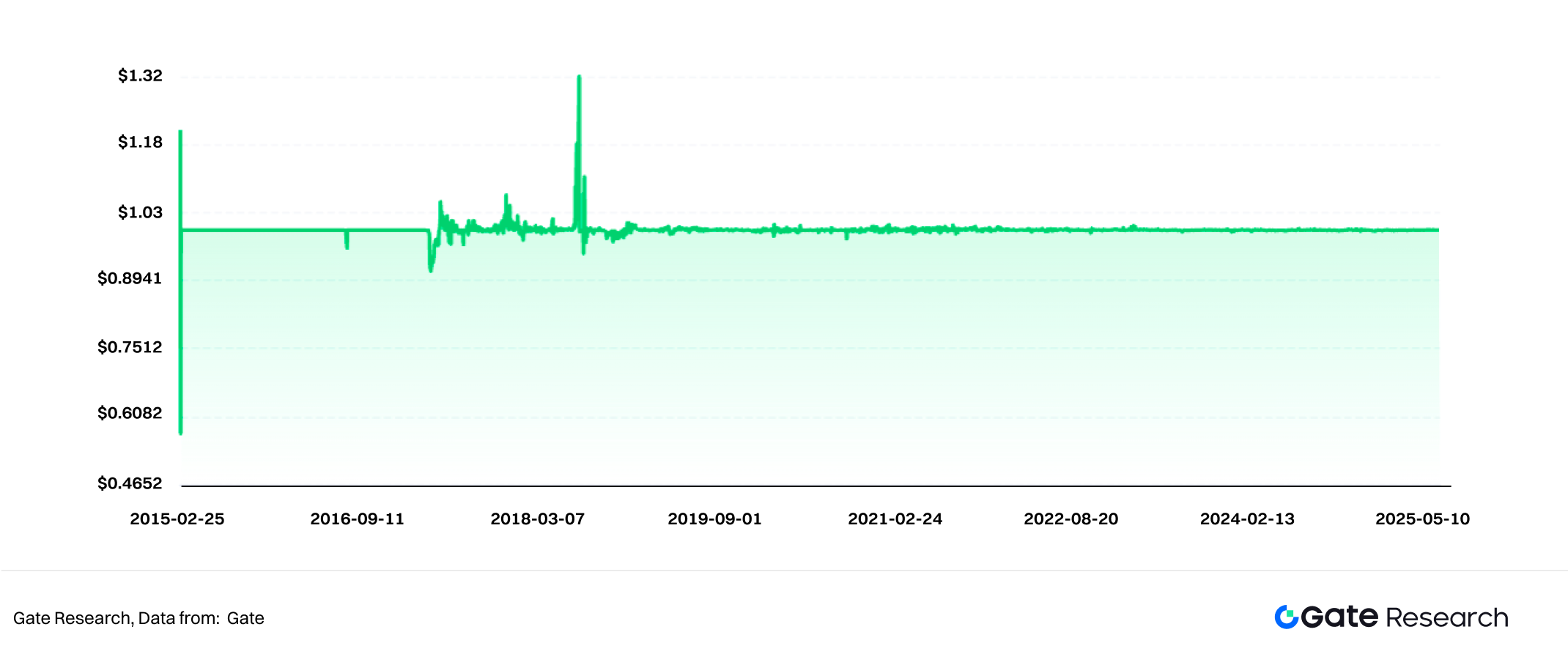

Fiat-collateralized stablecoins are the most common type, accounting for 92.4% of the market share. They achieve price stability by pegging their value to fiat currencies such as the US dollar. The issuing entities deposit fiat money or highly liquid assets (such as government bonds) into banks or custodial accounts, and then mint tokens at a 1:1 ratio for issuance. Examples include USDT and USDC.

- Cryptocurrency-Collateralized Stablecoins

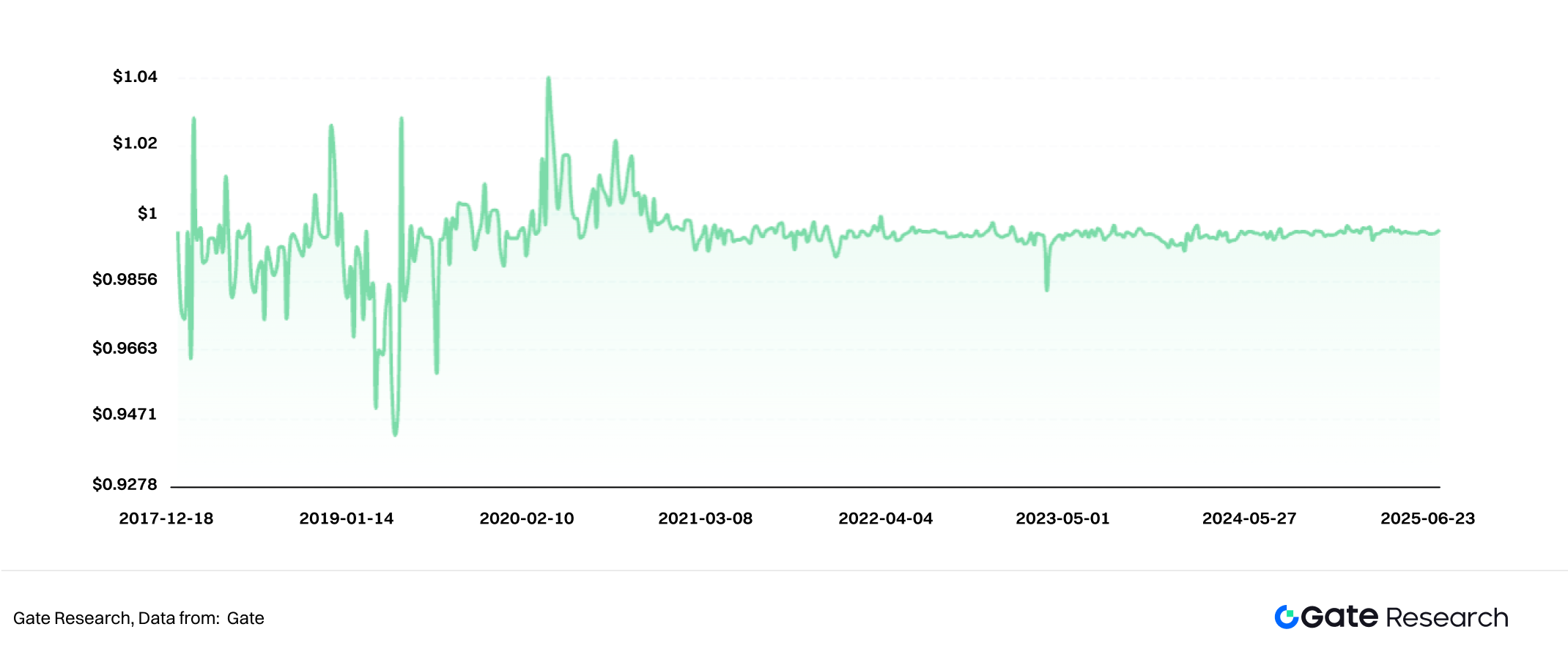

Unlike fiat-collateralized stablecoins, cryptocurrency-collateralized stablecoins are backed by cryptocurrency assets. Due to the high volatility of cryptocurrencies, these stablecoins typically use an over-collateralization model (with a collateralization ratio usually around 150%) and implement on-chain liquidation mechanisms to maintain the value of the stablecoin. For example, the DAI stablecoin issued by MakerDAO (Sky), where users over-collateralize ETH to mint DAI tokens.

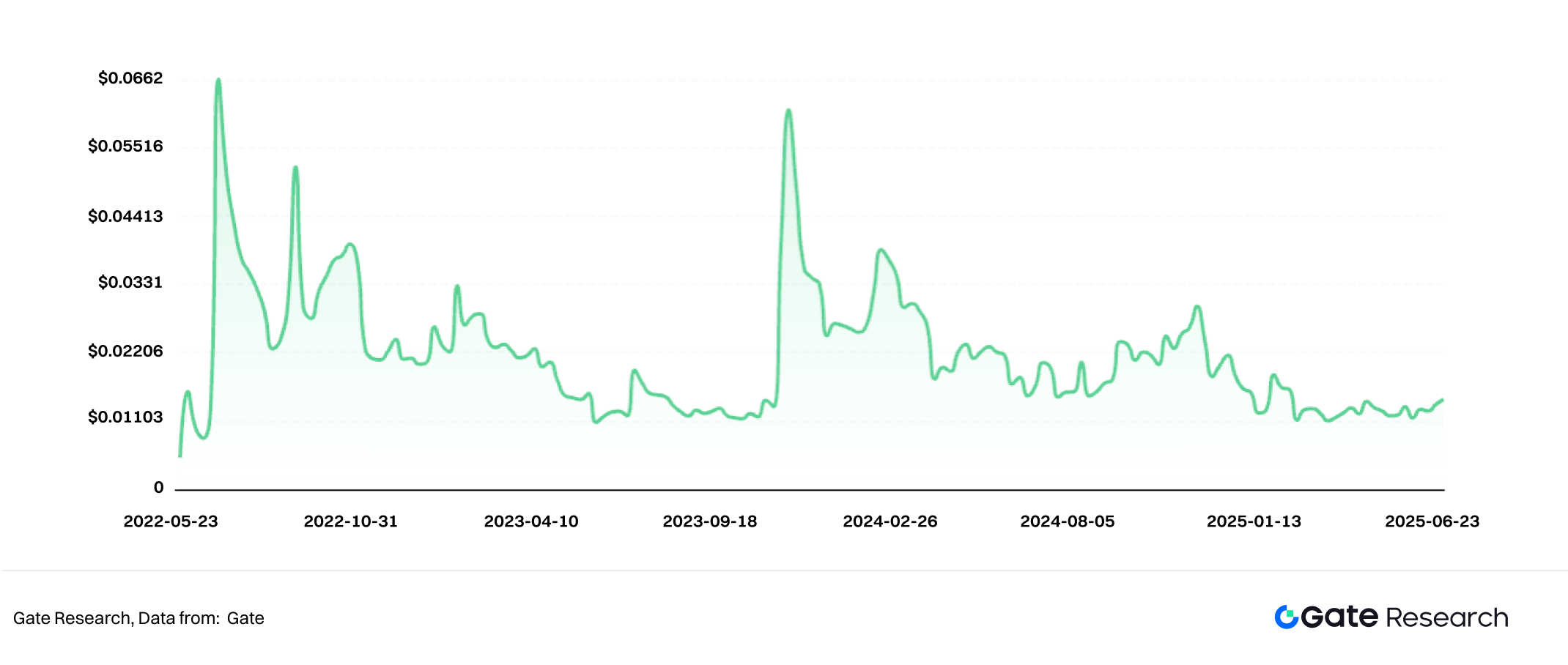

- Algorithmic Stablecoins

These stablecoins do not rely on physical assets for support but instead use algorithms and market supply-demand dynamics to maintain the token’s price. When the token price is above $1, the system will issue more tokens to increase supply and reduce the price; when the price falls below $1, the system will buy back and burn tokens to increase the price. For example, UST (which has collapsed), and by 2025, USTC has become an independent cryptocurrency, no longer pegged to the US dollar.

Comparison of Three Types of Stablecoins:

1.2 Characteristics of Stablecoins

The unique value-pegging mechanism of stablecoins distinguishes them from the extreme volatility of traditional cryptocurrencies. As a result, they are widely regarded as “digital cash” or “bridge assets” within the crypto ecosystem. Their main characteristics include:

- Price Stability By being pegged to stable assets such as the US dollar or gold, or through mechanisms like over-collateralization and algorithmic adjustments, stablecoins maintain relatively low price volatility. This gives them stronger attributes as a store of value and medium of exchange.

- Bridging Traditional Finance and Decentralized Finance (DeFi) Stablecoins are issued on blockchains while backed by traditional financial assets, allowing them to interact with on-chain protocols and tools. They play a vital role in core DeFi applications such as lending, liquidity mining, and derivatives trading.

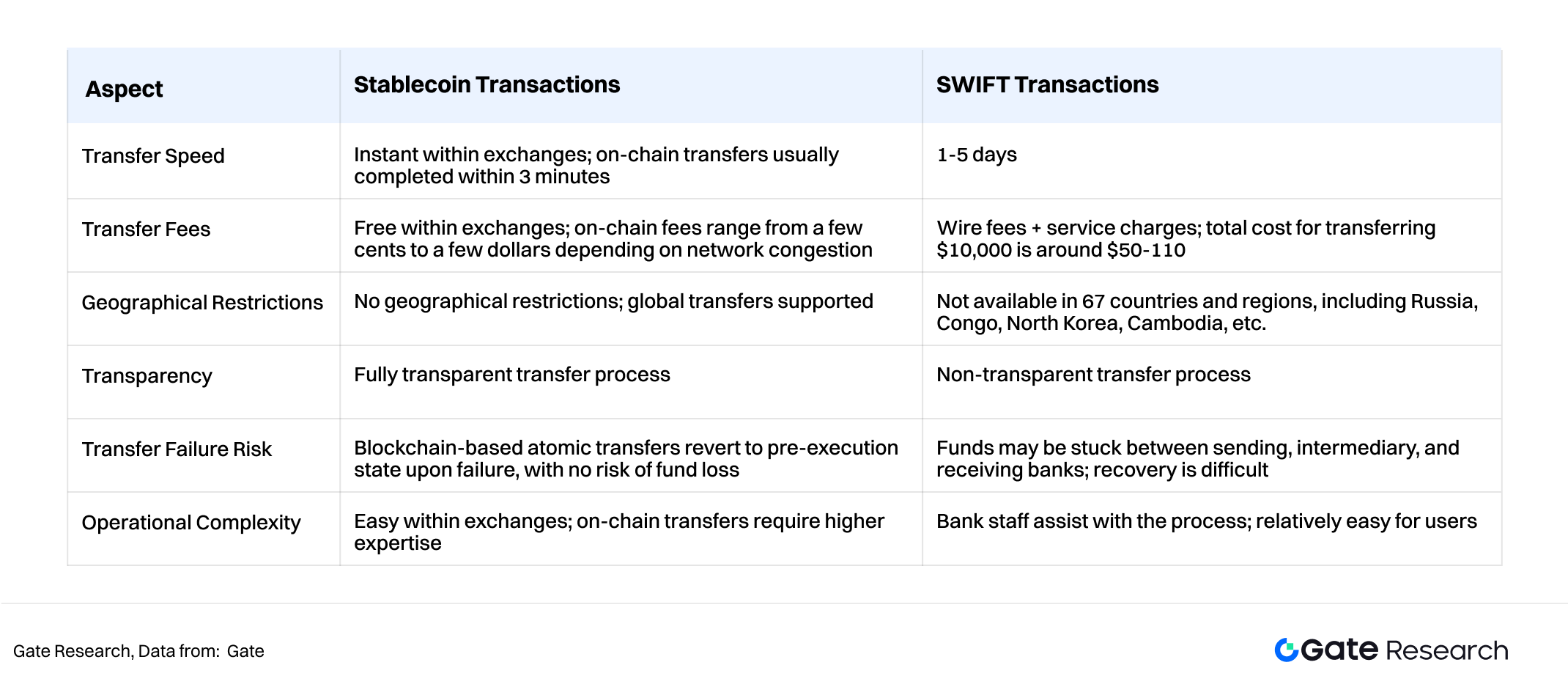

- Lower Payment Costs and Higher Efficiency Powered by blockchain technology, stablecoins enable near-instant cross-border transfers with fees far lower than those of traditional banking systems. They are free from geographical and time restrictions, significantly improving the efficiency of capital flows.

- Hedge Against Inflation and Capital Flight Most stablecoins are pegged to the US dollar, which means they share the same inflation characteristics as the dollar itself. In countries suffering from severe inflation or currency devaluation (such as Argentina and Turkey), stablecoins have become an important tool for residents to preserve wealth and hedge against risk. In some regions of Africa and Latin America, stablecoins are already widely used for daily payments.

1.3 Use Cases

Stablecoins have been widely adopted across various scenarios, including decentralized finance (DeFi), cryptocurrency trading, cross-border trade, daily payments, and capital flight. Among these, cross-border trade has become a key area of focus for recent regulatory efforts in the United States and Hong Kong.

Using stablecoins for transactions not only effectively mitigates the risks of currency inflation in certain countries but also offers significantly lower costs and higher efficiency compared to the traditional SWIFT system.

Legislative Background

2.1 The Rise of Stablecoins

Currently, the global market capitalization of stablecoins has reached USD 260.728 billion, surpassing the market value of MasterCard and accounting for approximately 1% of the United States’ nominal GDP in 2024. Stablecoins have become an indispensable part of the international financial system. Their global adoption continues to grow steadily; to date, over 170 million users hold stablecoins, accounting for about 2% of the world’s population, and they are widely distributed across more than 80 countries and regions.

2.2 Government Motivations for Regulatory Intervention

Governments worldwide are actively stepping into stablecoin regulation. The motivation behind this intervention goes beyond preventing financial risks; it touches on core national interests such as monetary sovereignty, financial security, and cross-border capital controls, as well as mitigating fiat currency credibility risks.

- Preventing Systemic Financial Risks: To avoid the loss of control over stablecoins triggering disruptions in payment systems and capital markets, and to prevent the spillover risks of a potential crisis similar to the 2008 shadow banking collapse.

- Safeguarding Monetary Sovereignty and Financial Order: To prevent private stablecoins from replacing fiat currencies in domestic circulation, which would weaken central banks’ control over monetary policy and payment systems.

- Combating Illegal Cross-Border Capital Flows: Stablecoins can bypass regulatory systems like SWIFT, raising government concerns over their potential misuse in areas such as money laundering, tax evasion, and sanctions evasion.

- Countering the Impact of “USD Stablecoin Hegemony”: The United States is actively promoting USDT/USDC as “on-chain dollars.” In response, other jurisdictions are exploring the development of local currency-pegged stablecoins (HKD, EUR, RMB) through legislation to counterbalance this influence.

- Mitigating Fiat Currency Credit Risks & Supporting Sovereign Bonds: By 2025, the market capitalization of USD-pegged stablecoins has exceeded USD 260 billion, with U.S. Treasuries typically accounting for 60%-80% of reserve assets. The demand for stablecoin reserves has become a key source of support for U.S. Treasury bonds, contributing to the ongoing reinforcement of dollar creditworthiness.

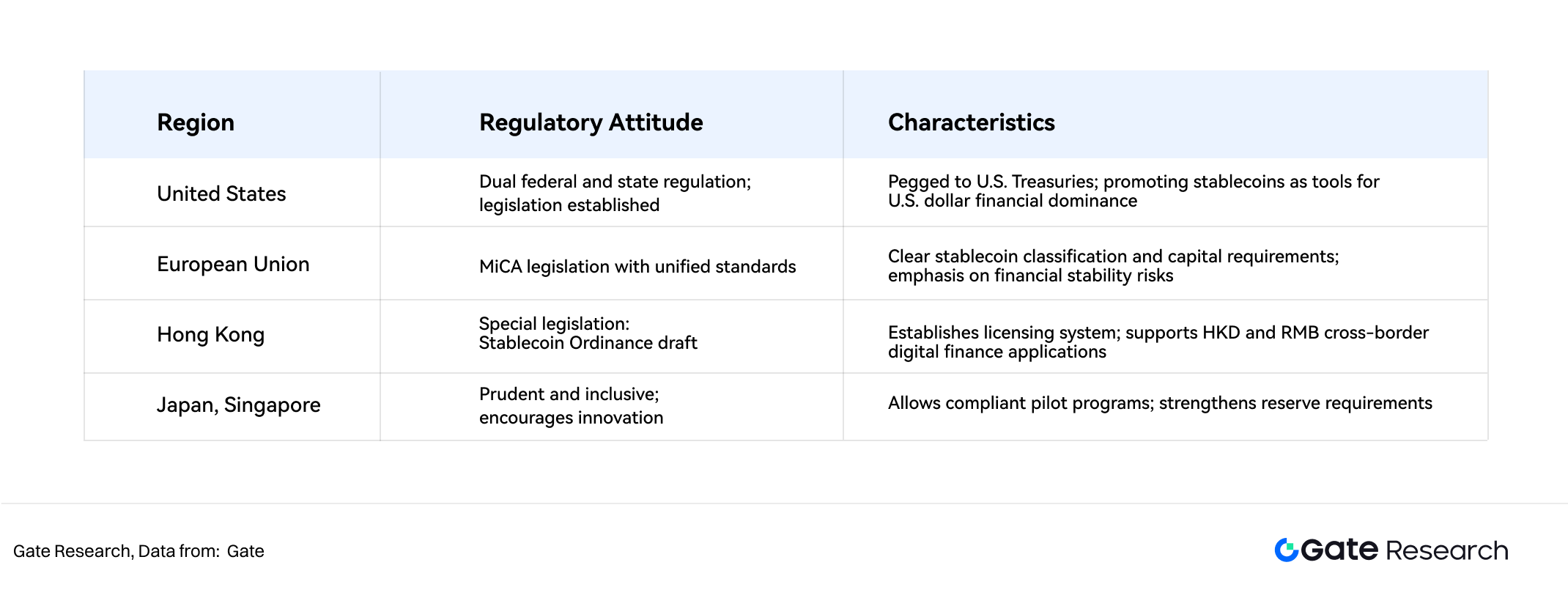

For these reasons, jurisdictions such as the United States, Hong Kong, and the European Union have successively introduced systematic regulatory frameworks, marking the beginning of a strictly regulated and compliant era for the stablecoin industry.

Stablecoin Regulatory Developments in Major Global Economies

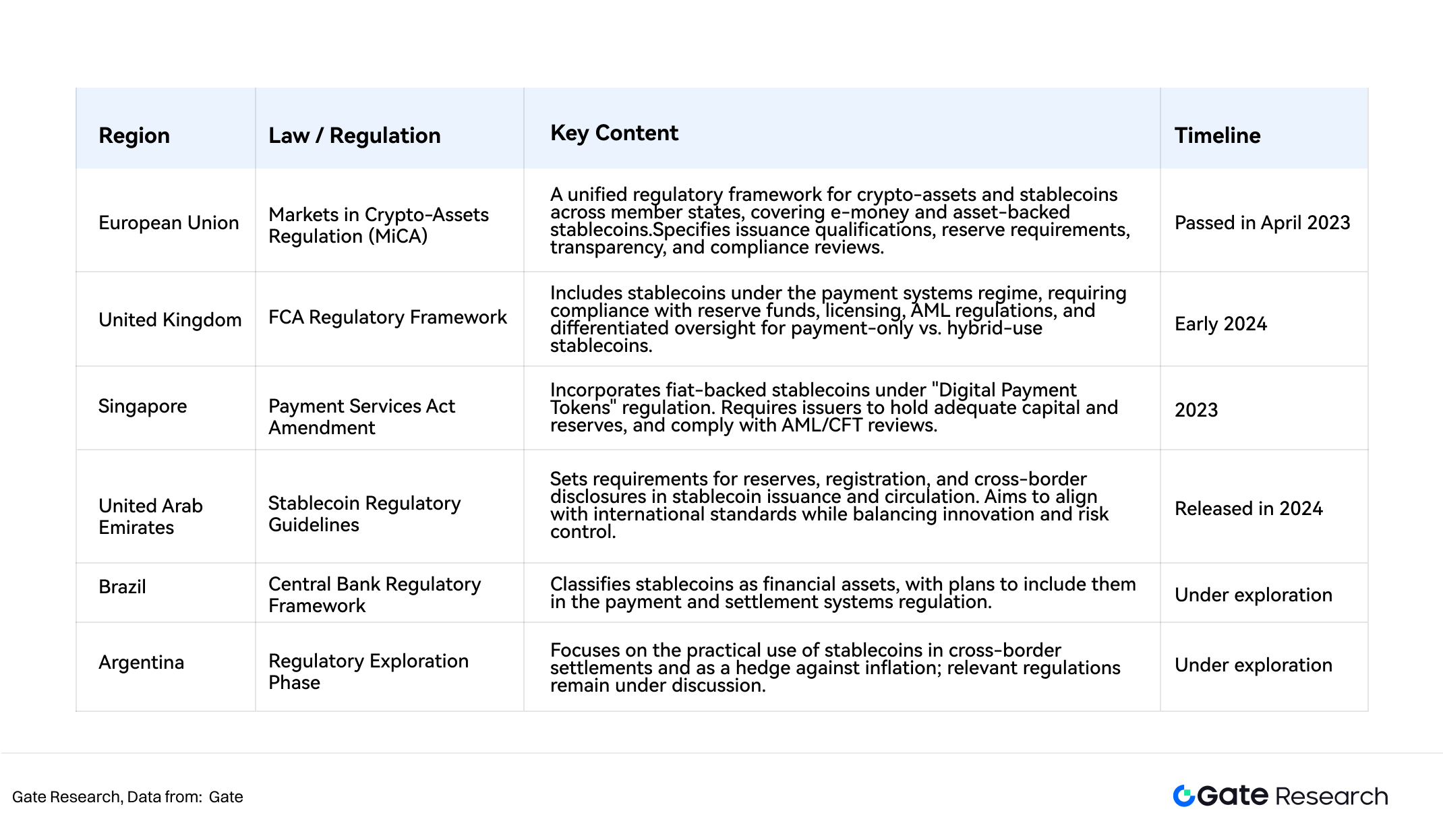

Since 2022, as stablecoins have rapidly expanded in global markets, various countries have successively introduced relevant regulations to strengthen oversight.

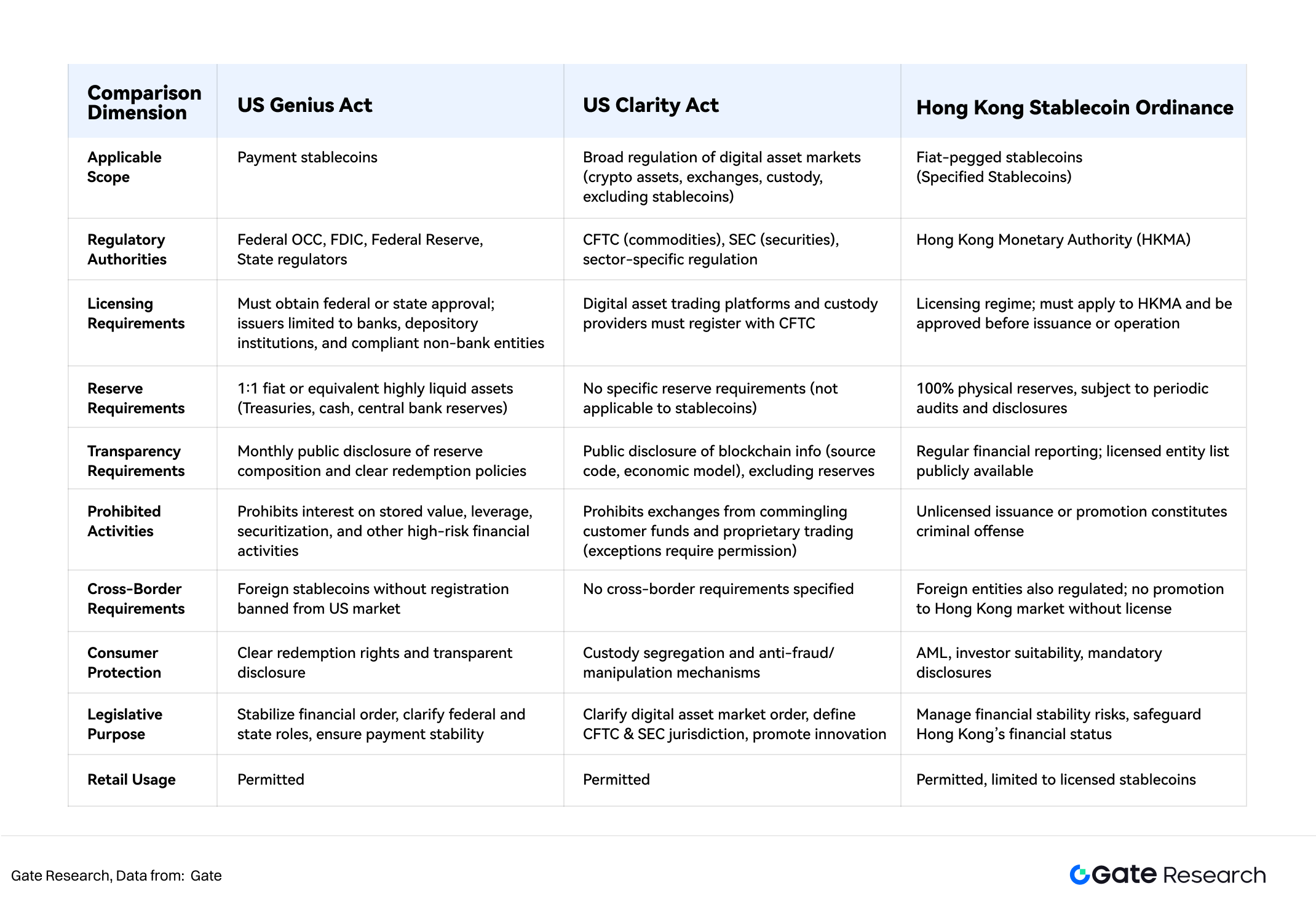

3.1 The United States Introduces the Genius Act and Clarity Act

The well-known Genius Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) was passed by the Senate on June 17, 2025, approved by the House of Representatives on July 17, 2025, with a vote of 308–122, and signed into law by President Trump on July 18, 2025. This marks the first time the U.S. has established a unified federal regulatory framework for stablecoin issuance. Key provisions include:

- Regulatory Model: A dual federal and state system with the Office of the Comptroller of the Currency (OCC) as the unified licensing authority.

- Issuers: Limited to banks, depository institutions, and approved specific non-bank financial institutions.

- Reserve Requirements: Mandates a 1:1 fiat reserve backed by U.S. Treasuries or cash to ensure stablecoin redemption capacity.

- Transparency Obligations: Issuers must undergo monthly audits, disclose information publicly, and comply with anti-money laundering (AML) reviews.

- Business Restrictions: Issuers are prohibited from offering interest on stored value or engaging in leverage, securitization, or similar financial activities to contain systemic risk buildup.

- Cross-Border Restrictions: Unauthorized foreign stablecoins are banned from entering the U.S. market to reinforce capital market firewalls.

On the same day, the Clarity Act (Digital Asset Market Clarity Act) was passed by the House and sent to the Senate for review. Its main purpose is to clarify the regulatory roles of the SEC and CFTC in the digital asset market, covering trading platforms, crypto derivatives, DeFi, and more.

3.2 Hong Kong Introduces the Stablecoin Ordinance

The Hong Kong Legislative Council passed the Stablecoin Ordinance on May 21, 2025, which will take effect on August 1, 2025. Main points include:

- Licensing Regime: All stablecoin issuance, sales, marketing, and related activities must obtain authorization from the Hong Kong Monetary Authority (HKMA).

- Scope: Focuses on fiat-pegged stablecoins, excluding products pegged purely to crypto assets.

- Capital Requirements: Minimum capital requirement of HKD 25 million, along with effective risk management and internal control mechanisms.

- Reserve Requirements: 100% backing by physical or equivalent liquid assets, subject to regular audits and disclosures.

- AML and Consumer Protection: Strict compliance with AML/CFT standards and investor suitability requirements.

- Enforcement: Conducting related business without a license constitutes a criminal offense, punishable by imprisonment and fines.

3.3 Developments in Other Economies

In addition to the United States and Hong Kong, other major economies are also actively advancing regulatory frameworks for stablecoins. Overall, these efforts reflect a trend toward more cautious, stringent, and progressively structured regulation.

Overall, most countries focus their regulatory efforts primarily on collateral-backed stablecoins, explicitly excluding the higher-risk algorithmic stablecoins from their frameworks, further limiting their future development. Notably, Hong Kong only recognizes fiat-backed stablecoins and does not permit the issuance or circulation of crypto-backed stablecoins, further consolidating the dominance of fiat-collateralized stablecoins.

Although regulatory approaches and progress vary across jurisdictions, most frameworks converge around the core principles of reserve transparency, anti-money laundering (AML) review, consumer protection, and financial stability. These regulations are gradually being integrated into each country’s broader digital asset and financial regulatory systems.

4. Reshaping the Financial Order of Stablecoins Amidst Great Power Rivalry

4.1 Financial Sovereignty Competition Behind Stablecoins

Currently, over 90% of the stablecoin market capitalization is anchored to the U.S. dollar. Products like USDT and USDC have become de facto standards across global exchanges, DeFi platforms, and cross-border payment scenarios. This reality not only extends the U.S. dollar’s dominance from traditional finance into the digital realm but also deeply embeds U.S. influence within the emerging digital financial ecosystem through stablecoins.

The U.S. Genius Act and related legislation explicitly require that USD stablecoins must be backed by high-quality assets such as U.S. Treasury bonds and short-term notes, thereby strengthening the connection between stablecoins and core U.S. financial assets. This forms a dual-anchor structure of “stablecoins–U.S. Treasuries,” in which stablecoin issuers, through their large holdings of U.S. Treasuries, indirectly provide ongoing buying demand for U.S. fiscal needs, further consolidating the dollar’s dominance in the global financial system. This mechanism establishes an “implicit buying relationship” between stablecoins and U.S. assets, reinforcing the foundation of U.S. financial hegemony on a global scale.

The widespread circulation of USD stablecoins globally has driven a trend of “on-chain dollarization” in many emerging markets and high-inflation countries, undermining the use of local currencies and eroding financial sovereignty. In regions such as Argentina, Turkey, and Russia, USDT has become the default tool for asset preservation and cross-border payments. In academic literature, this phenomenon is regarded as a form of U.S. digital infiltration into financially weaker nations through stablecoins, weakening their monetary policy independence.

Meanwhile, the regulatory advancements in euro- and HKD-pegged stablecoins reflect efforts by various countries to counterbalance the spillover effects of USD stablecoins through local currency digitization and stablecoin legislation. A new round of monetary competition in the digital era has begun, shifting the battleground of financial hegemony from traditional systems to on-chain ecosystems.

4.2 Competition for the Next Generation of Financial Infrastructure

Stablecoins now serve not only as payment and trading instruments but are increasingly becoming core components of next-generation cross-border payment and settlement infrastructure. Compared to the traditional SWIFT system, stablecoins offer advantages such as real-time settlement, lower costs, and decentralization. The United States aims to replicate its SWIFT-like dominance in on-chain finance through USD stablecoins, bringing global payments, settlements, and custodial services under its regulatory framework.

Meanwhile, international financial centers like Hong Kong and Singapore are leveraging policy initiatives to promote deeper integration between local financial infrastructure and fiat-backed stablecoins, aiming to secure strategic positions as key hubs and nodes in cross-border digital finance.

4.3 Competition for Pricing Power in Digital Assets

In the current digital asset market, stablecoins serve not only as transaction media but also play a significant role in reshaping pricing power within the digital asset ecosystem. USDT and USDC dominate major trading pairs in the crypto market, becoming the de facto standards for on-chain asset liquidity anchoring and pricing. Fluctuations in their supply directly impact overall market risk appetite and volatility.

Through stablecoin legislation and regulatory frameworks, the United States has strengthened its control over the pricing power and liquidity dominance of the digital asset market, indirectly reinforcing the dollar’s central position in global capital markets. Meanwhile, Hong Kong, the European Union, and others are advancing local fiat-backed stablecoins in an effort to secure greater regional pricing power and influence in the future competition for digital finance.

5. Risks and Challenges

The risks of stablecoins arise both from systemic risks inherent in their price-pegging mechanisms and from compliance risks driven by external regulations.

5.1 Mitigating Systemic Risks

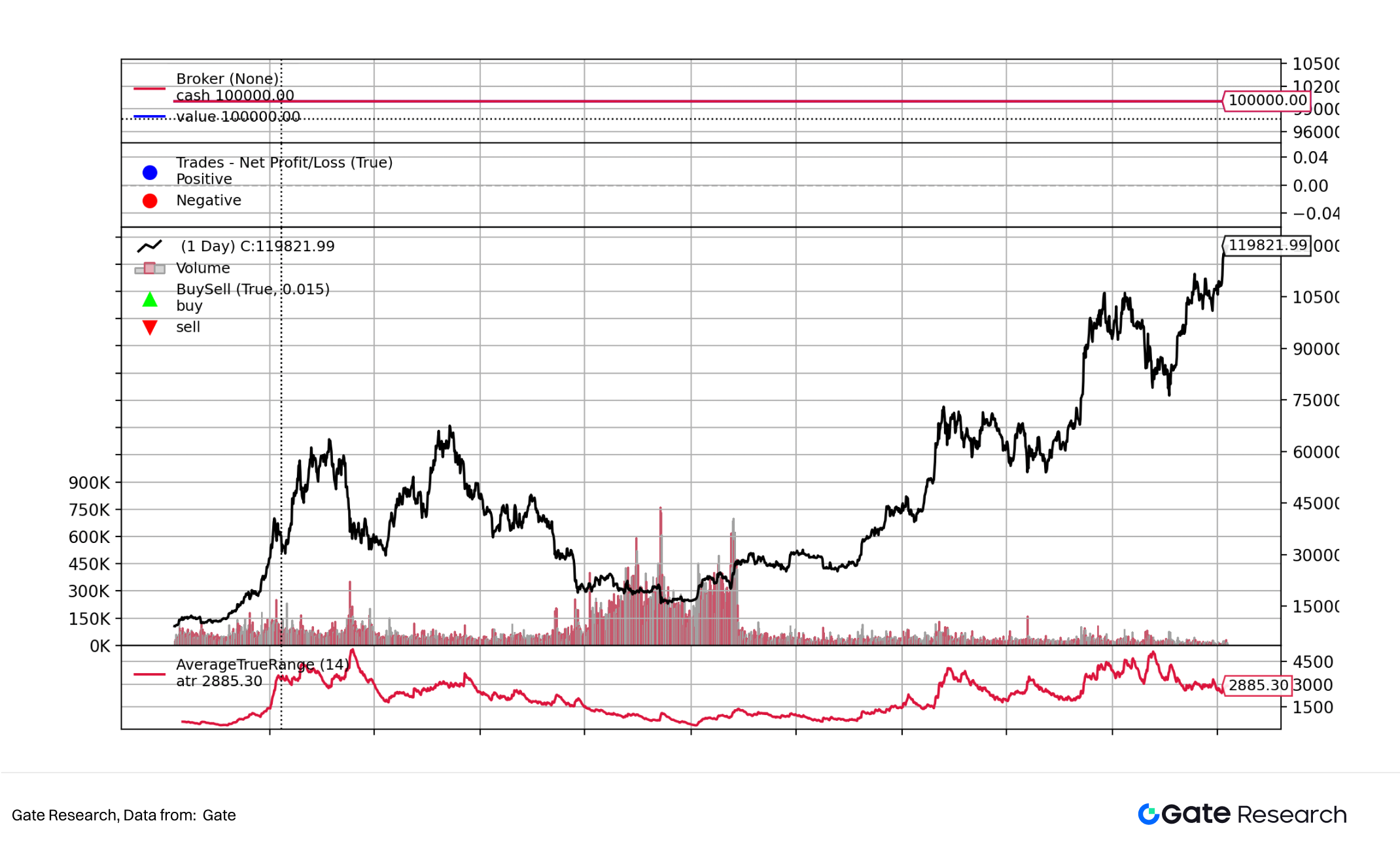

The core of a stablecoin’s price stability lies in the stability of its underlying collateral assets. Therefore, the greatest systemic risk for stablecoins stems from price volatility in the collateral assets, which can cause de-pegging from their target value.

Historically, the first stablecoin, BitUSD, launched in 2014, lost its 1:1 peg to the U.S. dollar in 2018. This failure was due to its collateral—BitShares, a little-known and highly volatile asset lacking any credible guarantees.

In the same year, MakerDAO’s DAI adopted over-collateralization and liquidation mechanisms to mitigate the volatility risks inherent in crypto assets. However, these mechanisms fundamentally failed to improve capital efficiency and still exposed stablecoins to collateral asset price volatility. Similarly, fiat-backed stablecoins do not guarantee absolute safety.

In March 2023, the collapse of three U.S. banks—Silicon Valley Bank (SVB), Signature Bank, and Silvergate Bank—led to de-pegging events for both USDC and DAI. According to USDC issuer Circle, $3.3 billion of the reserves backing USDC were held at SVB, triggering a single-day drop of over 12% in USDC’s value.

DAI’s value also experienced volatility, primarily because more than half of its reserves were linked to USDC and related instruments. The situation only stabilized after the Federal Reserve announced it would protect bank depositors, allowing both USDC and DAI to regain their pegs. Subsequently, both stablecoins adjusted their reserve structures: USDC shifted its cash reserves to BNY Mellon, while DAI diversified its reserves across multiple stablecoins and increased its holdings in real-world assets (RWAs).

This chain reaction of de-pegging events served as a stark reminder that stablecoin issuers must diversify asset allocations to mitigate systemic risks.

5.2 Contradiction to the Decentralization Ethos

Although stablecoins have facilitated the broader adoption and regulatory acceptance of cryptocurrencies, their mainstream models (e.g., USDT, USDC) rely on centralized entities and fiat-backed reserves, fundamentally contradicting the decentralization and censorship-resistance ethos of blockchain technology.

Some scholars argue that fiat-backed stablecoins are essentially on-chain representations of traditional fiat currencies like the U.S. dollar, further entrenching reliance on the traditional financial system (the dollar, banks). This creates a “centralized core under the guise of decentralization,” weakening the original decentralized ideals of cryptocurrencies.

This centralized reliance exposes stablecoins to the credit risks of issuers and custodians. In extreme cases (due to regulatory policies or censorship pressures), stablecoins can be frozen or manipulated, fundamentally violating blockchain’s principles of permissionless access and immutability.

5.3 Difficulties in Cross-Border Regulatory Coordination

Globally, stablecoins operate across multiple jurisdictions, involving cross-border finance and data flows, yet different countries maintain significant divergences in their regulatory positions, definitions, and compliance requirements for stablecoins.

Due to significant differences in regulatory frameworks across countries, stablecoins face considerable uncertainty and legal risks in cross-border usage, settlement, and compliance processes. These discrepancies easily give rise to regulatory arbitrage and compliance loopholes, hindering the globalization and broader adoption of stablecoins.

5.4 Potential Risks of Financial Sanctions

Amid growing geopolitical tensions, stablecoins also face the risk of being incorporated into financial sanction toolkits. Through regulatory control over USD-denominated stablecoins, the United States may leverage their global on-chain payment and settlement attributes to enhance scrutiny over capital flows and fund usage and could potentially enforce measures such as asset freezes and transaction blocks against specific entities or nations.

Alexander Baker has pointed out that stablecoins have, to some extent, become an “on-chain extension of the U.S. dollar” and may in the future, like SWIFT, become part of the United States’ financial weaponization strategies. For certain emerging markets, cross-border transactions, and on-chain financial projects, this undoubtedly increases exposure to political and compliance risks, further driving global efforts toward de-dollarization and the exploration of regional, local-currency stablecoins.

Conclusion

The rise of stablecoins is a microcosm of the reshaping of monetary order in the digital finance era. Since their inception, stablecoins have continuously penetrated multiple areas such as payments, trading, and asset reserves. With their high efficiency, low cost, and programmability, they have gradually become a crucial bridge linking traditional finance and the digital economy. Today, stablecoins are not only core infrastructure of the crypto market but also profoundly influence the evolution of the global financial landscape, increasingly attracting attention from countries’ financial regulators and monetary strategists.

Behind the rise of stablecoins lies a covert struggle over monetary sovereignty and financial hegemony. The dominant position of USD stablecoins in global markets further consolidates the dollar’s supremacy in the on-chain world. Their reserve structures, deeply tied to U.S. Treasury bonds, make stablecoins an important extension of U.S. financial strategy. Meanwhile, emerging markets and other major economies are attempting to weaken the influence of USD stablecoins by developing local currency stablecoins, regulating digital currencies, and building cross-border payment systems, thereby promoting global currency diversification and domestic currency digitalization. Stablecoin legislation has already become a key variable in the future reshaping of the international financial order, reflecting deeper issues of national interests and the redistribution of financial power.

However, the future development of stablecoins still faces many uncertainties. First, systemic risks inherent in the pegging mechanisms and reserve structures cannot be completely eliminated in the short term, leaving potential trust crises and market volatility risks. Second, global regulation lacks a unified framework; cross-border regulatory coordination and legal applicability face significant challenges, leaving stablecoins in a gray area subject to ongoing compliance and policy risks. Third, issues such as centralized issuance and financial weaponization create an intrinsic tension with blockchain’s original principles of decentralization and censorship resistance. Balancing regulatory compliance and technological autonomy remains a core challenge for the industry.

In the future, stablecoins will play an increasingly important role in financial infrastructure, monetary competition, and the international settlement system. Their development trajectory relates not only to the deep integration of decentralized finance with real-world assets but also to the construction of a new global financial order and the redistribution of discourse power.

Refrence

- Gate, https://www.gate.com/zh/price

- Sky, https://sky.money/

- Tether, https://assets.ctfassets.net/vyse88cgwfbl/1LdSmP3HBynDxm6wvkDSsL/c4bcbd1f6fc18a0e8b3a12444ac8ae97/ISAE3000R-_Opinion_Tether_International_Financial_Figures___Reserves_Report_31.03.2025_RC187322025BD0040.pdf

- Deltec, https://www.deltecbank.com/news-and-insights/the-history-of-stablecoins/

- Tether, https://tether.to/en/

- DeFiLlama, https://defillama.com/stablecoin/dai

- CSPengyuan, https://www.cspengyuan.com/pengyuancmscn/credit-research/macro-research

- rwa.xyz, https://app.rwa.xyz/stablecoins?utm_source=substack&utm_medium=email

- Swift, https://www.swift.com/about-us/legal/document-centre

- Congress, https://www.congress.gov/bill/119th-congress/senate-bill/394/text

- Whitehouse, https://www.whitehouse.gov/fact-sheets/2025/07/fact-sheet-president-donald-j-trump-signs-genius-act-into-law/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate.io is not liable for any losses or damages resulting from such investment activities.