Gate Research: Turtle Trading Rules – Classic System with Annual Returns Up to 62.71%

Key Takeaways:

- The Turtle Trading Rules is a classic trend-following strategy based on breakout and volatility principles, using Donchian Channels to determine entry and exit signals, combined with the ATR (Average True Range) indicator for stop-loss and position sizing, enabling a systematic approach to capturing market trends.

- The AdTurtle builds upon the original framework by introducing sliding ATR-based stop-losses and an exclusion zone mechanism, allowing for dynamic adjustment of stop-loss width and re-entry timing. These enhancements significantly improve the strategy’s robustness and performance in the high-volatility and frequently choppy conditions of the crypto market.

- Backtesting results show that the improved strategy outperforms the original Turtle system on hourly GT/USDT data, particularly in terms of higher Sharpe ratios, lower maximum drawdowns, and more stable annualized returns. The high-frequency variant demonstrates notable improvements in trend sensitivity and risk control.

- Future developments may include leveraged trading, expanded parameter optimization, and the integration of on-chain data and AI-assisted signals to further enhance strategy performance, boosting return potential and improving risk management.

Introduction

The Turtle Trading Rules were developed in the 1980s by legendary trader Richard Dennis and his partner William Eckhardt as a trend-following trading system. In a well-known experiment, Dennis trained a group of inexperienced individuals over a short period and provided them with a clear set of trading rules. These individuals, later known as the “Turtle Traders,” achieved remarkable profitability. This experiment not only validated the replicability of systematic trading but also established trend breakout strategies as a cornerstone of technical analysis.

In traditional financial markets, the Turtle Trading strategy gained popularity for its well-defined entry and exit rules, robust risk control, and effective trend identification. For instance, it achieved an annualized return of up to 24% in commodity futures markets between 1990 and 2000, and up to 12% annually in the Hang Seng Index futures market from 2005 to 2015.

With the rise of the cryptocurrency market, this new asset class—with its high volatility and strong trend characteristics—has become fertile ground for technical trading strategies. However, several structural differences between crypto and traditional markets pose challenges to directly applying legacy strategies. These differences include 24/7 trading, higher average volatility, stronger sentiment-driven moves, and shallower market depth.

This raises a critical question: Can the Turtle Trading Rules still be effective in the highly volatile crypto market?

In recent years, both academia and industry have begun exploring how traditional trend-following strategies can be adapted to digital assets. One such attempt is the AdTurtle (2020) framework—an improved version of the Turtle Trading System. This report reconstructs and applies the AdTurtle system to the GT/USDT trading pair, conducting a backtest across historical data from 2022 to 2025. The core objectives of this study are as follows:

- To evaluate the applicability of the original Turtle strategy in cryptocurrency trading;

- To assess the effectiveness of enhancements in the AdTurtle system, specifically sliding ATR stop-losses and the exclusion zone mechanism;

- To propose further optimization directions based on the AdTurtle framework, tailored to the structural characteristics of the crypto market.

Traditional Turtle Trading System

The traditional Turtle Trading System is one of the most iconic trend-following strategies. Its core logic is simple yet powerful: “Buy when the price breaks above the previous high, hold as the trend continues, pyramid into the position, and exit when the trend reverses.” The system incorporates the following key components:

2.1 Entry Signals: Price Breakouts

- A long position is initiated when the current price breaks above the highest high of the past N days—i.e., the upper band of the Donchian Channel.

- A short position is taken when the price breaks below the lowest low of the past N days—the lower band of the Donchian Channel.

- The Donchian Channel period N determines the historical window for identifying breakout levels, effectively reflecting the trend duration.

Common configurations include:

Fast system: Entry period N = 20 days, Exit period M = 10 days

- Slow system: Entry period N = 55 days, Exit period M = 20 days

2.2 Stop-Loss Settings: ATR-Based

A stop-loss is set at the time of entry, calculated as:

Entry Price ± 2 × ATR

- The Average True Range (ATR) is a widely-used indicator for measuring market volatility.

- The ATR period n (commonly set to 14) defines the number of days used to calculate the average true range.

2.3 Position Scaling: Pyramiding with Trend

For each additional movement of 0.5 × ATR in the direction of the trade:

Add to long positions if price increases

- Add to short positions if price decreases

- Each add-on position carries a risk of 1–2% of total capital.

- The system allows a maximum of 4 additional entries, building the position incrementally to maximize profits while managing risk.

2.4 Exit Signals: Reversal Breakouts

- A full exit is triggered when price breaks in the opposite direction using a shorter Donchian period (exit channel).

- This suggests the trend may be reversing.

- Positions are fully liquidated to lock in profits or avoid further drawdowns.

- The exit period is typically shorter than the entry period, such as 10 or 20 days.

2.5 Capital Management and Risk Control

- The maximum loss per trade is capped at 2% of the account balance.

Position size is dynamically adjusted based on market volatility (ATR):

Higher volatility → smaller position size

- Lower volatility → larger position size

- Position sizing is precisely calculated before each trade, prioritizing risk control over market prediction.

AdTurtle Trading System

AdTurtle is an optimized version of the classic Turtle strategy. While retaining its core trend breakout logic, it introduces enhanced robustness in both stop-loss mechanisms and entry conditions. By incorporating the Average True Range (ATR) indicator to define an Exclusion Zone, the strategy avoids immediate re-entry after being stopped out, thereby improving stability and performance. Named AdTurtle (Advanced Turtle), this system is the first to combine dynamic ATR-based stop-loss with exclusion zone logic in a Turtle-style trading framework. Its core objectives are:

- To prevent immediate re-entry after being stopped out;

- To enhance stability under high-volatility market conditions;

- To adapt better to high-frequency or automated trading environments.

Key concepts involved:

- Sliding Stop Loss: The stop-loss level moves in the favorable direction as the price progresses, locking in partial profits.

- Variable Stop Loss: The stop-loss range dynamically adjusts according to the current ATR, adapting to changing market volatility.

- Exclusion Zone: A buffer zone is defined after a stop-out. New positions are only allowed once the price breaks out of this zone, reducing the risk of repeated whipsaw losses in choppy markets.

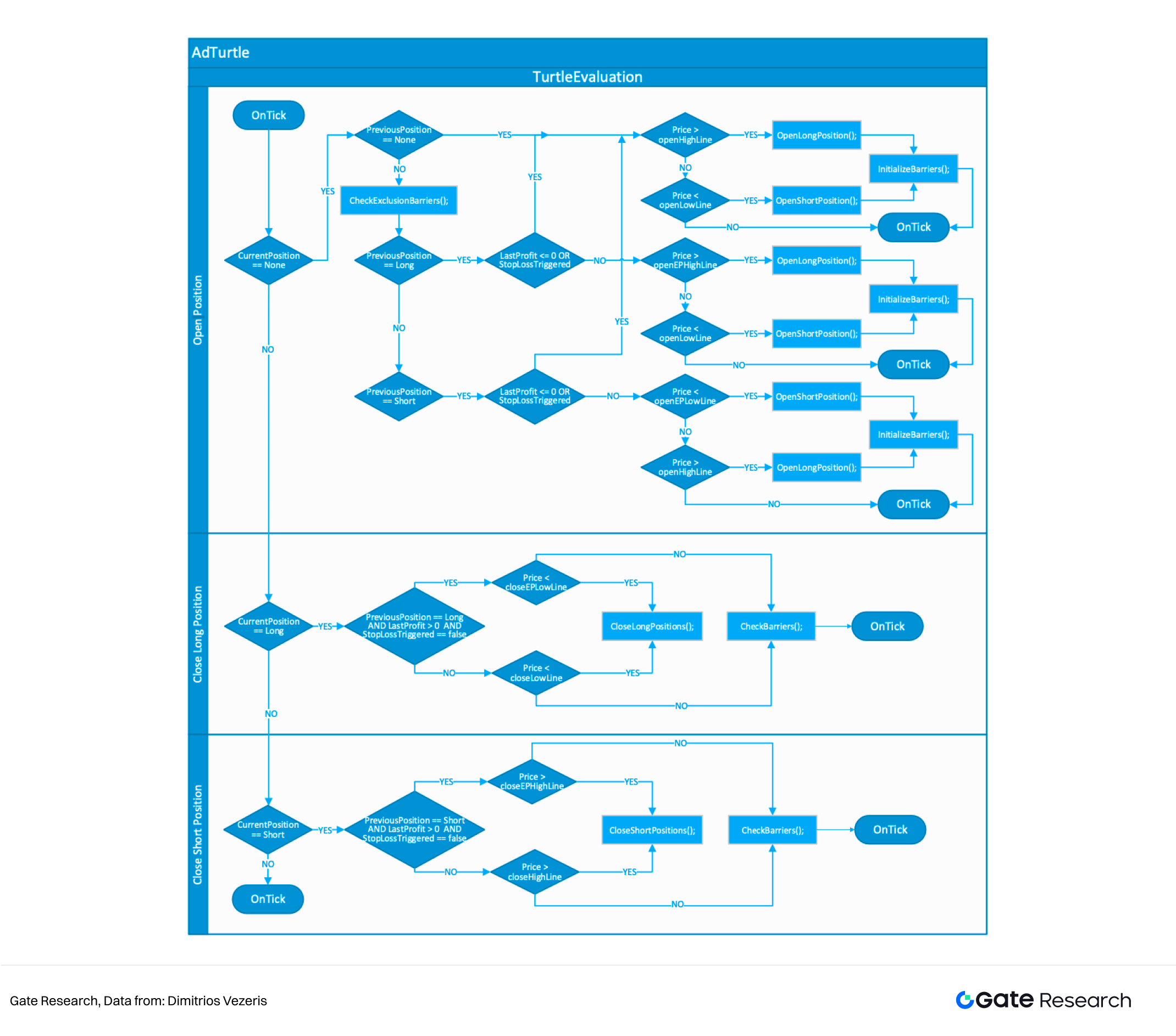

The following diagram illustrates the basic architecture of the AdTurtle system:

3.1 Entry Signal: Price Breakout + Exclusion Zone Filtering

- Still relies on the Donchian Channel to identify trend initiation points;

Introduces an Exclusion Zone mechanism:

When the previous trade was exited due to a stop-loss, the system will not immediately open a new position;

- A new entry is only allowed after the price moves beyond the previous stop-loss price by ± Y × ATR;

- This effectively avoids repeated entries and exits during volatile market swings.

Donchian Channel periods are categorized into:

Standard Period: x for entry and x/n for exit;

- Extended Period: y for re-entry and y/m for re-exit, used to filter out high-frequency repetitive trades.

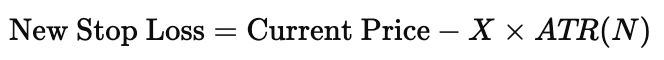

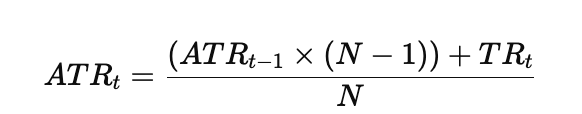

3.2 Stop-Loss Mechanism: Trailing + Variable ATR Range

Compared to the traditional fixed 2 × ATR stop-loss, AdTurtle adopts a combination of trailing stop-loss and variable ATR range, enabling more intelligent risk control.

Initial Stop-Loss Setup (at entry):

Long position:

Short position:

Trailing Update Logic (when price moves in favorable direction):

For long positions, the stop-loss is updated to:

For short positions, the stop-loss is updated to:

Variable Range Mechanism (based on real-time ATR updates):

ATR is recalculated with every new candlestick:

When volatility rises, the stop-loss widens automatically; when volatility drops, the stop-loss tightens — helping the system adapt to dynamic market conditions.

This mechanism allows the system to:

- Lock in trend-following profits;

- Avoid reacting to short-term price noise;

- Improve both the rationality and timeliness of stop-loss execution.

3.3 Trend-Following Pyramiding: Scaling In on Trend Continuation

- Every time the price moves favorably by Z × ATR, the system automatically adds to the position (Z is a customizable multiplier parameter used to define the sensitivity of the “pyramiding trigger threshold”).

- Each additional entry carries a risk of 4% of the account’s equity, with a maximum of 4 pyramiding steps, capping total exposure at 20%.

- The logic mirrors that of the classic Turtle system, using a pyramiding structure to scale in progressively during a strong trend.

3.4 Risk Management: Dynamic Sizing + Position Control

- Position sizing is dynamically calculated based on the current ATR value: the greater the volatility, the smaller the position size.

- Smart trigger mechanisms such as the Exclusion Zone and dynamic stop-loss improve execution robustness and risk control efficiency.

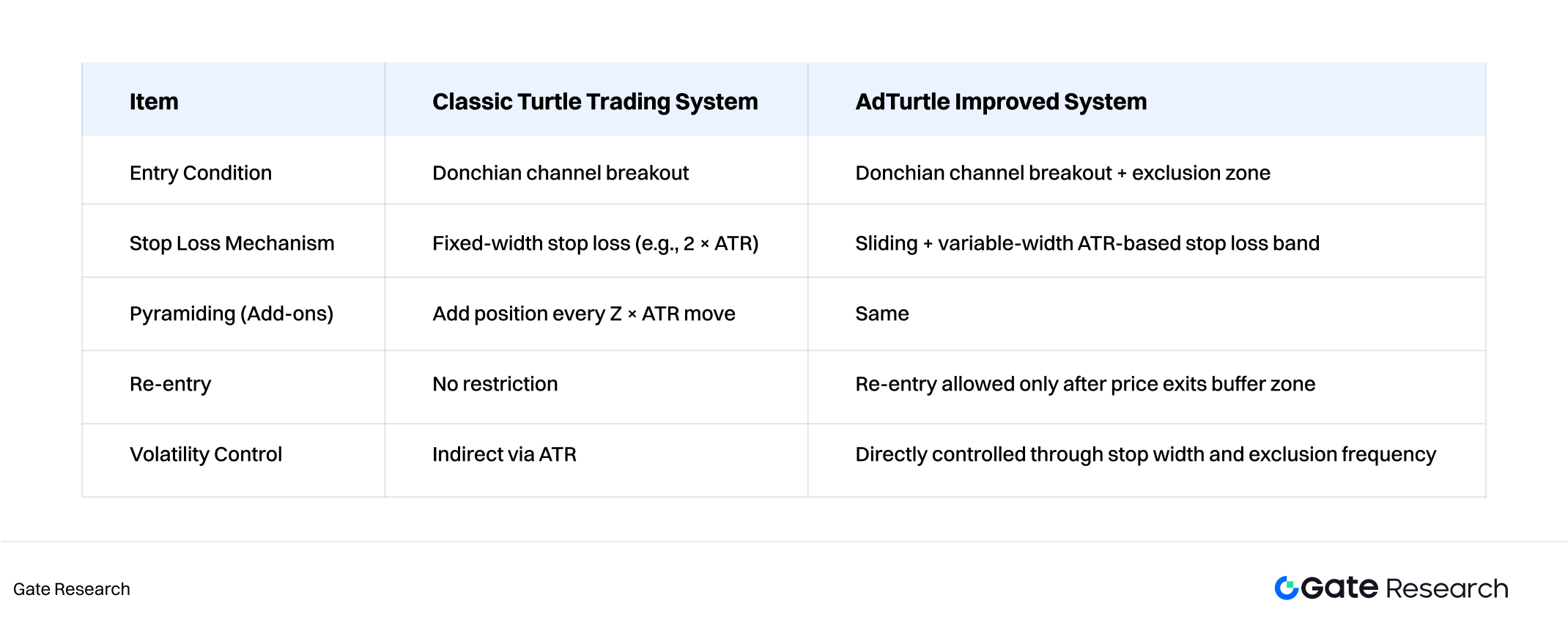

3.5 Comparison of the Two Turtle Systems

In the 1980s, the Turtle Trading System rose to fame with its simple rules and extraordinary profitability, becoming a legend among trend-following strategies. Its core idea was to detect price breakouts using Donchian Channels, apply fixed ATR-based stop-losses for risk control, and use pyramiding to follow trends more aggressively.

However, as market structures evolved—particularly with the rise of high-frequency trading (HFT) and frequent false breakouts—the classic Turtle system began showing critical limitations.

One common issue is that the system often re-enters too soon after being stopped out, especially in choppy or sideways markets, amplifying a series of small losses. The traditional fixed-width stop-loss (e.g., 2 × ATR) also lacks adaptability: it may stop out too early during high volatility or expose too much risk during low volatility. Moreover, the system lacks a cooldown or buffer mechanism, mechanically entering and exiting even after extreme price moves or market shocks, often leading to deeper drawdowns and reduced strategy stability.

The AdTurtle system retains the classic framework of “breakout entry + pyramiding + risk control,” while introducing three key enhancements:

- Exclusion Zone,

- Variable Stop-Loss Mechanism, and

- Dynamic Entry Filtering.

The Exclusion Zone is arguably the most innovative feature. After a trade exits via stop-loss, the system won’t allow immediate re-entry. Instead, price must break out of the previous stop-loss price ± Y × ATR before a new position is initiated. This effectively reduces whipsaws and repeated stop-outs in range-bound markets.

In terms of stop-loss logic, AdTurtle adopts a trailing + variable-width model. As price moves in a favorable direction, the stop-loss “trails” to lock in gains. The stop-band width is dynamically adjusted based on real-time ATR updates: widening in high volatility, tightening during low volatility. This responsive mechanism better reflects actual market behavior and prevents premature exits due to short-term noise.

During strong trends, AdTurtle maintains the classic approach of adding to positions every Z × ATR, emphasizing progressive exposure building only when already profitable, rather than placing large bets upfront. Both the number of add-ons and the total risk cap are strictly controlled, reinforcing risk discipline.

For position sizing, the system adjusts based on real-time ATR, ensuring that higher volatility leads to smaller position sizes—keeping total risk within acceptable bounds.

Ultimately, AdTurtle emphasizes robustness and adaptability in complex market conditions. It is not a full replacement for the classic Turtle system, but rather offers a more nuanced choice depending on market context. For markets with clear trends and smoother price action (e.g., certain commodities or major stock indices), the original Turtle strategy remains effective. But in crypto markets, forex, or other volatile and choppy environments, AdTurtle provides a lower-drawdown, higher-probability approach through its exclusion filters and dynamic stop logic.

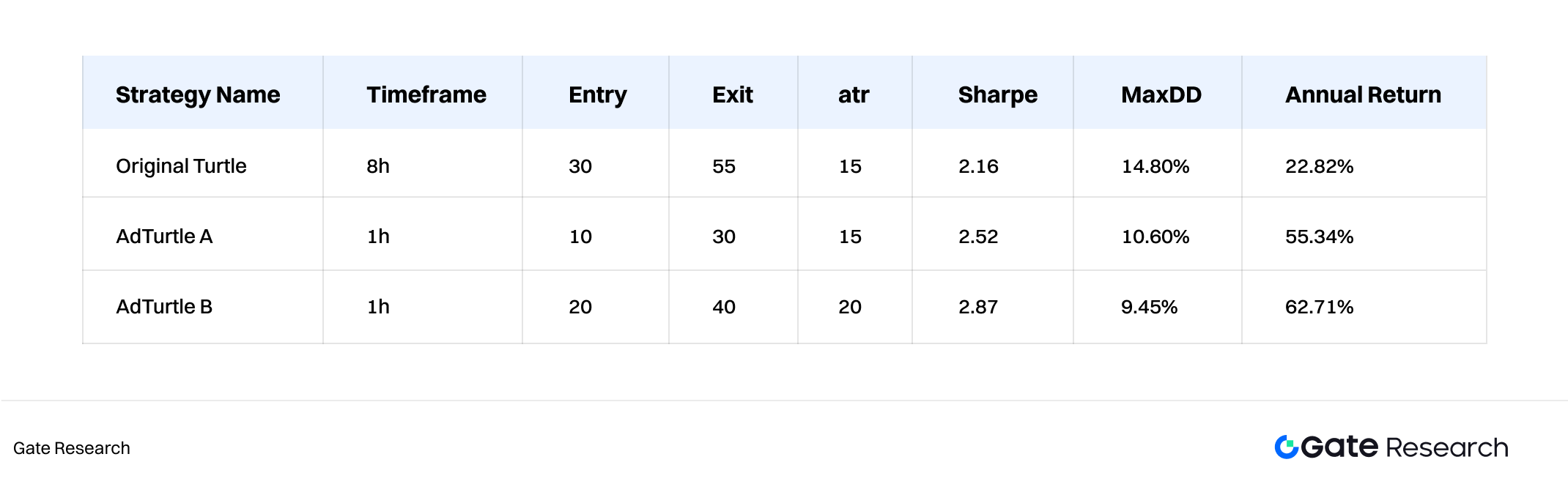

Backtesting the Trading Systems

To evaluate the real-world performance of the two trading strategies, this study selects the GT/USDT trading pair on the Gate exchange as the research subject. The backtesting period spans from 2024 to 2025, using hourly candlestick data. The initial capital is set at 1,000,000 USDT, with no leverage applied. Trading costs include a total commission of 0.1% per round-trip trade and a slippage of 0.05% per order.

4.1 Data Source and Preprocessing

- Target Asset: GT/USDT

- Data Source: Gate API (Kline data)

- Time Period: January 1, 2024 to January 1, 2025

- Time Interval: 1-hour candlesticks

- Data Handling: Unified format preprocessing

4.2 Trading and Backtesting Assumptions

- Initial Capital: 1,000,000 USDT

- Leverage: Not used

- Transaction Costs: 0.1% round-trip fee + 0.05% slippage per entry/exit

- Position Limit: Maximum position size per symbol is limited to 30% of total equity

- Signal Execution: Entry and exit signals are executed at the open of the next candle after confirmation at candle close

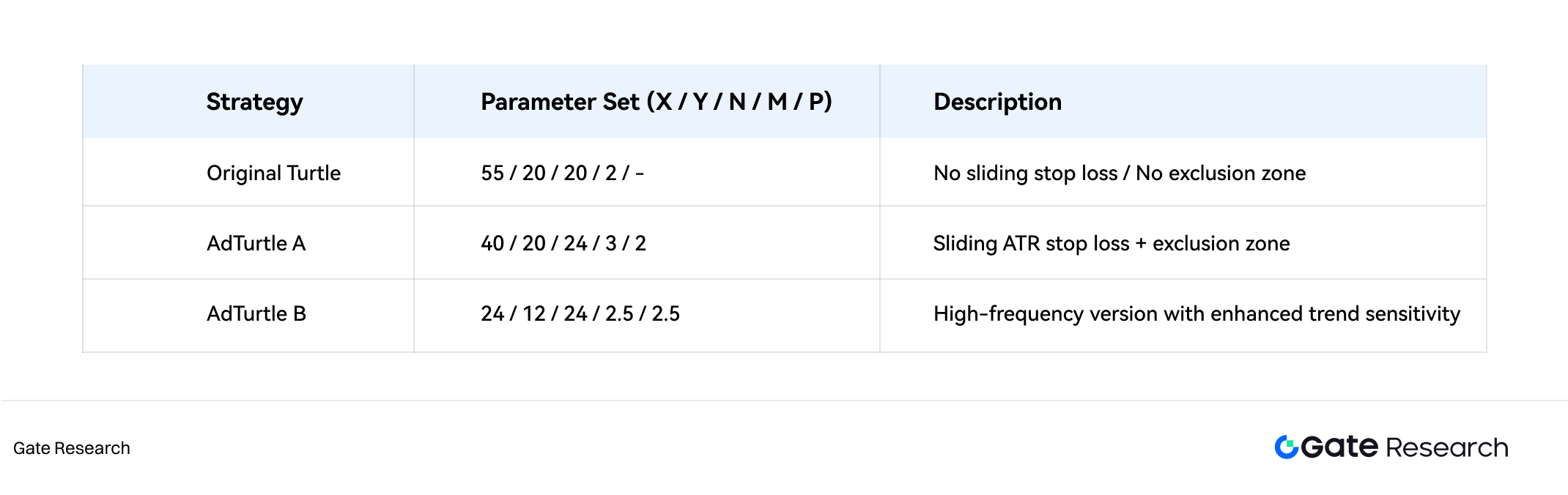

4.3 Strategy Parameter Optimization

The core parameters of each strategy are summarized into a quintuple (X / Y / N / M / P), where:

- X: Entry period (Donchian Channel)

- Y: Exit period (Donchian Channel)

- N: ATR calculation period

- M: Initial stop-loss multiplier (× ATR)

- P: Filter zone multiplier (× ATR)

The strategy parameters were optimized and selected through grid search to identify the optimal parameter combinations.

4.4 Backtest Results

The following chart shows the backtest results of the best parameter combinations for the three strategies:

The traditional Turtle Trading strategy performs excellently in clear trending markets but suffers significant drawdowns during sideways or rapidly reversing market conditions. In contrast, the AdTurtle strategy, enhanced with an exclusion zone and dynamic stop-loss mechanisms, effectively filters out most false signals and outperforms the original version in terms of overall return, Sharpe ratio, and maximum drawdown. The AdTurtle strategy shows the most consistent performance in its short-cycle variant. After grid search optimization, the best-performing parameter combination achieves an annualized return of up to 62.71%, with the maximum drawdown kept under 15%.

Conclusion

As a classic trend-following model, the Turtle Trading system holds an irreplaceable position for its clear structure and rigorous logic. With its systematic trend identification and risk management framework, it still demonstrates significant applicability in the crypto market. However, due to the distinct volatility characteristics, trading mechanisms, and investor composition in crypto compared to traditional markets, the original strategy requires structural adaptation during migration. The AdTurtle strategy significantly enhances its survivability and return stability in high-frequency and choppy markets by introducing mechanisms such as the exclusion zone, dynamic stop-loss, and variable pyramid thresholds.

Looking ahead, investors may further boost returns by testing more parameter combinations and incorporating leverage. It is recommended to explore the integration of on-chain data (e.g., capital flows, position changes), macro sentiment indicators (e.g., Fear and Greed Index), and machine learning models to improve signal identification and execution. This will drive trend-following strategies in the crypto space toward a higher dimension of intelligent evolution.

Reference

- Github, https://github.com/odonnell31/Turtle-Trading-Simulator

- Risk and Financial Management, https://www.mdpi.com/1911-8074/12/2/96

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.