The Rise of Stablecoins A Platform Revolution from Payment Rails to Financial Infrastructure

Preface

Every fintech company will become a stablecoin company.

Despite the hype, skepticism, hope, and concerns surrounding stablecoins, I believe we have crossed an important watershed. We have transitioned from the era of “Banking as a Service” (BaaS) to the era of stablecoins as infrastructure. Companies focused on stablecoins in B2C, B2B, and infrastructure will shape the industry in the next decade.

This transformation will be ten times more intense than the fintech boom of the past decade.

Because we are moving towards a new infrastructure layer. People still view stablecoins as a new payment channel, and when they see it as a platform that transcends all other layers, we will ultimately fully transition to native stablecoins. Stablecoins are a platform.

Key points of this article:

- Previous Era: Banking as a Service (BaaS) and Its Implications for Stablecoins

- Why stablecoins are the infrastructure layer (and not just a new channel)

- The Gold Rush of Stablecoins and Regulatory Unlocking

- Full-stack application scenarios

- Strategic Positioning and Future Outlook

1. Lessons Learned from BaaS to Stablecoin

As the saying goes, fools are always impulsive.

We have just witnessed this in BaaS.

The financial services era of the 2010s was characterized by companies adopting mobile-first distribution and cloud-first infrastructure.

We are witnessing a new generation of infrastructure providers designed specifically for financial services. Every department and IT system within banks can now be accessed via APIs. This includes customer onboarding, anti-fraud, anti-money laundering (AML), credit card services, and in some cases even customer service. This enables new companies to launch mobile applications, wallets, and “accounts,” allowing them to acquire and service customers at a cost far lower than that of existing enterprises.

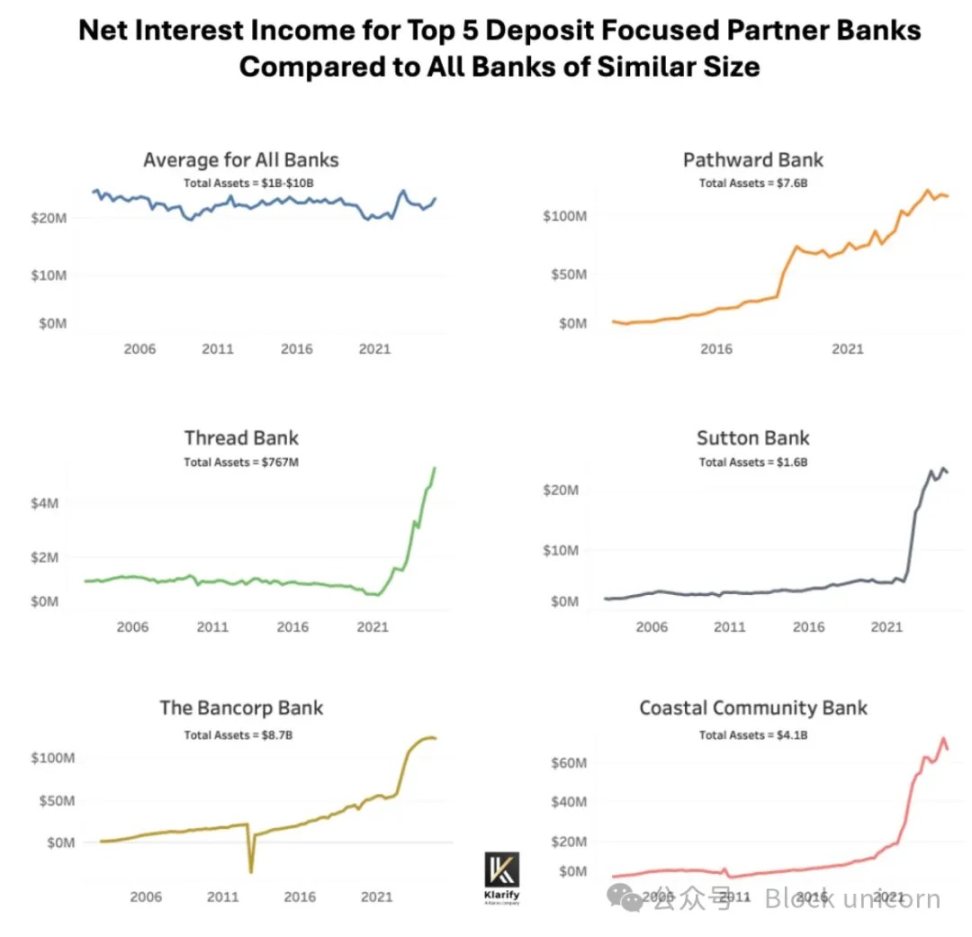

By combining API, mobile, and cloud technologies, fintech companies also benefit from the assistance of a few “sponsoring banks” that see opportunities to provide banking channels, store funds, and transfer funds for this new field. Some banks have achieved great success due to their “ease of collaboration.”

Image source: Klaros Partners

For fintech companies, their initial business model is:

- Earn income through interchange fees.

- Reduce customer acquisition costs (CAC) through frictionless digital onboarding.

As the saying goes: show me the incentive mechanism, and I will show you the results?

Some (not all) fintech companies have optimized conversion rates, and when you do this, many regulations in financial services seem like friction. For example, requiring customers to provide multi-page documents for “Know Your Customer” (KYC) checks or monitoring transactions for international terrorism risks, while the vast majority of customers are domestic.

When I wrote “BaaS is dead” in March 2023, we had already seen ominous signs.

Account opening is a critical moment for both parties to capture criminals. If you view account opening as a checkbox process that must be completed with minimal friction, then a minimalist interpretation of the Bank Secrecy Act / Anti-Money Laundering Act rules will lead to a high conversion rate in the account opening process. Over the past two years, this has allowed fraud and money laundering to be conducted remotely on a large scale, attacking the weakest parts of the system. ——— Excerpt from “BaaS is Dead”

If you are a bad person, attacking small new banks and digital banks is a piece of cake.

But the result is not good.

On April 22, 2024, when the blockchain-as-a-service (BaaS) provider Synapse went bankrupt, tens of thousands of customers lost their life savings. Financial technology applications could not access these funds, and the underlying banks were unable to track or verify the whereabouts of the money.

This event has triggered headlines in mainstream media, and within the banking industry, regulators have issued a series of consent orders, finding deficiencies in banks in the following areas:

- Third-party risk management (i.e., API providers and fintech companies)

- Anti-money laundering (i.e., the control measures of these companies may be inconsistent)

- Board governance (i.e., whether to hold management accountable)

Image source: Klaros Partners

The consequences of these failures are enormous.

If you cannot stop the flow of funds to bad actors, criminals will be rewarded, thus financing human suffering.

However, the lesson here is not that BaaS or fintech is bad; far from it.

Today we have:

- The ability for immigrants and low-income individuals to open free accounts.

- The ability to use cash flow (the funds you have) for loan approval, which means more people can avoid bankruptcy.

- Good spending management card

- Provide embedded loans for the market, small and medium enterprises, and vertical SaaS.

Successful large financial brands have reshaped the industry. Cash App, Venmo, Chime, Affirm, Revolut, Monzo, Nubank, Stripe, Adyen, and your favorite brands have become household names in their markets and industries. Fintech has fundamentally changed the distribution of finance and raised the standard for user experience.

We just learned some lessons along the way.

The investment scale of stablecoins and cross-border activities may lead to epic consequences in the event of any collapse.

Although I know that it is impossible to completely prevent bad things from happening, I hope that companies centered around stablecoins can learn from the mistakes and successes of the BaaS era and not be blinded by the impending gold rush.

2. Regulatory Unlocking and Surge in Funds

2.1 Regulatory Unlocking

The current draft of the “GENIUS Act” could change everything. According to the draft, if you are an approved stablecoin issuer, you can treat stablecoins as cash equivalents on your balance sheet. This is a significant matter.

Take prepaid cards as an example. They require funding transfer permissions, repayment rules, and consumer protection requirements. Cash is like the money in your pocket. It is much simpler to hold and manage. Stablecoins can inherit this simplicity.

2.2 The Stablecoin Gold Rush

The investment in stablecoin-related businesses is expected to grow 10 times year-on-year.

The funding situation related to stablecoin business

If the “GENIUS Act” is passed, a new regulated stablecoin channel and a new category of narrow banks will emerge, called licensed payment stablecoin issuers (PPSIs).

This means that every entrepreneur, venture capitalist, payment company, shadow bank, and even large banks will take action to defend or seize this new opportunity.

3. Argument: Stablecoins as a platform

Nowadays, stablecoins are used as alternative cross-border payment channels, and in the future, they may become domestic payment channels.

But if you only see this, you are missing the big picture. Stablecoins are also a platform that transcends channels such as SWIFT, ACH, PIX, and UPI, becoming the infrastructure that connects all these channels. This will unlock new use cases and opportunities.

Ultimately, stablecoins will create an abstraction layer on top of existing payment channels, just as the internet has done for telecom operators. Similarly, the entire industry will become “stablecoinized,” just like we see with video, messaging, and e-commerce. This network layer will ultimately eliminate intermediaries and reduce costs. — Extracted from “Stablecoins are not cheaper; they are better”

I envision it as follows:

Stablecoin as a platform

Stablecoin as a platform

This is what platform disruption looks like. Telecommunications traffic has grown by 60% year-on-year, while revenue has grown by 1% year-on-year. In 15 years, traffic has increased more than 1000 times compared to revenue growth.

Existing enterprises that cannot adapt to the new platform layer will be commoditized.

The impact of stablecoins on payments is similar to the impact of the internet on telecommunications – it has created a platform layer that commodifies the underlying infrastructure as a pipeline.

We can see this infrastructure layer gradually emerging in every payment process and business model. Here is how it works.

4. How stablecoins function within the entire system

Yes, stablecoins operate today as an alternative payment channel. But this is just the basis. Most people see it as a payment channel in the image below, rather than a platform:

Stablecoins as a payment channel - they are not only that, but they also have more functions.

The real opportunity lies in the functions they can achieve as infrastructure.

4.1 Stablecoins for International Payments - Starting Point

There is no doubt that the main use case of stablecoins is cross-border payments. The primary currency route is from Asian countries, followed by the route from the United States to Latin American countries (Mexico, Brazil, Argentina).

G20 passes Tron and Tether to lead payment activities in Global South countries

There are various types of cross-border payments. Let’s delve into each payment process.

B2B early adoption use cases:

- Large-scale enterprises for market expansion (e.g., SpaceX): used for financial management, vendor payments, and inter-company payments.

- International payroll and payments (e.g., Deel, Remote): Contractors and employer representatives will make payments to stablecoin wallets.

Artemis investigated over 30 companies engaged in stablecoin business and found that B2B as a category has grown by 400% year-on-year (and is accelerating), making it the fastest-growing category. (Note: The transaction volume shown in the figure below is only a part of the overall market.)

As shown by the growth curve, this is significant growth.

Currently, last-mile liquidity and forex spreads are bottlenecks, but new companies like Stablesea, OpenFX, and Velocity are entering the market to change this situation.

Cross-border stablecoin use cases for consumers include:

- Remittances and P2P (e.g., Sling Money): Customers use stablecoins for cross-border remittances, which are faster and usually cheaper.

- Stablecoin Linked Card: Also known as the “Dollar Card,” it allows consumers in the Southern Hemisphere to purchase services from Netflix, ChatGPT, or Amazon.

Artemis’s research also shows that the association of P2P and stablecoins has increased by over 100% year-on-year, with at least $1 billion in transaction processing volume (TPV) in their sample.

Stablecoins are becoming a feature of new banks (such as Revolut and Nubank), and while their current use cases are still relatively narrow, they may expand in the future. Applications like Revolut, which initially started with remittances and P2P, are well-positioned to take full advantage of this new channel.

Currently, the forex spreads for local currency trading are usually high and liquidity is low. However, this situation is changing.

The landscape of domestic payments is still taking shape, but it is fascinating.

4.2 Stablecoins Used for Domestic Payments (Future Direction)

Domestic B2B use cases include:

- All-weather yield stablecoins (such as ONDO or BUIDL): Currently, the crypto-native finance sector is converting stablecoins into tokenized government bonds to avoid exchanging them into fiat currency. If this all-weather functionality can be implemented in Enterprise Resource Planning (ERP) systems, it could be very attractive to any corporate financial officer.

- Stablecoins as an alternative to the FBO structure (e.g., Modern Treasury): A characteristic of U.S. regulation is that, as a non-bank institution, to transfer funds on behalf of clients, it often requires a “for the benefit of (FBO)” structure. These account setups are complex. Modern Treasury’s stablecoin product allows financial teams to set up payment processes for clients without the need for an FBO structure.

- Stablecoin native B2B accounts (e.g., Altitude): “Borderless accounts” provided by Wise or Airwallex can be native to stablecoins. These accounts use USD as the primary currency but offer a front-end to manage invoices, expenses, and finances.

Domestic consumer use cases are still in the early stages, including:

- Native “checking” accounts for stablecoins (e.g., Fuse): Similar consumer experiences to Wise, Revolut, or remittance apps, but with a global default. These services currently appear in countries in the Southern Hemisphere, but could represent a new, low-cost model for consumer fintech projects.

- Prepaid card project: Due to the potential cash equivalence of stablecoins, financial officers can obtain programmable currency that is recorded on the balance sheet like cash but is as liquid as digital payments, without having to manage complex prepaid debt issues.

- P2P stablecoins: Zelle, Venmo, Pix, and Faster Payments dominate their domestic markets, but if stablecoins become another development model, these applications may only need to serve as a front-end to support it.

4.3 Finance and Infrastructure (Hidden Layer)

The hidden layer is the infrastructure. Banking technology itself is becoming the native technology of stablecoins.

- Stablecoin Issuance as a Service (e.g., Brale, M^0): Banks and non-bank institutions may want to create their own stablecoins to attract deposits or avoid fees charged by other issuers.

- Stablecoins as side cores (for example Stablecore): Banks may want to create a record system that interacts with stablecoins, independent of their traditional platform. The “side core” can achieve this while still reconciling with the main core.

- Stablecoins provide infrastructure similar to BaaS (for example, Squads Grid): offering developers simple APIs to quickly create consumer, B2B, or embedded financial products.

Most companies in the market seriously underestimate developers’ love for the convenience of stablecoins. For companies like Stripe, convenience has always been the key to success.

You can imagine other possibilities. As a thought experiment, consider stablecoins as a global, programmable record system that everyone can reconcile and view.

Each wallet address can be assigned to a known front-end or wallet creator, allowing these companies to collaborate immediately in the event of KYC or AML issues.

4.4 Strategic Positioning of Stablecoin

Currently, the market has attackers, opportunists, and participants who are still observing and formulating strategies.

Currently, the vast majority of activities are happening on new platforms such as cryptocurrency exchanges and wallets, but opportunists are some companies that are now positioning themselves to take advantage of stablecoins as a new payment channel:

Here are my thoughts on which is which:

Attacker:

- Asset management companies: BlackRock, Franklin Templeton, and Fidelity rely on banks for wire transfer settlements. Since the financial crisis, they have taken market share from banks in credit and money market funds. Stablecoins connect all of this through an instant, round-the-clock settlement layer.

- Payment companies, such as Stripe, WorldPay, and Dlocal, are expanding the number of markets they can operate in and the types of payment processes they offer. “Financial accounts” are encroaching on the core businesses of large currency central banks, but are typically aimed at newer customer segments.

Defensive side:

- Large banks: JPMorgan Chase, Bank of America, Citibank, and other U.S. banks have previously discussed launching their own stablecoins. I believe this may be to seize market share in this new domestic and cross-border payment “channel,” just as banks dominate P2P payments through Zelle, they may “inevitably” also dominate this new channel.

- Small banks: have begun lobbying against stablecoins. Stablecoin issuers, asset management companies, and large banks may withdraw deposits from their low-yield checking accounts, resulting in the greatest losses for small banks.

There will be a group of opportunistic banks, similar to what we see in the sponsored banking business, that will gain enormous opportunities through the disruption of stablecoins.

The reality is that opportunities vary by use case. Startups are exploring new payment processes, while payment service providers (PSPs) are expanding market access through existing processes. In the future, asset management companies and banks will find their place in the market, possibly closer to their existing core businesses.

5. Criticism, Concerns, and Why Most of Them Are Exaggerated

I will summarize the criticism as follows:

Criticism: Stablecoins will trigger a bank run scenario. Rebuttal: This assumes Terra-style algorithmic stablecoins, rather than the government bond-backed licensed payment stablecoin issuers (PPSIs) under the “GENIUS Act”.

Criticism: Large tech companies will form a currency oligopoly. Rebuttal: This is a reasonable concern, but the framework makes it unlikely for large tech companies to directly issue stablecoins—they will use stablecoins rather than issue them. Becoming a PPSI presents a high regulatory barrier for them.

Criticism: It will lead to a loss of deposits in community banks. Rebuttal: Money market funds have already been causing this situation. Community banks that adapt to provide stablecoin services will thrive.

Criticism: “This is cryptocurrency,” implies it is filled with crime and scams. Rebuttal: It is time to abandon this view. The future of finance is on-chain, and institutional capital is building the infrastructure. There are real, novel risks, such as key management, custody, liquidity, integration, and credit risk, that should be focused on.

Criticism: Stablecoins are merely a regulatory arbitrage, as “holding USDC should be as difficult as holding dollars.” Rebuttal: Fintech itself achieves regulatory arbitrage through the Durbin Amendment. It’s easier to develop on stablecoins, but there is also a complete licensing system.

I believe this debate will continue.

Stablecoins will drive the next era of finance, and our outlook for the future is just beginning.

6. Finally, why does every company need a stablecoin strategy?

Everything we do today can realize the native integration of stablecoins, at which point finance will gain superpowers. We can build instant, global, and around-the-clock finance. We can recombine the financial Lego blocks, making it more developer-friendly.

The era of BaaS tells us that new infrastructure creates immense opportunities and significant risks. Companies that learn from the successes and failures of this era will win in the stablecoin-centric age.

Every company needs a stablecoin strategy. Every fintech company, every bank, and every finance team needs one. Because this is not just a new payment channel. It is the platform layer upon which all other things will be built.

I urge every reader to build based on the lessons of the past.

Collapse is inevitable, things will go wrong, and that is also certain.

This includes how you will protect yourself when things inevitably go wrong.

Build cool stuff.

and keep it safe.

Statement:

- This article is reprinted from [TechFlow] The copyright belongs to the original author [Simon Taylor] If there are any objections to the reprint, please contact Gate Learn TeamThe team will process it as quickly as possible according to the relevant procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author and do not constitute any investment advice.

- Other language versions of the article are translated by the Gate Learn team, unless otherwise mentioned.GateUnder such circumstances, it is forbidden to copy, disseminate, or plagiarize translated articles.

Share

Content