The Silent Crypto Bull Market

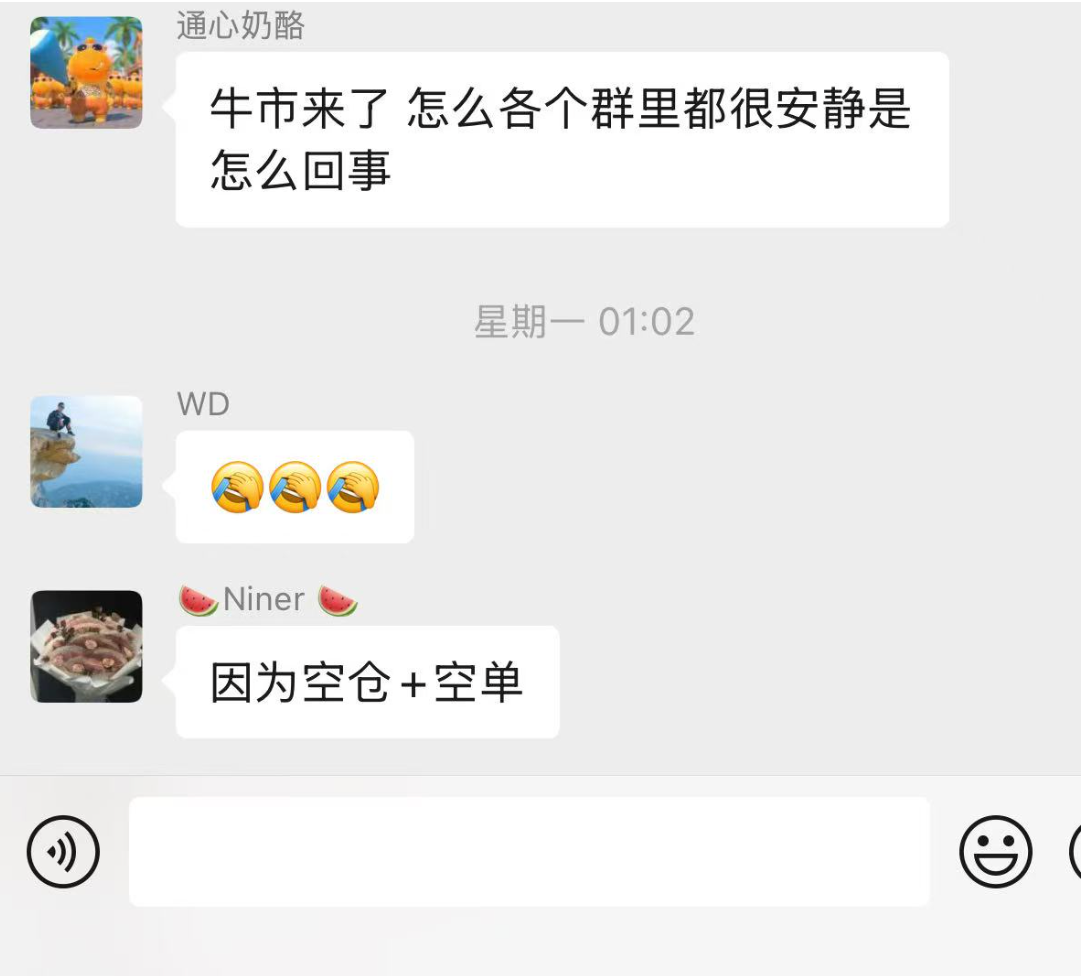

“The bull market has arrived, but why are all the chat groups so quiet?” This question was raised by a community member, Tongxin Cheese, in the Opensky community group.

“Because everyone’s either out of the market or shorting,” replied Niner, another group member.

Niner, who lived through the last bull and bear cycles, believed this bull market should have been a golden opportunity for significant gains. Yet, as Niner candidly admits, “I haven’t made any money this cycle.”

Johnny, a full-time trader in a similar situation, summed it up: “I haven’t made any money since Trump launched Trump.”

Niner and Johnny aren’t outliers. Mark, a partner at Wagmi Capital, notes, “In this bull market, 90% of retail investors aren’t making money.”

Although Niner hasn’t turned a profit yet, he’s already adjusted his investment strategy. “Last cycle, I mostly just held on for dear life. This time, I’m focusing more on swing trading. There’s a lot of new stuff out, so I have to keep learning—and everything moves much faster now.”

Niner’s changes were timely, but most investors are still slow to adapt.

“The investment logic has completely changed this cycle, but most retail investors haven’t caught on,” said KOL Hippo in an interview.

With institutional capital pouring into crypto and blue-chip coins repeatedly setting new all-time highs, this is no longer a market geared toward retail investors. From liquidity and capital flows to technical and narrative adoption, the landscape has shifted. Many believe the window for retail profits is closing, and this could be the last significant bull cycle for individual investors.

Against this backdrop, TechFlow interviewed a range of deep-market participants—including leading influencers, private equity partners, quant traders, and retail investors—to analyze this bull run from diverse perspectives and offer a multifaceted view of the current crypto landscape.

A New Breed of Crypto Bull Market

Hippo, who’s been in crypto since 2016, knows the market inside and out. During his interview, he was articulate and confident in describing the current bull cycle: “This isn’t a market where everything rises together anymore. In the past, bull runs were fueled by consensus—this time, different policies, capital forces, and alliances have created a completely new trajectory.”

With a background in both the military and commercial real estate investment, Hippo developed a style that’s both bold and cautious. After weathering several cycles, he reflects: “I’m always asking what truly has long-term value in this sector, and which assets will survive both bull and bear markets?”

If the previous market cycles were uncertain, this one has helped Hippo find some answers.

“After much consideration, I’ve realized this industry is essentially a financial internet. Lending, trading, staking—all the new trends like tokenized U.S. equities and stablecoins—are fundamentally about finance. They all require strong financial infrastructure,” Hippo says. “Based on this, I see tremendous potential in Ethereum, so I’m focusing my strategy there and on DeFi assets.”

Hippo believes this bull market began when BlackRock’s Bitcoin ETF was approved. After a brief pullback, the second stage started with the passage of the “Great Beauty Act” in the U.S., and he predicts a peak in November.

Mark, however, has a different perspective.

He contends that last year’s memecoin rally marked the beginning of this bull run—the first half—and that the recent spike in Ethereum kicked off the second phase. He expects the market to peak around September.

“In 2017, we saw an ICO supercycle, then an altcoin boom. But this cycle is clearly different: Investors aren’t buying into hype anymore—most concepts and stories have been debunked, and only financial applications are left. So even with Ethereum surging, it hasn’t broken old highs, and most altcoins are only up in isolated segments,” says Mark.

Another longtime market participant is Chenghua, a quant trader who runs his own crypto arbitrage shop.

Early this cycle, Chenghua noticed a major shift: Previous cycles were driven by retail money and dramatic surges in small-cap coins. Now, institutional money dominates, flowing heavily into assets like Bitcoin.

Despite his expertise, even Chenghua was “shaken out.” He still holds some bitcoin, but sold most of his position when it first broke $100,000. He also rotated out of Ethereum at its lowest, missing the rebound. Even for industry veterans, nailing market timing has become increasingly difficult for retail traders.

Where Can Retail Find Opportunity?

Johnny, a full-time trader, says the most striking aspect of this bull market is: “There are too many tokens and not enough innovation, liquidity is weak, and it’s getting harder for retail to make money.”

During the last bull run, Johnny jumped in when Elon Musk hyped up Dogecoin and rode the market-wide uptrend to huge profits. “I didn’t even know what candlestick charts were back then, but I still made money,” he recalls.

But those days are gone for good.

“What worked last cycle isn’t working now,” Johnny explains. “I used to just HODL or follow whatever was trending, but now I have to build my own trading system.”

Even so, “the upside for ‘junk’ altcoins isn’t what it used to be. The barriers for capital and technical know-how are much higher, and it’s harder to find profitable trades,” he says.

So why is it so tough for retail to profit in this bull market? And where do the real opportunities lie?

Mark sees two core reasons for retail’s struggles:

First, most retail investors haven’t moved on from the prior cycle—they’re still mostly holding altcoins instead of leading assets.

Second, they keep flip-flopping positions. “Chasing pumps and panic-selling are retail’s typical downfalls and the main enemy of profits,” Mark notes.

He believes this cycle’s best opportunities are in blue-chip coins and memecoins. But as liquidity improves, he’s noticed another trend: “The latest tokens listed on Binance are seeing 2–3x moves, unlike before when they would get slashed in half. So my main capital remains in Ethereum, but I’ll allocate a small portion to chase new listings and take calculated risks.”

“But honestly, opportunities for retail are running out.” Mark remains pessimistic, predicting that crypto will increasingly mirror the U.S. equities market, with blue-chip tokens dominated by institutional players. The only space left for retail will be memecoins, but succeeding there requires smarts, time, and dedication—meaning only about 10% of retail traders will profit.

While Hippo agrees with Mark to a degree, he also believes retail should watch for tokens tied to trading infrastructure.

These assets are essential, can’t be bypassed, and if they survive, they’ll attract strong consensus and potential value.

“The first thing retail needs to adjust is mindset—give up dreams of overnight riches,” Hippo says. “We probably won’t see 30x or 100x altcoin runs anymore, but blue-chip coins can still offer 3–5x per cycle. Also, every bull run has breakout memecoins. If you catch a true phenomenon, you could lock in strong returns.”

Some low-risk, low-barrier retail strategies popular in the last cycle—like trading new launches or minting inscriptions—are mostly gone in this market.

“Or you can try what I do: quant trading. It’s got a learning curve, but the risk is lower,” says Chenghua. “I still believe Bitcoin is a relatively fair opportunity for anyone. If you can stick with it and use a dollar-cost averaging strategy, odds are you’ll be rewarded over time.”

Is the Retail Crypto Golden Age Over?

By the end of the last cycle, some believed the retail crypto heyday was ending as institutions entered the market.

Although retail investors are still in play this cycle, institutionalization has accelerated significantly.

As of July 2025, Bitcoin spot ETFs had a total AUM of $137.4 billion, with over 400 major institutions—including pension and sovereign wealth funds—invested in BlackRock’s ETF.

Public companies worldwide now hold 944,000 BTC, about 4.8% of supply, with net new quarterly holdings of 131,000 BTC.

Platforms like Coinbase and Binance have seen surging ETH liquid staking (LSD) products, as institutions repackage ETH yields as fixed-income instruments.

These metrics make it clear: The crypto market is no longer retail’s playground.

Some media have called bitcoin at $120,000 “a capital feast without retail.” On that day, “there were no viral overnight riches—only BlackRock quietly streaming 13 ETF applications per second.”

This is exactly what Mark anticipated. “The golden age for retail profits is over. You could sense that last year’s second half was probably the last window,” he observes.

He’s already taken profits on some positions and rotated into A-shares.

“But I’m not leaving entirely. I believe the meme sector will always offer new opportunities,” Mark says.

Niner is more optimistic. She plans to stay involved, convinced that “the best big-money opportunities are now coming back to retail.”

“People have called every cycle the last one for years. But I think the wild growth phase is past us, and now is when real opportunities are emerging,” Niner says. “I’m not leaving—I want to be a true alpha player.”

Hippo is equally upbeat, believing that increased structure and regulation will actually lower risk and improve returns for individual investors.

“With institutional money in play, sticking to blue-chip coins can still yield solid returns. More importantly, the market is becoming more manageable and risk is much reduced,” Hippo says. “During cycle lows, bitcoin could drop 50–70%, but in bull markets it can multiply several times. If you time your entries and manage expectations, major coins like bitcoin are probably the most accessible way for retail to profit.”

After nine years in crypto, Hippo likens his relationship to the market to “a fish in water”: “I move through this market with ease; I never considered leaving. I believe there will always be opportunities for retail participants.”

Perhaps, whether you’re an optimist or skeptic, once you’re immersed in the market, it’s hard to walk away. The most important thing isn’t whether the market offers chances—it’s whether you have the curiosity to keep learning, the eyes to spot trends, and the discipline to seize opportunities.

Disclaimer:

- This article is reproduced from [TechFlow], with copyright belonging to the original author [Ada]. For any issues related to republication, please contact the Gate Learn team, and we will address them promptly according to our procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated content without citing Gate.